India’s financial landscape has undergone a monumental transformation, largely thanks to the Unified Payments Interface (UPI).

This indigenous payment system has not only revolutionized how Indians handle money but has also garnered international acclaim, becoming a global benchmark for digital payments.

If you want to understand the incredible growth of UPI, its current statistics in 2026, how it benefits users, and its expanding global footprint, you have come to the right place.

This detailed article will cover everything you need to know about UPI statistics 2026, written in simple English for everyone to grasp.

The UPI Phenomenon: Reshaping Digital Transactions

UPI is more than just an app on your phone; it’s a financial revolution that has brought unparalleled ease and speed to transactions.

It accounts for more than 80% of all digital payments in India, a testament to its widespread adoption and user trust.

In a remarkable display of its power, UPI processed over 14.96 billion transactions with a staggering total value of ₹20.60 lakh crores (approximately $247 billion USD) in recent months.

The International Monetary Fund (IMF) has even recognized UPI’s success, highlighting its ability to “transform the digital payments landscape in India” and offering crucial lessons to the world.

They note that UPI has become the largest real-time payment system globally by volume, processing over 19 billion transactions every month as of September 2025.

UPI Statistics: Top Highlights

Here’s a quick look at the most compelling UPI statistics:

- User Base: Over 350 million people actively use UPI in India.

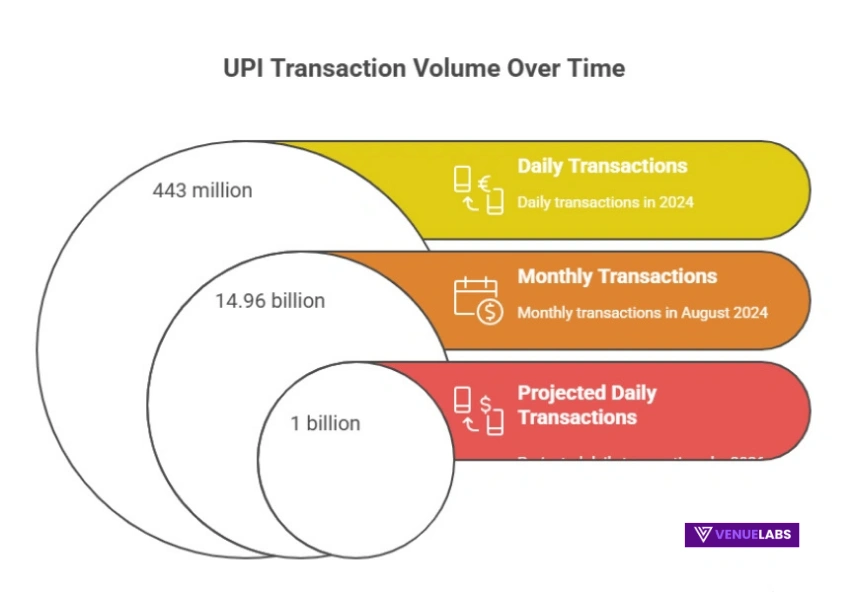

- Daily Transactions: More than 443 million UPI transactions happen every single day.

- Monthly Transaction Volume: UPI crossed the 14.96 billion transaction mark, with predictions to reach 20 billion monthly.

- Global Acceptance: UPI is accepted in 27 countries, and 10 more are potentially looking to adopt it.

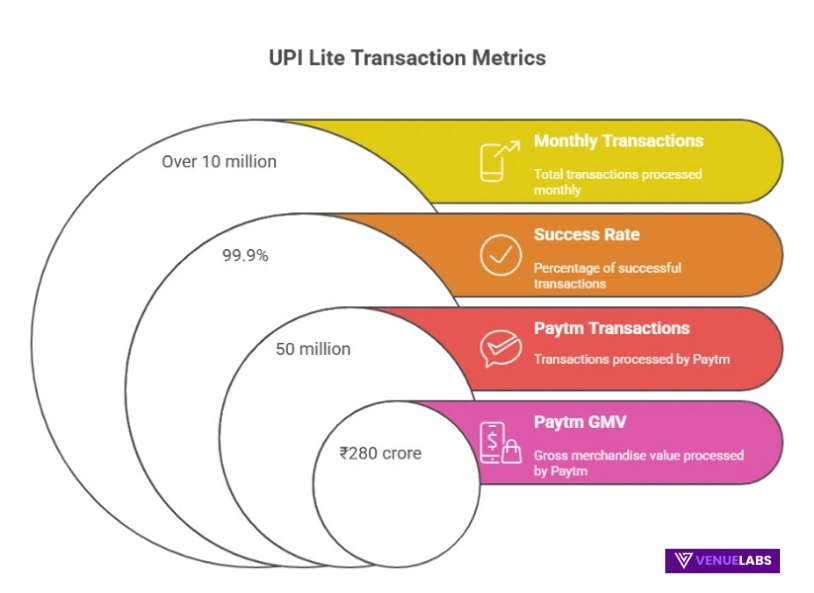

- UPI Lite Growth: Over 10 million small-value transactions are processed through UPI Lite every month.

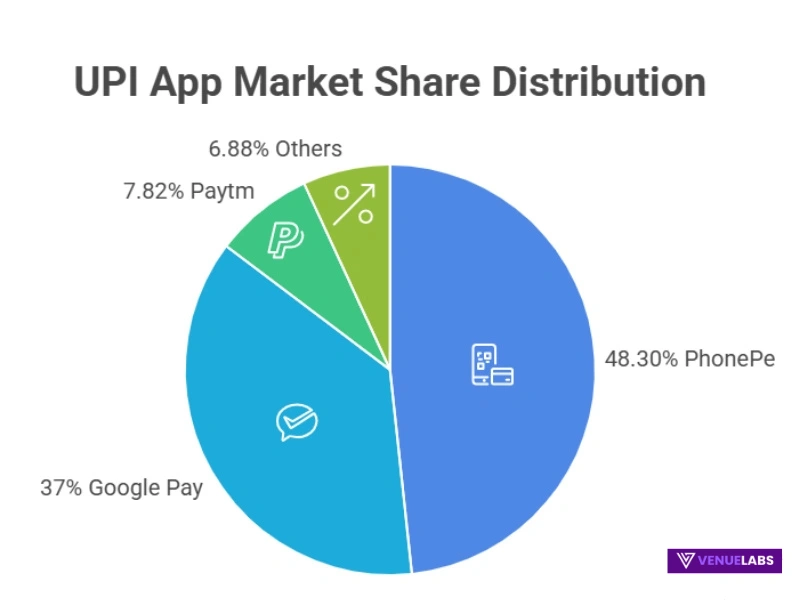

- Market Leader: PhonePe dominates the UPI market, accounting for over 48.3% of all UPI transactions.

- Transaction Limit Increase: The Person-to-Merchant (P2M) UPI transaction limit has been raised to ₹10 lakh per day for select verified categories since September 15, 2025.

Also read about: PayPal Statistics

Who Uses UPI? A Look at the Growing User Base

The growth of UPI users has been exponential since its launch in 2016. In just a few years, it quickly surpassed 100 million users and continues to grow at an incredible pace.

Millions Embrace Cashless Payments

- Over 350 Million People Use UPI in the Indian Market: Eight years after its launch, UPI has successfully reached a benchmark of 350 million users across India. This highlights a significant shift towards cashless payments among the Indian populace.

- Projected Growth: According to current estimates, the number of UPI users is expected to exceed 365 million very soon.

- Willingness to Adopt: The Asia-Pacific region, including India, shows a strong willingness to adopt emerging cashless payment methods, with 93% of people likely having made such payments in the past year.

UPI Transactions: A Daily and Monthly Phenomenon

The volume of UPI transactions in India has skyrocketed, particularly in the post-COVID era, showcasing its critical role in daily financial activities.

Daily Transaction Surge

- More Than 440 Million UPI Transactions Take Place Daily: Daily UPI transactions have experienced exponential growth, surpassing 443 million transactions per day. This is a massive increase from 240 million daily transactions recorded in February 2022.

- Projected Daily Transactions: These daily transactions are predicted to reach 465 million in the near future.

- Value of Transactions: As of 2023, the value of these daily UPI transactions was approximately ₹6.27 lakh crore, marking a 17% increase in value compared to the previous year.

Monthly Transaction Milestones and Limits

- An Average of 10.07 Billion UPI Transactions Per Month: UPI monthly transactions first crossed the 10 billion mark in August 2023 and have been steadily increasing. A study from November 2022 to November 2023 showed an average of 10.066 billion transactions monthly.

- Future Projections: The National Payments Corporation of India (NPCI) projects that UPI transactions could reach 20 billion monthly within the next 18–24 months.

- Daily Transaction Limit: Users can conduct up to 20 UPI transactions within a 24-hour period. This limit can vary based on individual banks. Popular UPI apps like Paytm, Google Pay, and Amazon Pay UPI typically set a daily transaction limit of ₹1 lakh (approximately $1,199.50 USD).

The following table displays the number of UPI transactions over time:

| Month | Number of UPI Transactions |

| Aug-24 | 14.963 billion |

| Jul-24 | 14.435 billion |

| Jun-24 | 13.885 billion |

| May-24 | 14.035 billion |

| Apr-24 | 13.303 billion |

| Mar-24 | 13.440 billion |

| Feb-24 | 12.102 billion |

| Jan-24 | 12.203 billion |

| Dec-23 | 12.020 billion |

| Nov-23 | 11.235 billion |

| Oct-23 | 11.408 billion |

| Sep-23 | 10.555 billion |

| Aug-23 | 10.586 billion |

| Jul-23 | 9.964 billion |

| Jun-23 | 9.335 billion |

| August 2025 | 20 billion |

Monthly Transaction Value and Limits

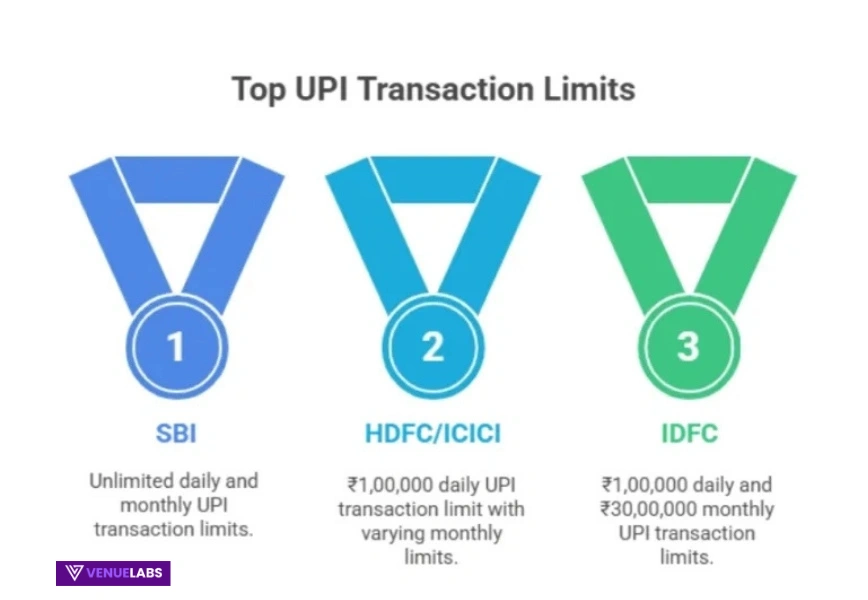

- The Maximum UPI Transaction Limit Per Month Is ₹30,00,000: While some public sector banks and recognized private banks have imposed a monthly UPI transaction limit, such as IDFC bank at ₹30,00,000, others like SBI have not set a specific monthly limit. These limits can vary until all banks adhere to a standard set by the RBI.

- New P2M Transaction Limit: As of September 15, 2025, the UPI transaction limit for Person-to-Merchant (P2M) payments has been increased to ₹10 lakh per day for select verified categories, further facilitating high-value digital transactions.

Here is the typical UPI limit of popular banks in India:

| Bank Name | UPI Transaction Limit (Daily) |

| Bank Of Baroda | ₹25,000 |

| HDFC | ₹100,000 |

| ICICI Bank | ₹100,000 |

| IDBI Bank | ₹100,000 |

| IDFC | ₹100,000 |

| India Post Payment Bank | ₹25,000 |

| Kotak Mahindra Bank | ₹100,000 |

| United Bank of India | ₹25,000 |

| Punjab National Bank | ₹25,000 |

UPI’s Global Footprint: Beyond India’s Borders

UPI’s success has not gone unnoticed internationally. What started as an Indian innovation is now a global symbol of efficient digital payments.

Expanding International Acceptance

- 27 Countries Worldwide Use UPI: UPI usage is no longer confined to India. Countries like Sri Lanka, France, Singapore, and the UAE have adopted the UPI payment system. Agreements with the Reserve Bank of India (RBI) and other central banks have facilitated this expansion. The NPCI is actively engaging with nations in the USA, Europe, and West Asia to further extend UPI services.

- Global Use Cases: Indian tourists can now pay at the Eiffel Tower in France using UPI, settling bills in rupees. This highlights the practical and growing international interoperability of UPI.

Here is a list of countries that accept UPI:

| Country | Country | Country |

| India | Singapore | South Korea |

| Armenia | Thailand | Bahrain |

| Bhutan | Cambodia | Maldives |

| Nepal | Vietnam | United Arab Emirates |

| France | Sri Lanka | Australia |

| Qatar | Indonesia | Japan |

| Saudi Arabia | Oman | Switzerland |

| Malaysia | Mauritius | Canada |

| United Kingdom | European Union | Russia |

UPI Lite: The Solution for Small-Value Transactions

UPI Lite is a game-changer for small, everyday transactions, allowing users to transfer money with a single click without requiring a PIN for each payment.

High Volume, High Success

- Over 10 Million Transactions Are Processed Through UPI Lite Every Month: UPI Lite has quickly gained traction, processing millions of small-value transactions monthly. Paytm was an early adopter, with over 63% of all UPI Lite payments through Paytm QR codes originating from the Paytm app. Paytm Payments Bank alone has recorded 50 million UPI Lite transactions and a total transaction GMV of ₹280 crore.

- Increased Transaction Limit: Recognizing its widespread popularity, the Reserve Bank of India recently increased the UPI Lite transaction limit from ₹200 to ₹500, further boosting its utility for everyday small payments.

- Exceptional Success Rate: UPI Lite boasts an impressive 99.9% success rate, even during peak transaction hours. This is largely due to its PIN-less nature, which reduces system load and speeds up processing.

Which Bank Leads in UPI Transactions?

Banks play a crucial role in facilitating UPI transactions. Knowing which banks handle the most volume can give you insight into the system’s infrastructure.

SBI at the Forefront

- The State Bank of India Has the Highest Share in UPI, with an Average of 4.05 Billion Transactions Recorded: SBI leads the pack, handling a massive volume of UPI transactions. This volume grew by almost 200 million in one month and increased by 1 billion within a year from October 2022.

- Top Contenders: HDFC Bank Ltd holds the second-highest share, followed by Bank of Baroda and Union Bank of India.

Here are further details about the top 10 banks with the highest share of UPI based on the number of transactions:

| Bank Name | Average Total Transactions Recorded |

| State Bank Of India | 4,052 million |

| HDFC Bank Ltd | 1,270 million |

| Bank of Baroda | 985 million |

| Union Bank of India | 941 million |

| Punjab National Bank | 835 million |

| Kotak Mahindra Bank | 772 million |

| Axis Bank Ltd | 730 million |

| Canara Bank | 722 million |

| ICICI Bank | 648 million |

| Bank of India | 478 million |

Share of Online Payment Apps in UPI Market

The competitive landscape of UPI apps is dynamic, with leading players constantly vying for market share.

PhonePe Dominates

- PhonePe Is the Leading Player in the UPI Market, With 48.3% of the Share: PhonePe, Google Pay, and Paytm consistently remain the top three players in India’s UPI payments market. Together, these three apps account for almost 95% of all UPI transactions by value.

- Growth of Other Apps: Over recent months, the market share of BHIM and Amazon Pay has also seen an increase.

The following table shows the share of UPI apps in all UPI transactions:

| UPI Apps | Market Share |

| PhonePe | 48.3% |

| GooglePay | 37% |

| Paytm | 7.82% |

| Others | 6.88% |

In-Depth Look at Top UPI Applications

Let’s dive deeper into the individual performance and features of the leading UPI applications.

PhonePe Statistics

PhonePe is the most preferred UPI app in India, with almost one in two UPI users relying on it for online payments.

- Revenue Growth: PhonePe recorded a consolidated revenue of INR 2,914 crores in the financial year 2023, marking a 77% year-over-year growth. They aim to be a leader in digital payments, particularly for money transfers, mobile recharges, and bill payments.

- Massive User Base and Reach: PhonePe has over 500 million registered users, meaning one in four Indians uses the app. It has successfully digitized over 36 million offline merchants, covering 99% of postal codes across India. PhonePe was also recognized as the Most Trusted Brand for Digital Payments in 2023.

Google Pay Statistics

Google Pay quickly gained popularity due to its seamless services and rewarding features.

- Global Reach: 150 million users across 19 countries use Google Pay, with projections to acquire another 100 million users in the upcoming year. In India, Google Pay has 67 million active users.

- Business Adoption: 2,193 companies worldwide use Google Pay as a mobile payment tool, especially in Germany, the United Kingdom, and the United States.

- High Usage in India: An impressive 77% of people in India make online payments using Google Pay. Specifically, 83% use it for in-store payments, and 79% for online transactions.

Here are further details about Google Pay Usage recorded for in-store and online payments:

| Country | Usage of Google Pay at Stores, Restaurants, and Other POS | Usage of Google Pay For Online Payments |

| India | 83% | 79% |

| United States | 37% | 32% |

| Poland | 34% | 39% |

| Finland | 32% | 29% |

| Germany | 31% | 16% |

| Italy | 30% | 18% |

| Switzerland | 29% | 27% |

| France | 29% | 15% |

| United Kingdom | 28% | 23% |

| Canada | 27% | 25% |

Paytm Statistics

Paytm has shown significant growth in its monthly transacting users and continues to be a major player.

- Growing User Base: Paytm had an average of 89 million monthly transacting users in the financial year 2023, a 36% increase from the previous year. Paytm’s CEO expects to reach 500 million payment users and 100 million merchants soon.

- Strong Revenue: The total revenue of Paytm in the financial year 2023 was ₹7,990 crore, with payment services alone contributing ₹4,930 crore, a 58% growth compared to 2021.

- Transaction Volume: Paytm Payments Bank witnessed a total transaction volume of 407.65 million in June 2023, an increase of almost 200 million transactions in one year.

Here are further details about the Revenue from Payment Services recorded by Paytm:

| Financial Year | Paytm Revenue From Payment Services Over The Years (in crores) |

| 2023 | 4,930 |

| 2022 | 3,432 |

| 2021 | 1,981 |

Here are the number of UPI transactions (transaction volume) recorded through Paytm Payments bank over the last months:

| Month | The Volume Of Transactions Recorded On Paytm (in millions) |

| June 2023 | 407.65 |

| May 2023 | 425.23 |

| April 2023 | 403.18 |

| March 2023 | 404.99 |

| February 2023 | 360.42 |

| January 2023 | 386.5 |

| December 2022 | 364 |

BHIM Pay Statistics

BHIM, launched by the NPCI and built on UPI, supports 13 Indian languages and continues to be an important payment option.

- Monthly Transactions: As of June 2023, 22.9 million monthly transactions were recorded through BHIM India, showing a slight increase from the previous year.

- Transaction Value: The value of monthly transactions made through BHIM amounted to over ₹72 billion Indian Rupees as of June 2023.

The following table displays further details about the number of BHIM transactions recorded over the past months:

| Month | Number Of Transactions Recorded On BHIM (in millions) |

| June 2023 | 22.9 |

| May 2023 | 22.8 |

| April 2023 | 23.61 |

| March 2023 | 23.53 |

| February 2023 | 23.06 |

| January 2023 | 24.79 |

| December 2022 | 25.31 |

| November 2022 | 24.83 |

| October 2022 | 25.36 |

The following table further details the value of monthly transactions recorded on BHIM over the past months:

| Month | Value Of Transactions Made On BHIM (Indian Rupees in billions) |

| June 2023 | 72.59 |

| May 2023 | 71.89 |

| April 2023 | 73.5 |

| March 2023 | 74.81 |

| February 2023 | 71.41 |

| January 2023 | 81.45 |

| December 2022 | 83.79 |

UPI Fraud Statistics: Safeguarding the Digital Economy

As UPI’s popularity grows, so does the importance of addressing fraud. Awareness and preventative measures are crucial to protect users.

The Rise of Digital Fraud

- More Than 95,402 UPI Fraud Cases Were Reported in the Financial Year 2023: This represents a notable increase from previous years (84,274 cases in 2021-22 and 77,299 in 2020-21). This surge in cases, particularly after the COVID-19 pandemic, highlights the need for continuous vigilance.

- Common Fraud Methods: Common UPI frauds include impersonating sellers, unauthorized access through screen mirroring apps, OTP and PIN fraud, initiating collect requests, phishing, and malware attacks.

- Internet Banking and UPI at Risk: Nearly 50% of financial fraud cases recorded between January 2020 and June 2023 were related to internet banking and UPI payments, underscoring the high-risk areas within digital financial crime.

Additional UPI Insights

Beyond the numbers, these facts offer a deeper understanding of UPI’s functionality and user behavior.

- Multiple UPI IDs for One Account: A user can have up to four UPI IDs for the same bank account, often created via apps like Google Pay. This provides additional payment routes, reducing failure rates if one route is unavailable.

- Weekend Spending Habits: The average spending of a PhonePe user increases by 35% from Sunday to Monday, reflecting typical weekly spending patterns.

- Evening Transaction Surge: More than 37% of all UPI transactions are recorded after 6 PM, with almost 10% occurring between 7 PM and 8 PM. This surge is often attributed to offline food and beverage purchases as people unwind after work.

- ₹1000 Most Common Transfer Amount: Did you know that ₹1000 is the most frequently transferred amount to a contact via UPI?

- Digital Public Infrastructure: UPI’s success is built upon India’s “Digital Public Infrastructure”: Jan Dhan Yojana (mass bank accounts), Aadhaar (biometric identity), and low-cost mobile data. This interconnected system has been praised by the IMF as a model for other nations.

- Interoperability as Key: The IMF highlights UPI’s interoperable design, allowing any app to send money directly between bank accounts, which fosters competition and innovation among service providers.

Quora and Reddit Insights: User Concerns and Questions

Beyond official statistics, online forums like Quora and Reddit provide a pulse on what users are actively discussing and asking about UPI.

- “Why is my UPI transaction failing, and how can I fix it?” This recurring question highlights user frustration with technical glitches. While UPI boasts a high success rate, individual transaction failures due to network issues, bank downtimes, or incorrect details remain a common concern. Users seek practical troubleshooting steps and reliable support.

- “What are the best practices to avoid UPI fraud, especially with the increase in reported cases?” Given the rising fraud statistics, users are increasingly proactive in seeking advice on how to protect themselves. Discussions revolve around recognizing phishing attempts, securing PINs, avoiding screen-sharing apps, and understanding “collect requests.”

- “How do UPI international payments work, and which countries offer the best interoperability?” With UPI’s global expansion, users are keen to understand the mechanics of cross-border transactions, supported countries, and the ease of use for travelers. This reflects a growing interest in UPI’s international utility.

- “Are there any new features coming to UPI that will make it even more convenient or secure?” Users are always looking for innovations. Discussions often touch upon potential new features, security enhancements, and improvements to the user experience, showing an eager anticipation for UPI’s evolution.

These discussions underscore the real-world impact of UPI, from daily convenience to ongoing security concerns and the excitement for future developments.

FAQs About UPI Statistics

1. How many people use UPI in India, and how fast is it growing?

Over 350 million people use UPI in India, with the number expected to exceed 365 million soon. UPI adoption has surged, especially post-COVID.

2. What are the daily and monthly transaction volumes on UPI in 2025?

UPI processes over 443 million daily transactions, with monthly volumes surpassing 14.96 billion, expected to reach 20 billion in 18–24 months.

3. Which countries accept UPI payments, and where is it expanding next?

UPI is accepted in 27 countries, including Singapore, UAE, Nepal, and France. India is expanding UPI to the USA, Europe, Asia, and Africa.

4. What is UPI Lite, and how is it making small transactions easier?

UPI Lite simplifies small-value transactions up to ₹500, with a single-click, PIN-free process. It processes over 10 million transactions monthly.

5. What should users do to protect themselves from UPI fraud?

Users should avoid sharing their PIN or OTP, verify recipients, and use trusted apps. Stay updated on fraud tactics and avoid unsolicited requests.

Also Read:

- Latest Digital Marketing Statistics

- Video Marketing Statistics

- Email Marketing Statistics

- WhatsApp Statistics

- iPhone Users Statistics

Conclusion: UPI’s Unstoppable Momentum

UPI has profoundly transformed India’s digital payment landscape, becoming a global symbol of financial innovation and inclusion.

With over 350 million users and an astounding 443 million daily transactions, it accounts for more than 80% of all digital payments in the country.

PhonePe leads the market, but Google Pay and Paytm remain strong contenders, continuously driving engagement and new features.

Innovations like UPI Lite offer seamless small-value transactions with a near-perfect success rate, while the system’s expansion to 27 countries solidifies its international presence.

While the rise in UPI fraud cases necessitates increased user awareness and robust security measures, UPI’s convenience, interoperability, and low-cost nature, built on India’s impressive Digital Public Infrastructure, continue to propel its growth.

The UPI statistics 2025 clearly paint a picture of an unstoppable force, redefining how money moves and empowering millions daily.