PayPal revolutionizes how people pay online. Back in the late 1990s, online shopping felt risky—no guarantees on deliveries or refunds. PayPal stepped in as one of the first trusted solutions. It started when Confinity and X.com merged in 2000, with Elon Musk briefly leading as CEO.

He focused on payments, but the board replaced him after less than a year. Peter Thiel took over and guided PayPal to its 2002 IPO. eBay soon bought it for $1.5 billion, integrating it deeply into e-commerce.

For over a decade, PayPal grew under eBay, acquiring Braintree and Venmo for $800 million combined. In 2015, it spun off as an independent company.

Since then, PayPal doubled its revenue and users. It added features like One Touch, PayPal Credit, and a super-app for payments, crypto, and shopping. Recent buys include iZettle for $2.2 billion and Honey for $4 billion, expanding services.

In 2025, PayPal leads digital payments with 45.52% market share, ahead of Stripe (17.15%) and Shopify Pay Installments (15.68%). It operates in over 200 countries, supports 25 currencies, and employs 27,200 people.

This article dives into PayPal statistics 2025, blending data from official reports, user trends, and fresh insights from Quora and Reddit.

You’ll learn key metrics like revenue and users, plus how businesses and consumers benefit. We mix bullets, tables, and details for easy reading—all in simple English.

Whether you run an online store or shop digitally, these PayPal statistics 2025 show opportunities. Businesses tap into millions of users for sales growth.

Consumers enjoy secure, fast payments. We also cover recent user concerns from forums, like data breaches, to give a balanced view.

Key PayPal Statistics 2026 Highlights

PayPal’s remarkable journey from its origins as Cofinity in 1998 to its current position as a global fintech leader highlights its relentless innovation and adaptability.

Today, PayPal stands as a dominant two-sided network, empowering e-commerce and digital transactions for millions of users worldwide.

Here’s a look at PayPal’s key statistics for 2025:

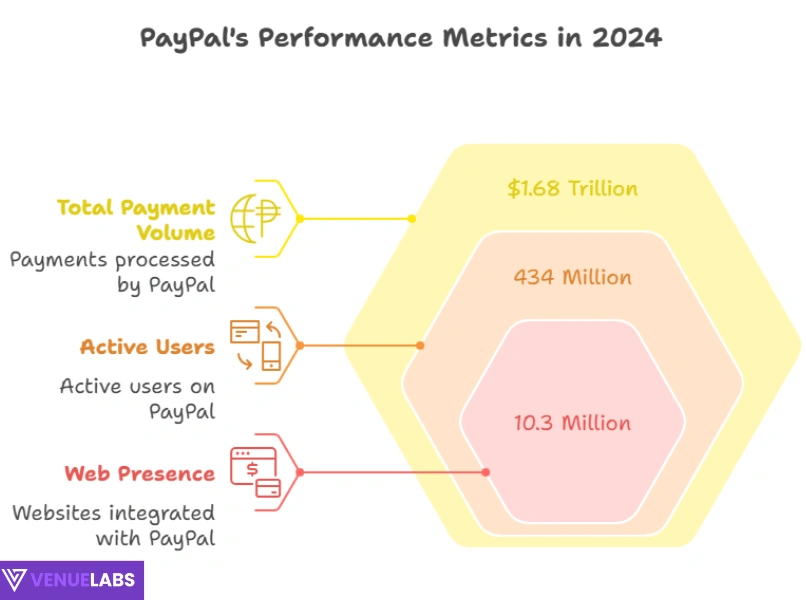

- Active Users: As of December 2024, PayPal boasts 434 million active users, reflecting steady year-over-year growth.

- Market Leadership: With a 45% share of the global payments market, PayPal continues to be the undisputed leader in online payments.

- Web Presence: PayPal is integrated into over 10.3 million live websites globally, offering a trusted payment option for millions of online shoppers.

- Total Payment Volume (TPV): In 2024, PayPal processed an impressive $1.68 trillion in TPV.

- Revenue Generation: PayPal achieved $31.8 billion in net revenue in 2024, underscoring its financial strength.

- Global Reach: Operating in over 200 markets worldwide, PayPal facilitates smooth, secure cross-border transactions.

- Financial Stability: Heading into 2025, PayPal enjoys a robust $6.8 billion in free cash flow, showcasing its solid financial health.

PayPal’s sustained success is rooted in its ability to offer secure, user-friendly payment solutions that cater to the evolving needs of businesses and consumers alike.

PayPal Revenue Statistics 2026

PayPal generates revenue mainly from transaction fees. In 2025, it continues upward trends, hitting new highs despite economic shifts.

In Q1 2025, PayPal earned $7.7 billion, up 9% year-over-year. Q2 jumped to $8.3 billion, a 5% rise. This brings year-to-date revenue to $16 billion. Analysts project full-year 2025 revenue at $33-34 billion, based on 5-6% growth guidance in transaction margins.

Here’s a table showing PayPal’s revenue growth:

| Year/Quarter | Revenue ($ billion) | Year-over-Year Change (%) |

| 2024 (Full) | 31.7 | 6.7 |

| 2023 (Full) | 29.7 | 8.1 |

| Q1 2025 | 7.7 | 9 |

| Q2 2025 | 8.3 | 5 |

| Projected 2025 (Full) | 33-34 | 4-7 |

Sources: Statista.

PayPal boosts revenue through subsidiaries like Venmo, which now profits after years of investment. From Quora discussions, users note Venmo’s free P2P transfers attract young people, but premium features like instant transfers add income.

How can you benefit? Businesses: Use PayPal’s tools for cross-border sales—26% of transactions come from China. Charge low fees (around 2.9% + $0.30 per transaction) and access 438 million users. Consumers: Link accounts for seamless shopping, earning cashback via Honey.

Revenue dipped slightly in some quarters due to fraud focus, but PayPal’s fraud rate stays low at 0.17-0.18%, losing about $1 billion yearly. This keeps trust high.

- Also read about: Best Surveys For PayPal Money

PayPal Profit and Net Income Statistics 2026

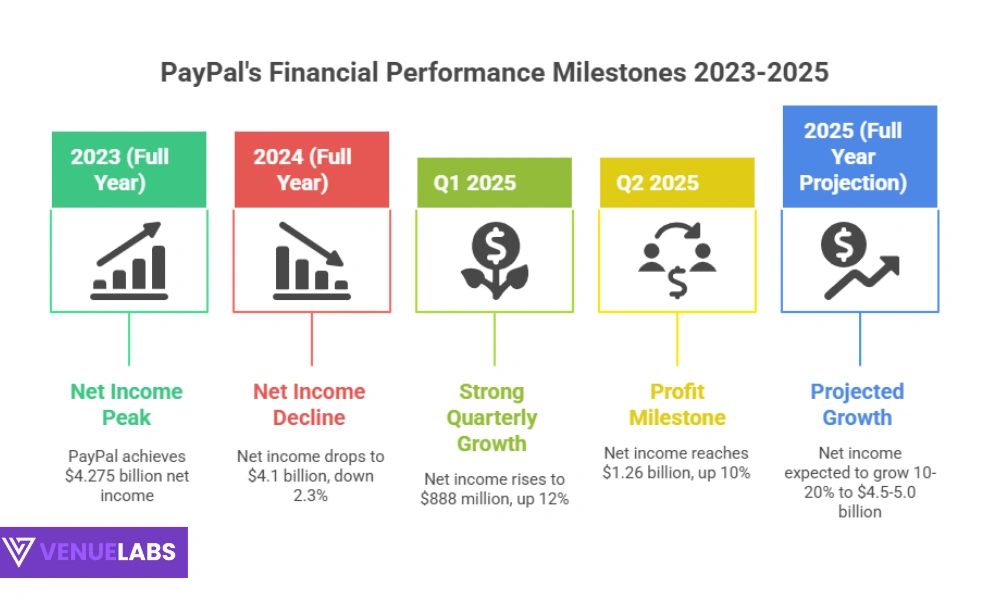

PayPal turns strong revenue into profits. In Q2 2025, net income reached $1.26 billion, up from $1.13 billion last year. GAAP EPS hit $1.29, non-GAAP $1.40. Q1 2025 saw $888 million in net income, up 12%.

Full-year guidance: Non-GAAP EPS around $5.00-5.20, with transaction margins growing 5-6%.

Table of net income trends:

| Year/Quarter | Net Income ($ billion) | Change (%) |

| 2024 (Full) | 4.1 | -2.3 |

| 2023 (Full) | 4.2 | 75 |

| Q1 2025 | 0.888 | 12 |

| Q2 2025 | 1.26 | 10 |

| Projected 2025 (Full) | 4.5-5.0 | 10-20 |

Profits come from efficient operations—take rates (fees per transaction) stabilize at 1.8-1.9%. Venmo contributes more, as Quora users highlight its monetization via cards and transfers.

Benefits: Investors see value—stock trades around $80-90, with 2025 upside from buybacks. Businesses: Low costs mean higher margins. Consumers: Profits fund innovations like crypto trading.

PayPal Payment Volume (TPV) Statistics 2026

TPV measures money flowing through PayPal. In 2025, it surges.

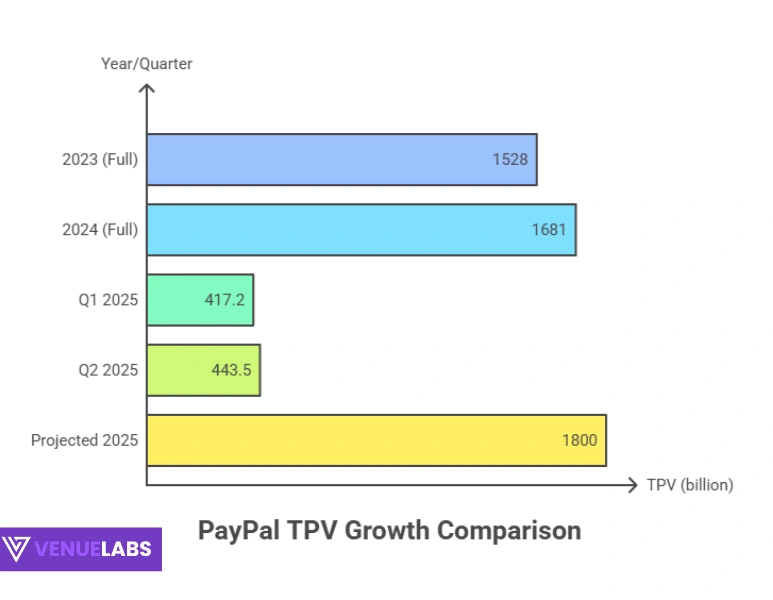

Q1 TPV: $417.2 billion, up 3%. Q2: $443.5 billion, up 6% (5% FX-neutral). Year-to-date: Over $860 billion, projecting $1.8 trillion for 2025—surpassing 2024’s $1.68 trillion.

Trends table:

| Year/Quarter | TPV ($ billion) | Growth (%) |

| 2024 (Full) | 1681 | 10 |

| 2023 (Full) | 1528 | 12 |

| Q1 2025 | 417.2 | 3 |

| Q2 2025 | 443.5 | 6 |

| Projected 2025 | 1800+ | 7+ |

Growth driven by mobile—over 2 billion global users. PayPal captures 22% of U.S. online transactions.

Benefits: Merchants handle high volumes without hassle. For example, integrate Braintree for seamless checkouts. Consumers: Pay quickly across borders, with 66% sticking to domestic, but options for international.

PayPal Transactions Statistics 2026

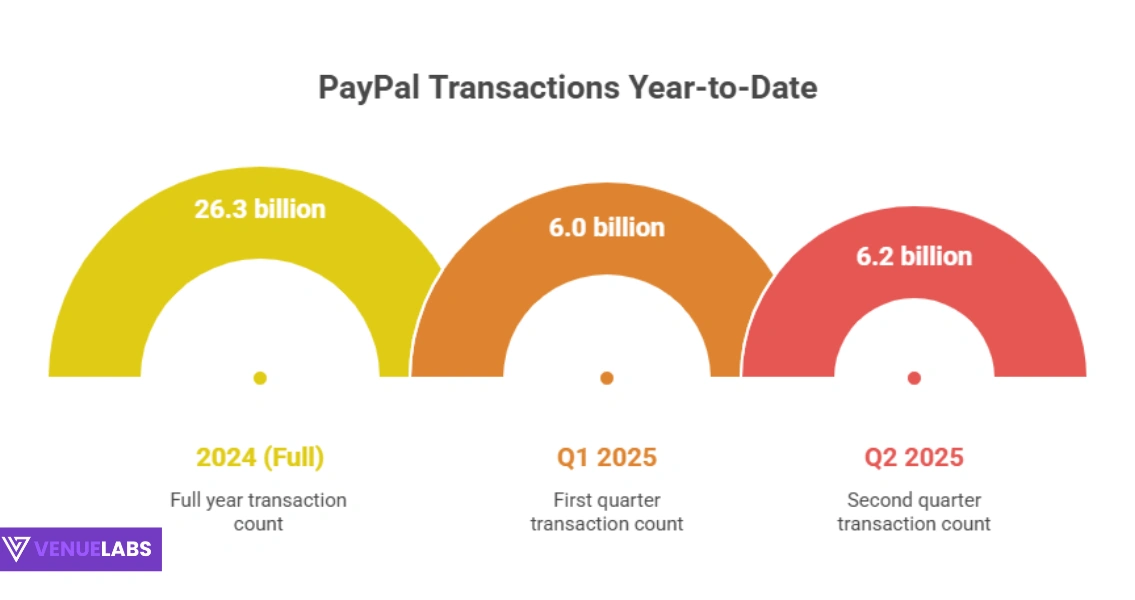

Transactions show activity. Q1 2025: 6.0 billion, down 7% but focused on quality. Q2: 6.2 billion, down 5% total but up 6% adjusted (excluding low-value Braintree deals).

Year-to-date: 12.2 billion, on track for 25-26 billion in 2025, similar to 2024’s 26.3 billion.

Per account: 58.7 in 2023, rising to 61 in 2024—expect 62+ in 2025.

Table:

| Year/Quarter | Transactions (billion) | Change (%) |

| 2024 (Full) | 26.3 | 5 |

| 2023 (Full) | 25 | 12 |

| Q1 2025 | 6.0 | -7 |

| Q2 2025 | 6.2 | -5 (6 adjusted) |

| Projected 2025 | 25-26 | Flat to +2 |

From Reddit, users discuss declining low-margin transactions as strategic—focusing on profitable ones.

Benefits: Businesses see repeat customers—average user transacts 61 times yearly. Offer PayPal to increase sales 54%.

Consumers: One Touch (80 million activated) speeds buys.

PayPal Users Statistics 2026

Users fuel growth. Q2 2025: 438 million active accounts, up 2% YoY. This reverses slight 2024 dips (429 million).

By quarter:

| Quarter | Active Users (million) |

| Q4 2024 | 429 |

| Q1 2025 | 427 |

| Q2 2025 | 438 |

| Q3 2023 | 428 |

By country: U.S. leads with 278.1 million, Germany 137.7 million, UK 56.2 million.

Demographics: 97% Millennials, 25% aged 25-34. 56% Americans have accounts; 75% Europeans trust PayPal. 9% U.S. users are children (with parental setup). 85% Gen X online shoppers use it.

From Quora, users ask about account numbers—over 432 million globally, per trends.

Benefits: Businesses target demographics—young users via Venmo. Reach 438 million for marketing. Consumers: Join for $485 average balances, easy P2P.

Recent Reddit buzz: A 2025 data breach exposed 16 million credentials (1.1GB dataset). Users worry about privacy—PayPal starts sharing shopping data in the summer of 2025 for personalization. Quora threads note hate for holds/freezes, yet growth continues due to convenience.

PayPal Merchant Accounts and Subsidiaries 2026

36 million merchant accounts in 2025, up slightly from 35 million in 2023.

Table:

| Year | Merchant Accounts (million) |

| 2024 | 36 |

| 2023 | 35 |

| 2022 | 35 |

| 2020 | 30 |

Subsidiaries expand reach:

- Braintree: Processes online transactions.

- Venmo: Popular P2P, now profitable—2 million new debit card users in Q2 2025.

- Xoom: Global transfers.

- iZettle: Card readers for small businesses.

- Honey: Coupon finder, saved users $1+ billion.

Acquisitions history (key ones):

- 2019: Honey ($4B)

- 2018: iZettle ($2.2B)

- 2015: Xoom ($800M)

- 2013: Braintree, Venmo ($800M combined)

From Quora, Venmo’s profitability draws praise—monetizes via fees, not just free transfers.

Benefits: Merchants use subsidiaries for tools—Honey boosts sales with discounts. Businesses: Accept PayPal in 200+ countries for global expansion.

Mobile Payments and Global Trends 2026

Over 2 billion use mobile payments globally, China leading. PayPal installs on 65% of payment-enabled mobiles.

PayPal’s super-app combines everything—payments, bills, crypto.

Benefits: Consumers switch to mobile for contactless—PayPal competes with Apple/Google. Businesses: Offer mobile checkouts to capture 66% domestic shoppers.

Fresh Insights from Quora and Reddit on PayPal 2026

Forums buzz with questions. On Reddit (r/ValueInvesting), users debate stock: “PYPL a buy for 2025?”—trading at $86, potential to $100+ with 3-5% revenue growth. r/privacy warns of data sharing starting 2025, auto-opting users in for better shopping.

A major thread: Global credential dump exposed 16M logins—users advise two-factor auth.

On Quora: “Why hate PayPal yet it grows?”—Complaints on freezes, but convenience wins. “Venmo profitable?”—Yes, via premium features.

These add real-user angles: Security matters, but stats show resilience.

How to Use PayPal Statistics 2026 for Your Benefit

These stats aren’t just numbers—they guide actions.

For Businesses:

- Tap 438 million users: Integrate PayPal to lift sales 54%. Small shops use iZettle for in-person.

- Go global: 200+ countries mean expand without borders. Focus on U.S./Germany for high users.

- Cut fraud: Low 0.17% rate protects profits.

- Use data: Track transactions (61/account) for loyalty programs.

For Consumers:

- Secure shopping: 75% Europeans trust it—enable One Touch for speed.

- Save money: Honey finds deals; average balance $485 for easy access.

- P2P ease: Venmo for friends, Xoom for international.

- Stay safe: Amid breaches, use strong passwords, monitor accounts.

Project for late 2025: With Q3 earnings October 28, expect user growth to 440+ million if trends hold.

FAQs About PayPal Statistics

1. How many active users does PayPal have in 2025?

PayPal boasts 438 million active users as of Q2 2025, up 2% from last year. This includes both consumers and merchants.

2. What is PayPal's revenue in 2025?

Q2 revenue hit $8.3 billion, with year-to-date at $16 billion. Full-year projections range from $33-34 billion.

3. Is PayPal safe amid 2025 data breaches?

A breach exposed 16 million credentials, but PayPal’s fraud rate remains low at 0.17%. Use two-factor authentication for protection.

4. How does PayPal compare to competitors in market share?

PayPal leads with 45.52%, far ahead of Stripe (17.15%) and others. Its user base and global reach give it an edge.

5. What is the average number of transactions per PayPal account?

Users average 61 transactions yearly, based on 2024 data—expect similar or higher in 2025.

6. Will PayPal continue growing in 2025?

Yes, with TPV up 6% in Q2 and user growth, projections show 5-7% revenue increase despite competition.

Also Read:

- Latest Digital Marketing Statistics

- Video Marketing Statistics

- Email Marketing Statistics

- WhatsApp Statistics

- iPhone Users Statistics

Conclusion

PayPal statistics 2025 paint a picture of a resilient giant. With 438 million users, $8.3 billion Q2 revenue, and $443.5 billion TPV, it dominates digital payments.

Trends show steady growth, fueled by subsidiaries like Venmo and innovations in crypto. Businesses leverage this for sales boosts, while consumers enjoy secure, convenient transactions.

Yet, forums like Reddit and Quora highlight challenges—data breaches and privacy shifts remind us to stay vigilant. Overall, PayPal adapts, projecting $33+ billion revenue.

Whether you shop, sell, or invest, these stats empower smart decisions. As online spending rises, PayPal remains essential—embrace it for your financial edge in 2025 and beyond.