Software as a Service (SaaS) has revolutionized how businesses operate, offering flexible, scalable, and cost-effective solutions that drive efficiency and foster innovation.

From small startups to multinational corporations, companies across all sectors are embracing SaaS, making it one of the fastest-growing segments in the technology industry.

Understanding the latest SaaS statistics for 2025 is not just helpful, it’s essential for anyone looking to harness its power for their benefit.

Imagine a world where you can access powerful tools without worrying about complex installations, expensive hardware, or constant maintenance. That’s the promise of SaaS, and it’s a promise that millions of businesses are already experiencing.

Think about how platforms like Shopify empower entrepreneurs to build online stores effortlessly, or how CRM software helps sales teams manage customer relationships with unprecedented ease.

SaaS simplifies, streamlines, and elevates business operations, allowing companies to focus on what they do best.

This detailed article explores the current landscape and future trajectory of the SaaS market, providing insights into its size, growth, adoption trends, usage patterns, customer dynamics, pricing strategies, and critical security considerations.

We’ll also delve into emerging trends and address common questions to give you a comprehensive understanding of SaaS in 2025 and beyond.

The Phenomenal Growth of the SaaS Market

The global SaaS market is not just growing; it’s exploding. Businesses recognize the immense value SaaS applications bring, from streamlining workflows to enhancing overall efficiency.

This recognition translates into significant market expansion and increasing investment.

The market value continues its upward climb, reflecting a consistent trend of robust growth. Looking ahead, this trajectory is set to continue, with substantial projections for the coming years.

SaaS Market Size and Growth (2020-2025 Projected)

| Year | Market Size (USD Billion) | Growth Rate (%) |

| 2020 | 178 | 13.4 |

| 2021 | 197 | 10.7 |

| 2022 | 217 | 10.2 |

| 2023 | 273.55 | 26.1 |

| 2024 | 317.55 | 16.1 |

| 2025 | 380 (Projected) | 19.6 (Projected) |

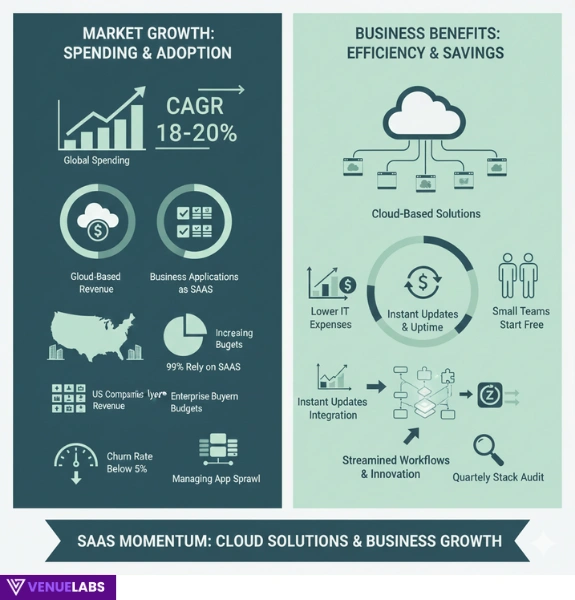

- By 2025, the global SaaS market is projected to reach an estimated $380 billion, continuing its rapid expansion. This phenomenal growth means the SaaS industry has expanded by approximately 500% over the last seven years, showcasing its undeniable impact.

- The compound annual growth rate (CAGR) for the SaaS sector remains impressive, with projections reaching 18.4% from 2023 to 2032. This sustained high growth rate signals a healthy and expanding market.

- The United States continues to be the largest revenue generator in the SaaS market, with expected earnings of US$221.50 billion in 2025. This highlights North America’s leadership in SaaS innovation and adoption.

- Companies are significantly increasing their investment in public cloud services. Experts predict public cloud spending will soar from 17% of company IT spending in 2021 to over 45% by 2026. This shift underscores a broader trend towards cloud-first strategies.

- In 2025, the estimated expenditure on SaaS applications per employee will likely exceed $92.19, reflecting increased reliance on these tools.

These statistics paint a clear picture: SaaS is not just a trend; it’s a fundamental shift in how businesses acquire and utilize software, driving unprecedented growth and opportunity.

Also read about: Conversion Rate Optimization Statistics

Widespread Adoption: SaaS Becomes the Standard

SaaS is no longer an option; it’s becoming the standard. Businesses across every industry are integrating SaaS applications into their daily operations to improve efficiency, enhance customer experiences, and achieve faster results.

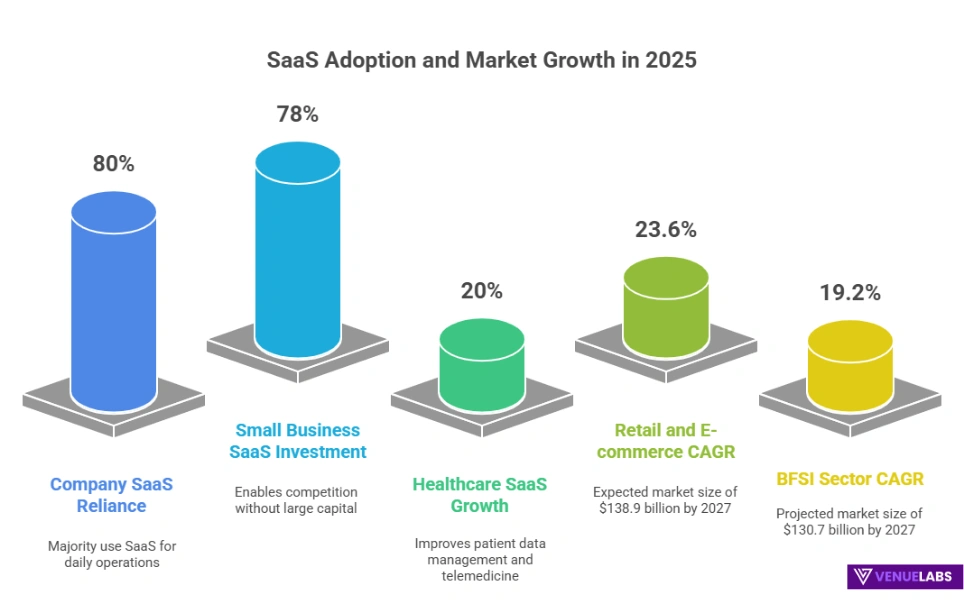

- A remarkable 99% of businesses will use at least one SaaS application by the end of 2024, emphasizing widespread cloud adoption. This statistic alone speaks volumes about how integral SaaS has become to modern business.

- Looking ahead to 2025, experts predict that an astounding 85% of all business applications will be SaaS-based. This near-universal adoption transforms how companies manage their software portfolios.

- Small businesses are actively embracing SaaS solutions, with 78% already making investments. This shows that the benefits of SaaS are accessible and valuable to organizations of all sizes.

- The healthcare industry is a notable area of growth, with SaaS adoption increasing at an exciting rate of 20% each year. This highlights the critical role SaaS plays in modernizing and improving healthcare operations.

- Larger organizations with over 10,000 employees are power users, employing an average of about 447 SaaS applications. This demonstrates the scalability and comprehensive utility of SaaS for complex enterprise environments.

- The retail and e-commerce industries are experiencing explosive growth in SaaS adoption, with projections indicating a CAGR of 23.6% and a market value reaching $138.9 billion by 2027. This reflects the critical role SaaS plays in enabling online commerce and retail innovation.

- The global BFSI (Banking, Financial Services, and Insurance) sector also anticipates significant SaaS growth, reaching a value of $130.7 billion by 2027, with a CAGR of 19.2%. Financial institutions are leveraging SaaS for enhanced security, compliance, and efficiency.

- A significant 71% of businesses are deploying cloud-based SaaS primarily to enhance IT service delivery speed. Other key drivers include increased flexibility (63%) and business continuity (58%).

The overwhelming adoption rates confirm that businesses understand and value the agility, scalability, and cost-effectiveness that SaaS provides.

Also read about: OptimizePress vs Leadpages

How Businesses Use SaaS: Efficiency and Innovation

With such high adoption rates, it’s clear that companies are actively using SaaS to improve their operations. But how exactly are these applications being leveraged?

- An impressive 80% of businesses actively use at least one SaaS application, underscoring the critical role of cloud-based software. This widespread usage is not surprising given the flexibility and scalability SaaS offers.

- A strong 70% of CIOs favor SaaS for its unparalleled flexibility and scalability. These characteristics are vital for businesses operating in dynamic markets.

- Businesses are increasingly integrating more SaaS applications into their operations. The average organization escalated from using 80 apps in 2020 to 130 apps in 2022, a clear indicator of the accelerating shift towards cloud-based workflows.

SaaS has emerged as the standard for business software, enabling companies to work smarter, boost their efficiency, and drive innovation.

Keeping Customers: Retention and Churn in SaaS

While acquiring new customers is important, retaining existing ones is often more cost-effective and profitable for SaaS companies. Understanding churn rates – the rate at which customers cancel their subscriptions – is crucial for sustained growth.

- A good churn rate for SaaS companies targeting small businesses typically falls between 3-5% annually. This benchmark helps companies assess their customer satisfaction and retention strategies.

- Businesses generate 65% of their income from returning customers, who generally spend 67% more than new users. This highlights the significant financial value of customer loyalty.

- Retaining existing customers costs five times less than acquiring new ones. This economic reality underscores the importance of strong customer success initiatives.

- Even a modest 5% increase in customer retention can lead to a substantial increase in profits, ranging from 25% to 95%. This demonstrates the powerful impact of loyalty on the bottom line.

- The median annual churn rate for SaaS businesses generating less than $10 million in revenue annually is 20%, while companies earning over $10 million typically see an average churn rate of 8.5%. This indicates that scale and maturity often correlate with better retention.

- Two-thirds of companies (64%) experience churn rates of 5% or more, with 32% reporting 5-10% churn and 17% reporting 10-15%. This shows that churn is a common challenge that requires continuous attention.

- Lower-growth companies are more likely to experience high churn rates. For example, 42% of low-growth companies report high churn, compared to 34% of high-growth companies.

- The acceptable churn rate typically ranges from 5-7% annually, or approximately 0.42-0.58% monthly. This means losing around 1 in 200 customers each month.

- A majority of SaaS businesses (69%) measure churn rates by the number of customers, while 62% use revenue-based metrics.

- In the past year, 30% of SaaS companies reported an increase in their churn rates, highlighting the dynamic nature of customer retention.

- Longer contracts often correlate with lower churn rates. For contracts of 2.5 years or more, the churn rate is 8.5%, significantly lower than the 16.7% for contracts under a year.

- Channel sales tend to have the highest churn rate at 17%, while field sales have the lowest at 11.8%.

- Customers logging into a mobile app show a 41.5% monthly retention rate, indicating that mobile platforms significantly boost engagement and loyalty.

These statistics emphasize that effective customer retention strategies are paramount for the long-term success and profitability of any SaaS business.

Also read about: Graphy VS LearnDash

Pricing Strategies: Finding the Sweet Spot

SaaS pricing models play a critical role in attracting and retaining customers while ensuring profitability. Companies employ various strategies, each with its own advantages.

- Per-user pricing remains the most popular option among SaaS businesses, offering simplicity and scalability. This model directly links cost to usage, making it easy for customers to understand.

- Price inflation for SaaS products is currently 8.7%, meaning subscriptions are nearly 9% more expensive than last year. This reflects the increasing value and demand for SaaS solutions.

- Over 94% of B2B SaaS leaders adjust their pricing and packaging annually, with almost 40% making changes as frequently as quarterly. This agile approach allows companies to adapt to market demands and optimize revenue.

- Only 10% of SaaS companies use a cost-plus pricing strategy, which involves adding a markup to production costs. This suggests a greater emphasis on value-based pricing.

- When setting prices, 39% of companies adopt a value-based approach, focusing on the perceived value to the customer. This contrasts with 26% who make a judgment call, 25% who copy competitors, and 10% who use a cost-plus method.

- Usage-based pricing is gaining traction, with 38% of SaaS companies implementing it. This model often aligns well with customer value perception.

- A mere 31% of businesses offer small discounts, with 38% providing occasional discounts of 10-25%. This suggests a shift away from aggressive discounting.

- Even a 1% improvement in pricing can boost profits by an impressive 11%, highlighting the power of effective price management.

- The optimal number of paid packages is typically between 3 and 4. Too few options can limit upsell opportunities, while too many can overwhelm potential buyers.

- An astonishing 38% of SaaS companies prefer not to offer free trials or a ‘freemium’ option. This suggests that for some business types, these models may not be a good fit or could even harm revenue.

- More than half of companies (54%) offer annual pricing plans, which can benefit both customers (discounts) and businesses (reduced churn and increased customer lifetime value).

Effective pricing is a dynamic process that requires continuous evaluation and adjustment to maximize revenue and customer satisfaction.

Security and Compliance: A Top Priority

As SaaS adoption grows, so does the importance of robust security measures and compliance with regulations. Protecting sensitive data is a primary concern for both providers and users.

- A concerning 55% of organizations experienced a SaaS security incident in the last two years, with an additional 12% uncertain. This highlights the ongoing challenge of maintaining security in the cloud.

- Over half (58%) of organizations report that their current SaaS security solutions cover 50% or less of their applications, and 7% have no monitoring in place. This points to significant gaps in security coverage.

- A troubling 31% of respondents reported their organizations experienced a data breach, a 5-point increase from the previous year. This underscores the escalating threat landscape.

- Nearly 38% expressed concerns about data risks and protecting intellectual property related to Generative AI (GenAI). The rise of AI introduces new security considerations.

- Interestingly, 15% of organizations have centralized responsibility for SaaS security within their cybersecurity teams. This indicates a move towards more integrated security management.

- Data loss and leakage remain the biggest cloud security concern for 67% of cybersecurity professionals, followed by data privacy (61%). Confidentiality, accidental exposure, and regulatory compliance also rank high.

- When purchasing SaaS apps, cost (59%) and security (47%) are the two most important factors for IT experts. This prioritization reflects the critical nature of these elements.

- SaaS statistics reveal that 18.1% of files uploaded to cloud-based file-sharing and collaboration services contain sensitive data. This includes confidential documents (44.4%), personally identifiable information (3.9%), and payment information (2.3%).

These statistics clearly demonstrate that SaaS security is not a luxury but a necessity, demanding continuous vigilance and investment from both providers and users.

Regional Dominance: A Global Landscape

The SaaS market is global, but certain regions stand out for their concentration of SaaS companies and market value.

Number of SaaS Companies by Country (Top 10)

| Country | No. of SaaS Companies |

| United States | 9,100 |

| United Kingdom | 1,500 |

| Canada | 992 |

| Germany | 840 |

| India | 711 |

| France | 684 |

| China | 443 |

| Australia | 408 |

| Netherlands | 402 |

| Brazil | 342 |

- The United States leads the world in SaaS businesses, hosting 9,100 companies and accounting for 46% of the global market. This firm leadership underscores the U.S. as a powerhouse of SaaS innovation.

- In 2023, the market value in North America reached $131.18 billion, solidifying its position as a dominant force.

- Germany is poised to capture the largest share of the European SaaS market, reflecting strong regional growth.

- In 2023, China led the Asia Pacific SaaS market, with Japan and India following closely, indicating robust growth across the region.

These regional statistics highlight the diverse yet concentrated nature of the global SaaS market, with North America and parts of Asia leading the charge.

Marketing and Sales: Reaching and Converting Customers

Effective marketing and sales strategies are crucial for SaaS companies to attract leads, convert them into customers, and drive revenue growth.

- B2B SaaS sales cycles averaged 69 days, a slight increase from previous years, indicating that purchasing decisions are becoming more deliberate.

- SaaS companies typically allocate around 15% of their yearly budget to marketing activities. This investment is vital for brand visibility and lead generation.

- SaaS businesses typically lose 18% of the contract value due to discounts, highlighting the impact of pricing strategies on profitability.

- SaaS marketing predominantly employs three key tactics: Email Marketing (84%), Social Media Advertising (75%), and Content Marketing (69%). These digital channels are essential for reaching target audiences.

- Almost half of users (47%) will engage with 3 to 5 pieces of content before contacting a sales representative, emphasizing the importance of a well-developed content strategy.

- SaaS companies with blogs generate 67% more leads than those without, showcasing the power of content marketing in attracting potential customers.

- New customer acquisition remains the top growth activity for 89% of SaaS businesses, highlighting the continuous need to expand the customer base.

- However, existing customer renewals (59%) and upselling/add-on sales (46%) are also critical growth strategies, emphasizing the value of nurturing current customer relationships.

- The average startup spends a staggering 92% of its first-year revenue on customer acquisition, indicating the high initial investment required to gain market share.

These statistics provide valuable insights into the dynamic marketing and sales landscape within the SaaS industry, emphasizing the need for strategic and integrated approaches.

Quora & Reddit Insights: What Users Are Asking

Beyond the official reports, online communities like Quora and Reddit offer a pulse on real-world user concerns and emerging needs. Here’s what users are frequently asking about SaaS:

- “How do I choose the Users are often overwhelmed by the sheer number of options and seek guidance on evaluating features, pricing, integration capabilities, and scalability for their unique workflows. They want practical advice on cutting through the noise.

- “What are the best practices for integrating multiple SaaS applications without creating a ‘spaghetti’ mess?” As businesses use more SaaS tools, the challenge of seamless integration becomes a major pain point. Users are looking for strategies to avoid data silos and workflow disruptions.

- “Are smaller, niche SaaS tools more effective than large, all-in-one platforms?” This question often comes from users looking for specialized solutions that perfectly fit their needs versus generalized tools that might offer more features but less depth in specific areas.

- “How can I manage SaaS sprawl and optimize my subscriptions to avoid unnecessary costs?” With the proliferation of SaaS, businesses are realizing they might be paying for underutilized tools or redundant subscriptions. They are seeking advice on auditing, consolidating, and negotiating SaaS contracts.

- “What are the long-term implications of relying heavily on SaaS for data security and vendor lock-in?” Despite the benefits, users express concerns about data ownership, vendor stability, and the ease of migrating data if they decide to switch providers.

These questions reveal a user base that is increasingly sophisticated, concerned with practical implementation, cost optimization, and long-term strategic considerations when adopting SaaS.

Emerging SaaS Industry Trends

The SaaS landscape is constantly evolving, driven by technological advancements and changing business needs. Several key trends are shaping its future:

- Artificial Intelligence (AI) and Machine Learning (ML) Integration: AI and ML are becoming increasingly vital to SaaS solutions, enhancing features, automating tasks, providing predictive analytics, and improving the overall user experience. Expect more personalized and intelligent SaaS applications.

- Remote and Hybrid Work Enablement: The widespread adoption of remote and hybrid work models continues to drive demand for SaaS solutions that enhance collaboration, communication, and productivity for distributed teams. Tools facilitating virtual meetings, project management, and secure document sharing are booming.

- Low-Code and No-Code Platforms: These platforms empower non-technical users to create applications easily, accelerating workflows and enhancing customization. This trend democratizes software development, allowing more businesses to build bespoke solutions without extensive coding knowledge.

- Hyper-Focused Security Measures: As cyber threats escalate, SaaS providers are prioritizing and investing heavily in robust security measures, including advanced encryption, multi-factor authentication, and compliance with stringent data protection regulations, to safeguard user data and maintain trust.

- Vertical SaaS: Tailored SaaS solutions designed for specific industries (e.g., healthcare, construction, legal) are gaining traction. These vertical SaaS offerings provide highly specialized features and workflows that generic solutions cannot match, offering deeper value to niche markets.

- Composability: Businesses are moving towards “composable” architectures, where they can easily mix and match different SaaS components and APIs to build highly customized technology stacks. This offers unprecedented flexibility and agility.

These trends indicate a future where SaaS solutions become even more intelligent, specialized, secure, and adaptable to the unique demands of modern businesses.

FAQs About SaaS Statistics

1. What does SaaS stand for and why is it so popular?

SaaS stands for Software as a Service. It’s popular because it offers cloud-based software with lower costs, automatic updates, and accessibility from anywhere.

2. How will SaaS impact small businesses in 2025?

In 2025, SaaS will help small businesses access powerful tools for operations, marketing, and finance, boosting competitiveness without large IT budgets.

3. What are the main security concerns with SaaS, and how are they being addressed?

Security concerns include data privacy and compliance. Providers use encryption, multi-factor authentication, and regular audits to address these risks.

4. How do businesses choose the right SaaS pricing model for their needs?

Businesses choose SaaS pricing models based on value, industry standards, and customer needs, with options like per-user, usage-based, or tiered pricing.

5. What emerging technologies are most influencing the future of SaaS?

AI, Machine Learning, low-code/no-code platforms, remote work tools, and enhanced security measures are key technologies shaping SaaS’s future.

Also Read:

- Artificial Intelligence Statistics

- Gemini Statistics

- Metaverse Statistics

- Online Advertising Statistics

- Google Ads Statistics

Conclusion

SaaS is an indispensable force transforming the business world. Its continuous evolution, driven by market demand, technological innovation, and a constant focus on user needs, makes it a dynamic and exciting sector.

From its impressive market size and consistent growth to its widespread adoption across industries, SaaS is proving to be a cornerstone of modern business strategy.

In 2025, we will see 85% of business applications becoming SaaS-based, highlighting its critical role in enhancing efficiency and productivity.

The integration of AI, the rise of low-code/no-code platforms, a strong focus on security, and the move towards specialized vertical solutions are all shaping a future where SaaS is more intelligent, adaptable, and indispensable than ever before.

For businesses looking to thrive, understanding these SaaS statistics and trends is paramount. It empowers you to make informed decisions, optimize your operations, and leverage the power of cloud-based software to unlock new levels of success.

The future of business is in the cloud, and SaaS is leading the way.