The world of cryptocurrency is dynamic and constantly shifting. In 2025, altcoins—any cryptocurrency other than Bitcoin—are capturing significant attention.

For those looking to understand and potentially benefit from this exciting market, staying informed about the latest statistics, trends, and future projections is crucial.

This detailed guide explores altcoin usage, trading volume, market insights, and what you need to know to make informed decisions.

A Snapshot of the Altcoin Market in 2026

Altcoins are no longer just niche digital assets; they represent a substantial and growing portion of the overall crypto market. While Bitcoin (BTC) still dominates, altcoins are increasingly making their mark, driven by innovation, diverse use cases, and expanding adoption.

Let’s begin with some key altcoin statistics for 2025:

- Altcoin Market Capitalization: As of August 2025, the altcoin market cap stands at approximately $610.91 billion. This figure fluctuates daily due to the inherent volatility of the crypto market.

- Total Crypto Market Cap: The entire cryptocurrency market cap is a staggering $3.94 trillion, highlighting the immense value locked within digital assets.

- Leading Altcoins: Ethereum (ETH), XRP (Ripple), and newer contenders like Raydium are currently considered top altcoins for potential purchase, trade, or investment, based on market activity and utility.

- Ethereum’s Dominance: Ethereum maintains a robust market cap of around $4.476 billion (subject to change) and secures its position as the second-largest cryptocurrency after Bitcoin.

- Gender Demographics: Men actively participate in crypto trading and investment at a higher rate (74%) compared to women (26%). However, in specific regions like Asia, female millennials and Gen Z show higher crypto ownership than their male counterparts.

- Cryptocurrency Variety: The market now boasts over 18,449 cryptocurrencies, a number that continues to grow, showcasing the rapid expansion and diversification of the digital asset space.

Also read about: Cryptocurrencies Statistics

Global Market Overview: Bitcoin and Altcoins in 2026

In 2025, altcoins collectively claim approximately 43.7% of the global crypto market. This significant share indicates their growing influence and importance within the broader digital economy.

The total crypto market cap currently exceeds $3.942 trillion, with a daily trading volume of over $154.7 billion.

While the altcoin market experienced a decline in market capitalization from $1,610,722 in July 2025 to $607,724 by August 21, 2025 (a 62.3% drop), its trading volume saw a remarkable increase of 96.7%, jumping from $676,239 to $1,330,585 during the same period.

This suggests that while overall valuations may consolidate, trading activity remains high, indicating ongoing interest and liquidity.

The Altcoin Season Index, a measure of altcoin performance relative to Bitcoin, currently sits at 43 out of 100, suggesting that while some altcoins perform well, a widespread “altcoin season” (where most altcoins significantly outperform Bitcoin) has not yet fully materialized.

Also read about: Blockchain Statistics

Market Dominance Breakdown: Bitcoin vs. Altcoins

Bitcoin continues to hold the largest slice of the crypto pie, commanding 56.3% of the market. However, Ethereum is a strong contender, securing the second position with a substantial 13.7% market share.

The remaining 30% is distributed among thousands of other altcoins.

This distribution highlights a significant trend: while Bitcoin remains the market’s foundation, a diverse ecosystem of altcoins is actively competing for attention and capital.

Total Crypto Market Overview (August 2025)

| Metric | Value |

| Total Crypto Market Cap | $3.942T |

| BTC Dominance % | 56.3% |

| Ethereum Dominance % | 13.7% |

| Other Altcoins Dominance % | 30% |

Top Altcoins by Market Cap: A Detailed Look

Ethereum, a leading smart contract platform, remains the top altcoin by market capitalization. It is widely recognized as a trusted blockchain for digital assets, processing over 15.12 million daily transactions.

Even traditional financial institutions, such as the European Investment Bank, have utilized Ethereum’s public blockchain for digital bonds.

Here’s a closer look at the top altcoins by market cap, providing insights into their current valuations and trading activity:

Table: Top Altcoins by Market Cap (August 2025)

| Sr. No. | Name | Symbol | Market Cap (Billion USD) | Trading Volume (Billion USD) |

| 1 | Ethereum | ETH | $517.52 | $33.98 |

| 2 | XRP | XRP | $170.59 | $6.73 |

| 3 | Tether | USDT | $167.00 | $97.42 |

| 4 | BNB | BNB | $115.47 | $1.16 |

| 5 | Solana | SOL | $96.88 | $5.78 |

| 6 | USDC | USDC | $67.81 | $13.29 |

| 7 | Lido Staked Ether | STETH | $36.75 | $0.063 |

| 8 | TRON | TRX | $33.07 | $1.18 |

| 9 | Dogecoin | DOGE | $31.95 | $3.11 |

| 10 | Cardano | ADA | $30.75 | $2.89 |

| 11 | Chainlink | LINK | $16.76 | $2.29 |

| 12 | Wrapped stETH | WSTETH | $16.06 | $0.069 |

| 13 | Wrapped Bitcoin | WBTC | $14.42 | $0.240 |

| 14 | Hyperliquid | HYPE | $13.82 | $0.311 |

| 15 | Wrapped Beacon ETH | WBETH | $13.28 | $0.039 |

| 16 | Stellar | XLM | $12.39 | $0.309 |

| 17 | Sui | SUI | $12.09 | $1.47 |

| 18 | Ethena USDe | USDE | $11.60 | $0.293 |

| 19 | Wrapped eETH | WEETH | $11.59 | $0.032 |

| 20 | Bitcoin Cash | BCH | $10.91 | $0.189 |

These figures demonstrate that beyond Ethereum, a variety of altcoins attract significant capital and trading activity, reflecting their diverse functionalities and growing communities.

- Also read about: 10 Bitcoin Survey Sites 2025: How to Earn Bitcoin

Trending Altcoin Categories by Market Cap in 2026

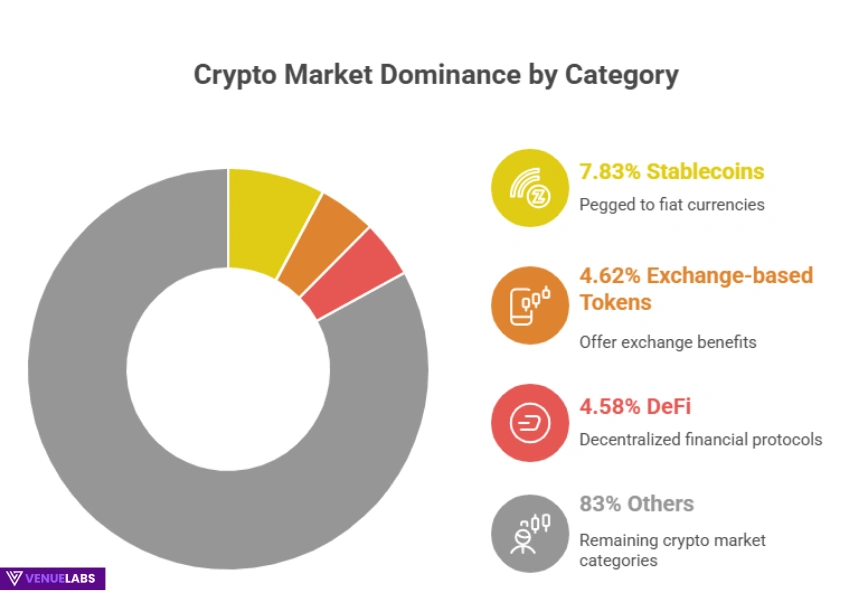

The altcoin market is not monolithic; it divides into various categories, each with unique characteristics and investment appeals. In 2025, certain categories stand out due to their market capitalization and the number of projects they encompass.

Table: Top Altcoin Categories by Market Cap (August 2025)

| Top Altcoin Categories | Market Cap (Billion USD) | Dominance (%) | Coins Count |

| Stablecoins | $279.8 | 7.83 | 350 |

| Exchange-based Tokens | $165.1 | 4.86 | 128 |

| Decentralized Finance (DeFi) | $163.5 | 4.44 | 1,395 |

| Meme | $72.7 | 4.21 | 5,310 |

| Real World Assets (RWA) | $55.3 | 4.50 | 540 |

| Artificial Intelligence (AI) | $29.4 | 2.54 | 1,189 |

| Layer 2 (L2) | $18.4 | 1.12 | 125 |

| Gaming (GameFi) | $12.6 | 2.14 | 909 |

Stablecoins lead with a substantial $279.8 billion market cap, representing 7.83% of total crypto dominance. These tokens, pegged to fiat currencies, offer stability in the volatile crypto market.

Exchange-based tokens and Decentralized Finance (DeFi) projects also hold significant market share, demonstrating the continued growth of platform-specific tokens and decentralized financial applications.

Meme coins, though often speculative, boast the largest number of tokens, reflecting a unique cultural phenomenon within crypto.

Emerging categories like Real World Assets (RWA) and Artificial Intelligence (AI) tokens are gaining traction, indicating a shift towards projects with tangible real-world applications and technological innovation.

Demographics and Adoption

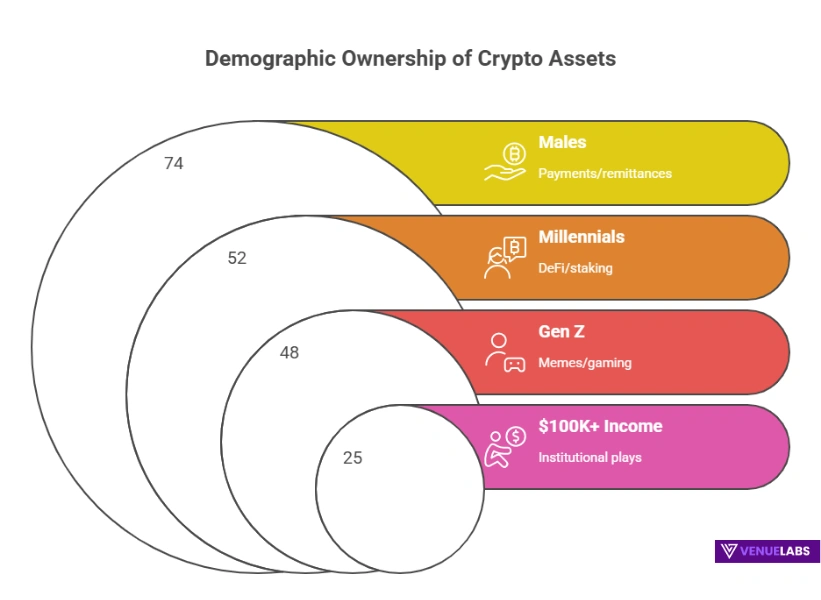

Understanding who is investing in crypto provides valuable insights into market trends. In 2025, generational and gender demographics play a crucial role in crypto adoption.

Approximately 70% of men show more interest in buying, selling, trading, and investing in cryptocurrencies compared to 30% of women.

However, younger generations are leading the charge: about 52% of Millennials and 48% of Gen Z have engaged in crypto trading or investment at some point.

The United States continues to lead the global cryptocurrency market in terms of overall trading volume and adoption.

Bitcoin & Altcoin Market: By Age and Gender

While men generally dominate crypto ownership, there are interesting nuances by age and region. In Asia-specific countries, 31% of crypto holders are women, with female millennials and Gen Z showing higher ownership rates than their male counterparts.

In the U.S., about 64% of crypto investors are male, and a significant 70% of individuals under 40, across both genders, participate in the crypto market.

This highlights the strong appeal of digital assets to younger generations. Furthermore, the adoption of cryptocurrency for payments is growing, with approximately 85% of businesses in the United States accepting and processing crypto payments.

Table: Crypto Owners Based on Gender (%)

| Gender | Crypto Ownership |

| Male | 74% |

| Female | 26% |

Bitcoin & Altcoin Market: By Income

Income levels also influence crypto ownership. Individuals earning over $100,000 annually account for 25% of all crypto investments. In contrast, only 18.6% of Americans earning less than $50,000 annually own cryptocurrency.

The average crypto investor earns about $111,000 each year. This data suggests that higher-income individuals are more likely to participate in the cryptocurrency market.

Table: Crypto Ownership by Income Level

| Income Level | Ownership Rate |

| $100,000+ annually | 25% of crypto owners |

| Under $50,000 annually | 18.6% ownership |

| Average crypto investor | $111,000 annual income |

Bitcoin & Altcoins Market Among Crypto Owners

Bitcoin, as the oldest and most established cryptocurrency, continues to be dominant among owners. A significant 76% of crypto owners hold Bitcoin, followed by 54% owning Ethereum.

Dogecoin, a popular meme coin, also captures a notable 26% of crypto owners. Looking ahead, 63% of current crypto owners express intentions to acquire more cryptocurrency in 2025, signaling continued confidence and growth.

Table: Crypto Ownership Among Current Holders

| Cryptocurrency | Market Share Among Owners | Category |

| Bitcoin | 76% | Leading cryptocurrency |

| Ethereum (ETH) | 54% | Primary altcoin |

| Dogecoin (DOGE) | 26% | Meme coin leader |

Bitcoin & Altcoins Market: By Countries

While the United States remains a leader in cryptocurrency trading, interesting trends emerge regarding global search interest in altcoins.

Bulgaria, for example, leads with a maximum search interest score of 100 for the term “altcoin” over the past 30 days. This indicates a high level of curiosity and engagement from its population.

Table: Altcoin Search Interest by Country (Past 30 Days)

| Country | Search Interest Score |

| Bulgaria | 100 |

| United States | 71 |

| Netherlands | 62 |

| Norway | 48 |

| Switzerland | 47 |

| Nigeria | 47 |

| Austria | 37 |

| Pakistan | 37 |

| Germany | 35 |

| Belgium | 29 |

Note: This data reflects search interest on Google and does not directly correlate with actual market cap or trading volume.

Altcoin Market Risks and Investment Considerations

Investing in altcoins, like all cryptocurrencies, comes with significant risks. The market experiences drastic price fluctuations, making investments highly unpredictable.

Once completed, cryptocurrency transactions are irreversible, leaving users vulnerable to potential losses. A notable 82% of people express a lack of confidence in investing in cryptocurrency, and those aged 50 and above are less likely to trade in cryptos compared to younger generations.

Moreover, government insurance does not protect cryptocurrency, unlike traditional bank deposits, adding another layer of risk for investors.

FAQs About Etheruem Statistics

1. What is an altcoin, and how is it different from Bitcoin?

An altcoin is any cryptocurrency other than Bitcoin. Bitcoin acts mainly as a store of value, while altcoins offer different functions like smart contracts, faster transactions, or stable pricing.

2. Why do altcoins often lag behind Bitcoin in market performance?

Altcoins lag because investors prioritize Bitcoin, liquidity is spread thin across many altcoins, and attention rotates quickly between sectors. Thousands of new tokens also dilute demand.

3. What factors should I consider when investing in altcoins in 2025?

Focus on real utility, strong teams, tokenomics, user growth, and on-chain activity. Compare performance to Bitcoin and understand the high volatility and survival risk.

4. Are meme coins a good investment in 2025?

Meme coins can spike fast but are mostly speculative and risky. They rely on hype, not fundamentals, so only suit high-risk investors.

5. What is the future outlook for the altcoin market beyond 2025?

The market will grow but favor altcoins with real usage and strong fundamentals. Many weak projects will fade, while selective, high-quality picks may outperform long-term.

Also Read:

- Artificial Intelligence Statistics

- Live Streaming Statistics

- Content Marketing Statistics

- Smartphone Usage Statistics

- YouTube Creator Statistics

Conclusion: Ethereum Leads, Altcoins Gain Traction

In 2025, Ethereum firmly establishes itself as the leading altcoin, commanding a significant 13.2% of the crypto market share. Other altcoins, including XRP, Raydium, and a host of emerging projects, are also gaining substantial attention in the digital crypto market.

Market capitalization, trading volume, and current price determine their growth and popularity. The United States maintains its position as a leading country in the crypto market, with India emerging as the second-largest in terms of adoption and activity.

Altcoins are progressively capturing the interest of buyers, sellers, and investors worldwide. While the market presents risks, the potential for innovation and financial benefit continues to draw a diverse range of participants.

Strategic investment, coupled with a deep understanding of market trends and individual project fundamentals, remains key for navigating the evolving altcoin landscape in 2025 and beyond.

Source: Coingecko, CoinMarketCap