The world of cryptocurrencies is buzzing in 2025, and understanding the number of cryptocurrencies statistics 2025 is key to making smart decisions.

We are seeing a market that is both incredibly vast and incredibly dynamic, offering exciting opportunities for those who know how to navigate it.

Whether you are a seasoned investor or just starting, this detailed guide will help you grasp the current landscape, explore the different types of digital assets, and uncover how you can benefit from this evolving financial frontier.

The Sheer Scale: How Many Cryptocurrencies Truly Exist?

When you ask about the “number of cryptocurrencies,” you are actually exploring two distinct figures: the vast universe of all tokens ever created and the more manageable number of actively tracked, meaningful projects.

The 37 Million+ Token Tsunami:

As of 2025, an astonishing over 37 million unique cryptocurrencies have been launched. This colossal figure reflects the ease with which new tokens can now enter the market.

Blockchains like Solana, for example, have made it incredibly simple and inexpensive to create a new token. Platforms such as pump.fun even allow individuals to launch a new memecoin within minutes for just a few dollars.

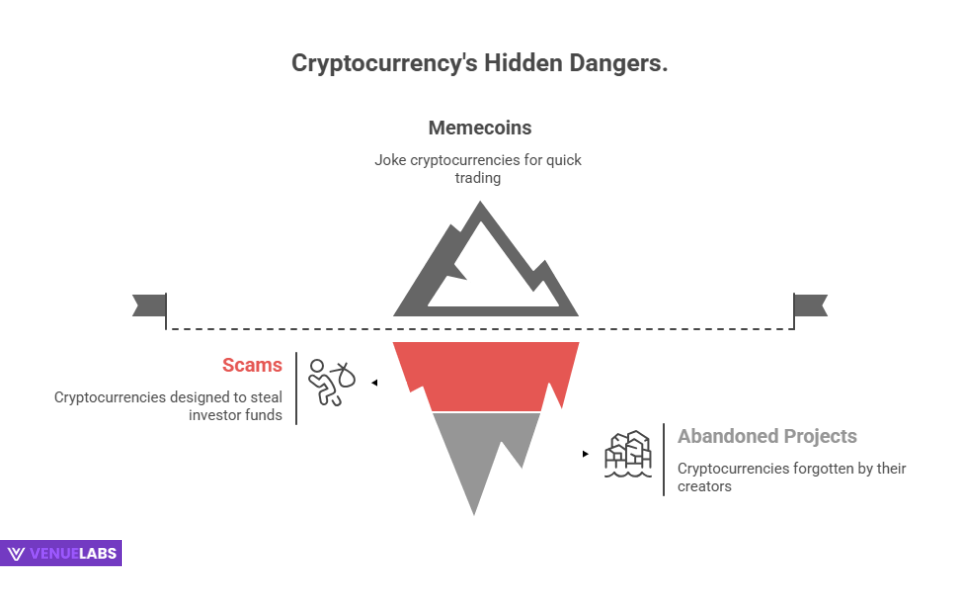

However, a massive percentage of these tokens fall into categories with little to no real value or longevity:

- Memecoins: Many begin as jokes or as vehicles for quick speculative trading.

- Scams: Unfortunately, a significant portion are designed as “rug pulls,” where developers quickly exit after collecting investor funds.

- Abandoned Projects: Countless ideas never gain traction, leaving their digital tokens forgotten by their creators.

The Solana blockchain alone now accounts for roughly 70% of all tokens ever created. This oversaturation means that while the technical number of cryptos is in the millions, most lack utility, a strong community, or significant trading volume.

The 17,151 Active Players:

For a more practical and useful understanding, we turn to leading crypto-tracking platforms like CoinGecko and CoinMarketCap.

These platforms actively list cryptocurrencies that meet specific criteria, such as maintaining an active trading volume on an exchange and possessing a functioning website or a legitimate project behind them.

As of 2025, these platforms track approximately **17,151 active cryptocurrencies. This figure, while still substantial, filters out the millions of “dead” or worthless tokens, giving you a much more realistic view of the market’s actionable landscape.

This is the number that most investors, analysts, and everyday users consider when discussing the current crypto market.

Why the Crypto Market is Exploding with New Coins

The rapid expansion in the number of digital coins is not a sudden phenomenon. In 2013, we saw fewer than 500. So, what factors fueled this incredible growth?

- Ease of Creation: In earlier days, developing a new cryptocurrency demanded deep technical expertise. Today, platforms like Ethereum, with its widely adopted ERC-20 standard, and Solana, with its efficient SPL tokens, provide simple, accessible frameworks. You no longer need to build an entire blockchain from scratch; you can easily launch a new token on an existing, robust network.

- Diverse Use Cases: Crypto has moved far beyond just digital money. Tokens now represent ownership or utility across a vast array of projects:

- DeFi (Decentralized Finance): These tokens facilitate lending, borrowing, and trading without relying on traditional banks.

- Gaming & Metaverse: These function as in-game currency, virtual land ownership, or unique digital assets within virtual worlds.

- NFTs (Non-Fungible Tokens): These represent unique digital assets like art, collectibles, or even event tickets.

- Governance: Holders of governance tokens gain voting rights, allowing them to influence a project’s future direction and development.

- Speculation and Hype: The allure of potentially massive returns has drawn millions of investors into the crypto space. This high demand for the “next Bitcoin” or “next big altcoin” actively encourages developers to launch new projects, all hoping to capture a significant piece of the market’s attention and capital. This trend has fueled the memecoin craze, where tokens with little intrinsic utility can achieve billion-dollar valuations based purely on community hype and viral interest.

The Crypto Market Landscape in 2026: Key Statistics

Understanding the sheer number of cryptocurrencies is just one piece of the puzzle. The overall size of the market and the platforms where these digital assets trade are equally crucial.

Global Cryptocurrency Market Size

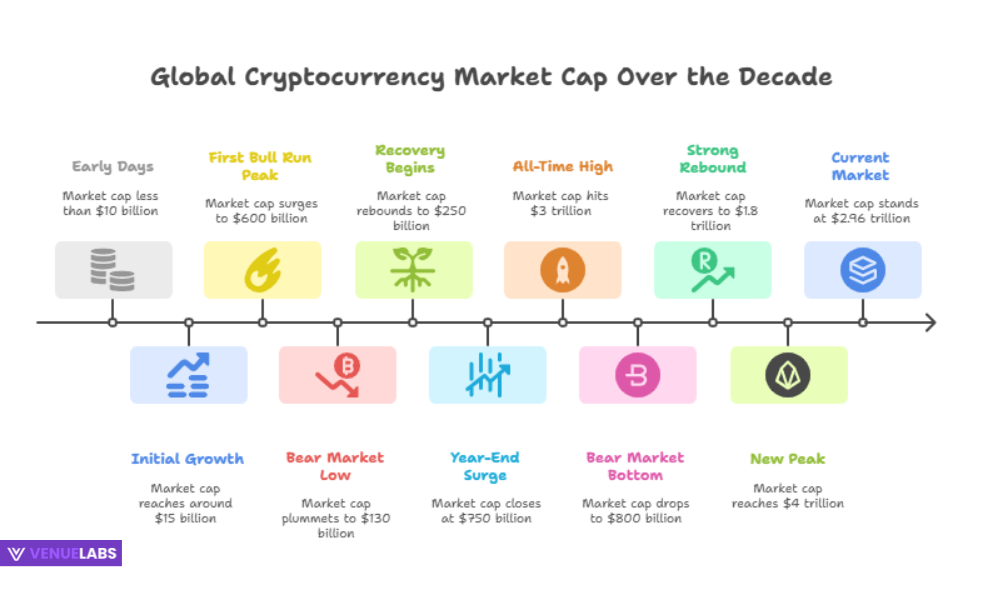

The crypto market is famous for its extreme volatility, experiencing incredible highs and devastating lows. As of 2025, the global cryptocurrency market cap stands at $2.96 trillion.

While this figure is down from its all-time peak of approximately $4 trillion reached in late 2024, it still represents monumental growth over the last decade.

Let’s look at the market cap’s journey over the years:

| Year | Approximate Cryptocurrency Market Cap |

| 2015 | <$10 billion |

| 2016 | ~$15 billion |

| 2017 | ~$600 billion (Dec peak) |

| 2018 | ~$130 billion (Bear market low) |

| 2019 | ~$250 billion |

| 2020 | ~$750 billion (End of year) |

| 2021 | ~$3 trillion (Nov peak) |

| 2022 | ~$800 billion (Bear market low) |

| 2023 | ~$1.8 trillion |

| 2024 | ~$4 trillion (Peak) |

| 2025 | ~$2.96 trillion (Current) |

Source: Forbes

Leading Cryptocurrency Exchanges

With thousands of coins available, cryptocurrency exchanges serve as the essential gateways for buying, selling, and trading digital assets. In 2025, we count 217 active cryptocurrency exchanges worldwide. Interestingly, a major shift in exchange dominance has occurred.

Here are the top 10 exchanges based on their 24-hour trading volume as of 2025:

| Exchange | 24h Trading Volume (in Billion USD) |

| SuperEx | 163.61 |

| Binance | 15.41 |

| 4E | 3.52 |

| BiFinance | 3.32 |

| HTX | 2.99 |

| Darkex Exchange | 2.95 |

| Zedcex Exchange | 2.59 |

| Bybit | 2.47 |

| MEXC | 2.45 |

| OKX | 2.30 |

Source: Statista

SuperEx’s astounding volume, over 10 times that of Binance, signals a significant shift in trader preference and potentially new regional influences.

The combined trading volume of these top 10 exchanges alone exceeds $203 billion in just 24 hours, highlighting the immense liquidity flowing through centralized platforms.

Bitcoin’s Enduring Dominance

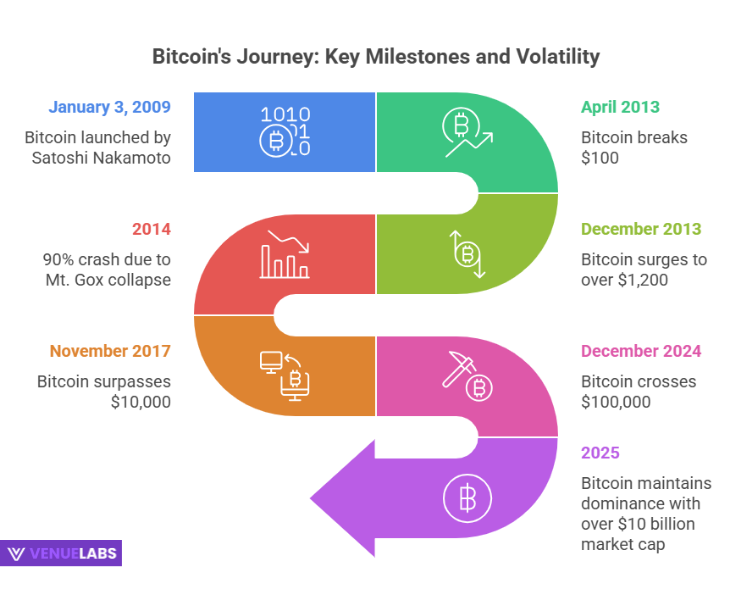

Bitcoin (BTC), launched on January 3, 2009, by the anonymous Satoshi Nakamoto, continues its reign as the “high cap” asset. As of 2025, Bitcoin maintains a market capitalization exceeding $10 billion, solidifying its dominance in the crypto space. It remains the most widely held cryptocurrency, owned by 74% of crypto investors.

In December 2024, Bitcoin impressively crossed $100,000 for the first time, fueled partly by pro-crypto policies following a specific political election.

However, early 2025 saw some volatility after the announcement of a Strategic Bitcoin Reserve. Bitcoin’s journey has involved multiple boom-and-bust cycles, frequently dropping 50-90% before rebounding even stronger.

For instance, it broke $100 in April 2013, surged to over $1,200 by December, only to face a 90% crash in 2014, dropping to $111 due to events like the Mt. Gox exchange collapse. It then rebounded to $430 by 2015 and skyrocketed past $10,000 in November 2017, peaking at over $19,000 due to mainstream interest.

Here is a look at Bitcoin’s historical price movements and returns:

| Year | Price at Start | Price at End | Return (%) |

| 2009 | N/A | N/A | N/A |

| 2010 | ~$0.00099 | ~$0.30 | 30,203%* |

| 2011 | ~$0.30 | ~$4.70 | 1,467% |

| 2012 | ~$4.70 | ~$13.50 | 187% |

| 2013 | ~$13.50 | ~$805 | 5,870% |

| 2014 | ~$805 | ~$318 | -61% |

| 2015 | ~$318 | ~$430 | 35% |

| 2016 | ~$430 | ~$960 | 124% |

| 2017 | ~$960 | ~$13,850 | 1,338% |

| 2018 | ~$13,850 | ~$3,709 | -73% |

| 2019 | ~$3,709 | ~$7,200 | 94% |

| 2020 | ~$7,200 | ~$28,949 | 302% |

| 2021 | ~$28,949 | ~$46,000 | 60% |

| 2022 | ~$46,000 | ~$16,000 | -65% |

| 2023 | ~$16,000 | ~$42,000 | 163% |

| 2024 | ~$42,000 | ~$100,000+ | 138%+ |

| 2025 | ~$100,000+ | N/A | N/A |

As of January 30, 2025, Bitcoin (BTC) impressively reached a price of $105,510, reflecting a 12.5% increase over the past 30 days.

- Also read about: Bitcoin Survey Sites 2025: How to Earn Bitcoin in Your Spare Time

Ethereum and the Altcoin Landscape

Ethereum (ETH) holds a strong position as the leader in smart contract platforms, with a $264.67 billion market cap and processing over 1 million transactions daily.

However, its ownership has declined from 65% in 2022 to 49% in 2025, coinciding with rising competition from faster smart contract platforms like Solana, which boasts 65,000 transactions per second (TPS) compared to Ethereum’s lower throughput.

Despite this, Ethereum recorded over 39 million on-chain transactions in December 2024, making it the most-used cryptocurrency that month. Bitcoin processed 12.7 million transactions in the same period, roughly one-third of Ethereum’s volume.

Other altcoins are also making waves:

- Onyxcoin (XCN) led January 2025 with a +1,550% price spike, showcasing the potential for low-market-cap altcoins to significantly outperform major assets during market surges.

- Dogecoin ownership has surprisingly increased to 31%, surpassing Solana (18%) and USDC (17%).

- Solana has gained significant traction, with 17% of crypto buyers planning to invest in it this year.

Here are the top 10 performing cryptocurrencies by 30-day change as of January 30, 2025:

| Rank | Cryptocurrency (Symbol) | Price (USD) | 30-Day % Change |

| 1 | Onyxcoin (XCN) | $0.04 | +1,550.7% |

| 2 | Gate (GT) | $24.8 | +55.1% |

| 3 | Raydium (RAY) | $7.46 | +51.7% |

| 4 | XRP (Ripple) (XRP) | $3.11 | +50.8% |

| 5 | Jupiter (JUP) | $1.11 | +35.3% |

| 6 | MANTRA (OM) | $4.78 | +34.2% |

| 7 | Litecoin (LTC) | $128.43 | +28.6% |

| 8 | Marinade Staked SOL (MSOL) | $304.1 | +26.7% |

| 9 | Solana (SOL) | $241.19 | +25.8% |

| 10 | KuCoin (KCS) | $13.93 | +30.0% |

Types of Cryptocurrencies and Their Role in 2026

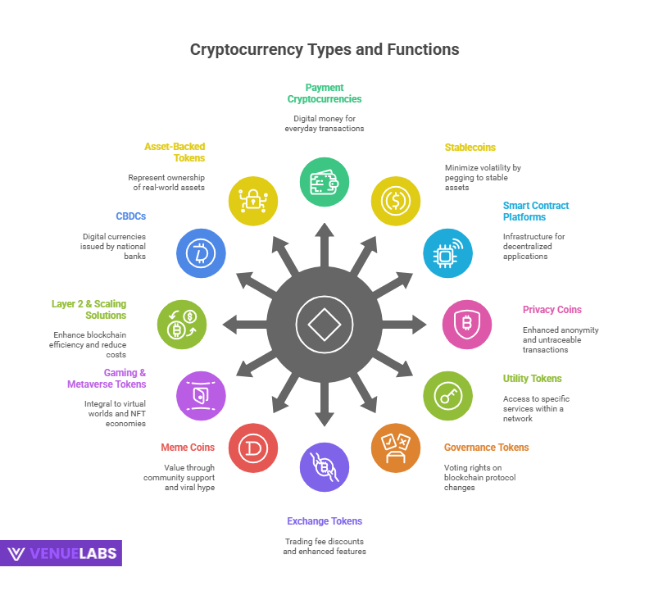

To truly understand the “number of cryptocurrencies statistics 2025” and how you can benefit, you need to recognize the diverse categories of digital assets. There are 12 main types of cryptocurrencies, each serving unique functions:

| Type of Cryptocurrency | Primary Function & Key Statistics | Examples |

| Payment Cryptocurrencies | Designed as digital money for everyday transactions. Bitcoin (BTC) remains the largest with a $1.75T market cap (March 2025). Litecoin (LTC) has 4x Bitcoin’s supply, often called “digital silver.” | Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH), Dash (DASH) |

| Stablecoins | Minimize volatility by pegging their value to a stable asset, typically the U.S. dollar. Tether (USDT) is dominant with a $142.69B market cap (4th largest overall). USD Coin (USDC) holds a $57.23B market cap and claims 100% backing. | Tether (USDT), USD Coin (USDC), Dai (DAI), Binance USD (BUSD) |

| Smart Contract Platforms | Provide infrastructure for decentralized applications (DApps) and automated contracts. Ethereum (ETH) leads with a $264.67B market cap, processing over 1M daily transactions. Solana (SOL) boasts 65,000 transactions per second (TPS), making it one of the fastest networks. | Ethereum (ETH), Solana (SOL), Cardano (ADA), Avalanche (AVAX) |

| Privacy Coins | Prioritize enhanced anonymity and untraceable transactions. Monero (XMR) ensures full anonymity, with over 95% of its transactions shielded. Zcash (ZEC) offers optional privacy features and has facilitated over 20M transactions. | Monero (XMR), Zcash (ZEC), Dash (DASH), Verge (XVG) |

| Utility Tokens | Grant access to specific services or functionalities within a blockchain network. Binance Coin (BNB) has an $84.33B market cap, widely used for trading fee discounts. Chainlink (LINK), a leading oracle network, has facilitated over $500B in innovative contract transactions. | Chainlink (LINK), Binance Coin (BNB), Uniswap (UNI), Filecoin (FIL) |

| Governance Tokens | Allow holders to vote on proposed changes to a blockchain’s protocol. Maker (MKR) holders manage over $8B in assets within MakerDAO. Aave (AAVE) governance decisions impact a DeFi lending market worth over $10B. | Maker (MKR), Aave (AAVE), Compound (COMP), Curve DAO (CRV) |

| Exchange Tokens | Issued by cryptocurrency exchanges, offering trading fee discounts, enhanced features, and rewards. Binance Coin (BNB) is the most valuable at $84.33B. OKB (OKX Exchange token) has seen over 200% price growth in the last two years. | Binance Coin (BNB), FTX Token (FTT), OKB (OKB), KuCoin Token (KCS) |

| Meme Coins | Originated as internet jokes but gained significant value through strong community support and viral hype. Dogecoin (DOGE) has a $29.84B market cap and is accepted for payments. Shiba Inu (SHIB) has over 1.3M holders. | Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Floki Inu (FLOKI) |

| Gaming & Metaverse Tokens | Integral to virtual worlds, gaming platforms, and NFT-based economies. The Sandbox (SAND) has powered $500M in virtual land sales. Axie Infinity (AXS) once processed $3B in NFT transactions in a year. | Decentraland (MANA), Axie Infinity (AXS), The Sandbox (SAND), Gala (GALA) |

| Layer 2 & Scaling Solutions | Enhance blockchain efficiency by reducing transaction costs and alleviating congestion on major chains like Ethereum. Polygon (MATIC) processes over 2.3M daily transactions, significantly reducing Ethereum gas fees. Arbitrum (ARB) holds over $10B in Total Value Locked (TVL) in DeFi protocols. | Polygon (MATIC), Optimism (OP), Arbitrum (ARB), Loopring (LRC) |

| Central Bank Digital Currencies (CBDCs) | Digital currencies issued and backed by national banks and governments. China’s Digital Yuan (e-CNY) boasts over 260M users and has completed $14B in transactions. Over 130 countries are exploring CBDCs, representing 98% of global GDP. | Digital Yuan (e-CNY), Digital Euro, Digital Rupee, FedNow (U.S. proposal) |

| Asset-Backed & Commodity Tokens | Represent ownership of real-world assets like gold, real estate, or stocks. Paxos Gold (PAXG) represents over $500M in gold-backed assets on the blockchain. Wrapped Bitcoin (WBTC) has a circulating supply of over 160,000 BTC, bridging Bitcoin to Ethereum-based DeFi. | Paxos Gold (PAXG), Tether Gold (XAUT), Synthetix (SNX), Wrapped Bitcoin (WBTC) |

The Story of Dead Cryptocurrencies: A Reality Check

With millions of tokens being created, it comes as no surprise that most of them eventually fail. Over 50% of all cryptocurrencies ever launched have ultimately failed. This is a critical point to remember when you consider the sheer number of cryptocurrencies statistics 2025.

A project is generally considered “dead” if its developers abandon it, it experiences extremely low trading volume, or it is exposed as a scam. The year 2021 saw the highest number of failures, with over 5,700 projects dying off.

Here’s a breakdown of failed coins by their launch year:

| Year of Launch | Number of Dead Coins | Failure Rate |

| 2014 | 37 | Low |

| 2015 | 27 | Low |

| 2016 | 32 | Low |

| 2017 | 346 | ~70% |

| 2018 | 1,104 | ~70% |

| 2019 | 1,154 | Moderate |

| 2020 | 1,806 | Moderate |

| 2021 | 5,724 | ~70% |

| 2022 | 3,520 | ~60% |

| 2023 | 289 | <10% |

This data clearly shows that during periods of intense market hype (like 2017-2018 and 2020-2021), a huge number of projects launch, but the vast majority ultimately do not survive the test of time or market conditions.

Crypto Users in 2026: Who is Participating?

Cryptocurrency is no longer a niche interest for tech enthusiasts; it has firmly moved into the mainstream.

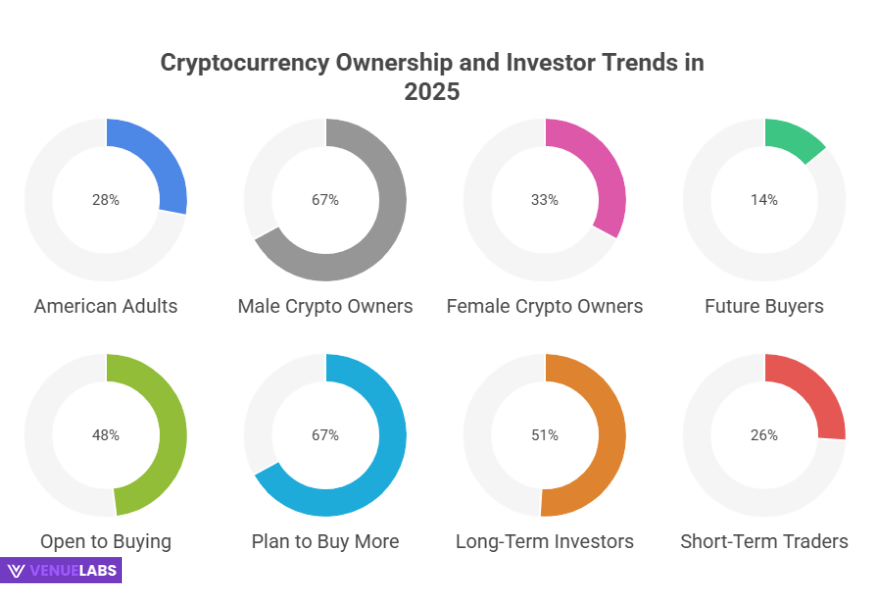

- Growing Ownership: A significant 28% of American adults (approximately 65 million people) now own cryptocurrency in 2025, nearly doubling from just 15% in 2021.

- Gender Gap: Men still dominate the space, making up 67% of crypto owners, while women account for 33%.

- Age Profile: The median age of a crypto owner is 45.

- Future Buyers: An encouraging 14% of non-owners plan to enter the crypto market in 2025, and another 48% are open to doing so.

- Investor Behavior: A majority, 67% of current crypto holders, plan to buy more this year.

- Long-Term vs. Short-Term: In 2025, 51% of crypto users identify as long-term investors, while 26% are short-term traders. The global cryptocurrency user base experienced its most significant growth, nearly 190%, between 2018 and 2020. The worldwide cryptocurrency market expects to generate $45.3 billion in revenue in 2025, with an estimated penetration rate of 11.02% globally. The United States will likely contribute the highest revenue, projected at $9.4 billion by the end of 2025.

Current Trends and Emerging Discussions (Quora/Reddit Insights)

Beyond the raw numbers, conversations on platforms like Quora and Reddit reveal key user interests and emerging trends in 2025, giving us a pulse on what crypto users truly care about:

- “DeFi 2.0 and Real-World Assets (RWAs)”: Users are keenly discussing how DeFi is moving beyond simple lending and borrowing into more sophisticated financial instruments and bringing real-world assets (like real estate or commodities) onto the blockchain. They want to know which tokens are leading this charge and how these innovations reduce traditional financial risks.

- “AI Integration in Crypto Trading”: A major hot topic is the integration of Artificial Intelligence (AI) into crypto trading strategies and analysis. People are asking about AI-driven trading bots, predictive analytics, and how AI can help identify undervalued altcoins or predict market shifts. 93% of respondents familiar with Crypto AI are based in Europe, Asia, North America, and Africa, highlighting global interest.

- “Green Crypto & Sustainability Efforts”: With increasing environmental awareness, discussions around “green crypto” are growing. Users are looking for energy-efficient blockchains and projects that actively offset their carbon footprint. They are asking about proof-of-stake vs. proof-of-work, and how to invest responsibly.

- “The Future of Web3 Gaming & NFTs with Utility”: While the initial NFT hype might have cooled, users are focusing on NFTs with actual utility in Web3 gaming and metaverse projects. They want to know about play-to-earn models, true digital ownership, and how gaming tokens contribute to immersive virtual economies.

- “Security Beyond Exchange Hacks”: While cyberattacks remain a concern (32% of owners fear them), users are now also discussing personal wallet security, seed phrase management, and advanced phishing scams. Nearly 1 in 5 crypto owners have struggled to withdraw funds from custodial platforms, highlighting concerns beyond just simple hacks.

- “The Impact of Regulation and CBDCs on Privacy”: With more countries exploring Central Bank Digital Currencies (CBDCs), users are expressing concerns on Reddit and Quora about privacy implications and government oversight. They question how regulation will shape the decentralized nature of crypto and whether CBDCs will truly offer user benefits or simply extend governmental control. Only 24% trust the government to regulate cryptocurrencies effectively.

- “Evolving Staking and Yield Opportunities”: Beyond traditional staking, users are exploring new yield-generating strategies, including liquid staking, restaking, and various DeFi protocols offering higher APYs. They are looking for ways to maximize passive income from their crypto holdings safely.

These discussions highlight a maturing market where users are not just looking for quick gains but are also deeply interested in the technological advancements, ethical implications, and practical applications of blockchain and cryptocurrency.

Concerns and The Future of Cryptocurrencies

Despite the rapid growth and innovation, several concerns persist within the crypto space in 2025:

- Security: A significant 59% of people familiar with crypto lack confidence in its security, including 40% of current crypto owners.

- Volatility: 39% of non-owners cite unstable value as their top concern, while 32% of owners fear cyberattacks.

- Withdrawal Issues: Nearly 1 in 5 crypto owners have reported struggling to withdraw funds from custodial platforms.

- Limited Adoption in Payments: Cryptocurrency adoption in payments remains minimal, with forecasts predicting it will account for only 0.2% of global transaction value by 2027.

However, the future also holds immense promise. The number of cryptocurrency users worldwide is projected to reach 861.01 million in 2025.

Will Crypto Change Under a Specific Political Administration?

Political landscapes significantly influence market sentiment. In 2025, 60% of Americans familiar with crypto expect its value to increase under a specific presidency.

A notable 46% believe that such an administration will boost mainstream adoption of cryptocurrency. Moreover, 28% support the creation of a national Bitcoin reserve, a figure that rises to 44% among current crypto owners.

Maximizing Your Benefit in the Crypto World

To truly benefit from the dynamic crypto market in 2025, consider these strategies:

- Educate Yourself Continuously: The crypto space evolves rapidly. Stay updated on new technologies, project developments, and market trends. Understand the underlying technology of the cryptocurrencies you invest in.

- Diversify Your Portfolio: Do not put all your funds into one cryptocurrency. Explore different categories like payment tokens, stablecoins, and smart contract platforms to spread risk.

- Prioritize Security: Use strong, unique passwords, enable two-factor authentication (2FA) on all your accounts, and consider hardware wallets for storing significant amounts of crypto offline. Be extremely wary of phishing attempts and suspicious links.

- Understand Risk Management: Cryptocurrencies are highly volatile. Invest only what you can afford to lose. Set clear entry and exit strategies for your investments.

- Utilize Reputable Exchanges: Choose exchanges with a strong track record of security, good customer service, and robust trading volumes. Research their security features and insurance policies.

- Explore Different Use Cases: Look beyond just trading. Engage with DeFi protocols for lending or borrowing, explore Web3 gaming, or participate in governance if you hold the relevant tokens. This deepens your understanding and can unlock new opportunities.

FAQs About Cryptocurrencies Statistics

1. How many cryptocurrencies exist in 2025?

As of 2025, over 37 million unique cryptocurrencies have been created, but a more practical number for active and meaningful projects tracked on major platforms like CoinGecko is around 17,151.

2. What is the total market capitalization of cryptocurrencies in 2025?

The global cryptocurrency market capitalization stands at $2.96 trillion in 2025, reflecting a significant rebound from previous lows but a decrease from its peak of $4 trillion in late 2024.

3. Which cryptocurrency is the most dominant in 2025?

Bitcoin (BTC) remains the most dominant cryptocurrency in 2025, with a market capitalization exceeding $10 billion, and it is owned by 74% of crypto investors.

4. What are the main concerns people have about cryptocurrencies in 2025?

The main concerns in 2025 include a lack of confidence in crypto security (59%), the unstable value of coins (39% of non-owners), and fears of cyberattacks (32% of owners).

5. How are new cryptocurrencies primarily being used in 2025 beyond just payments?

Beyond payments, new cryptocurrencies in 2025 are primarily used for diverse purposes like decentralized finance (DeFi), in-game currency and virtual land in the metaverse, non-fungible tokens (NFTs) for digital ownership, and governance tokens allowing users to vote on project developments.

Also Read:

- Internet User Statistics

- Latest Digital Marketing Statistics

- Video Marketing Statistics

- PayPal Statistics

- Social Media Statistics

Conclusion

The “number of cryptocurrencies statistics 2025” paints a picture of a vibrant, complex, and rapidly expanding digital asset landscape. While millions of tokens exist, a focused group of active cryptocurrencies drives the market.

Understanding these numbers, the different types of coins, and the evolving trends empowers you to make informed decisions and harness the potential benefits of this revolutionary technology.

The crypto market is not just about speculation; it represents a fundamental shift in how we think about finance, technology, and ownership. By staying informed and strategic, you can confidently navigate this exciting frontier.