Blockchain technology is no longer a niche concept. It is a foundational innovation rapidly reshaping industries, economies, and how we interact with digital information.

As we delve into blockchain statistics 2025, we uncover a landscape of explosive growth, widespread adoption, and transformative potential.

This detailed article provides a comprehensive look at blockchain’s current state and future trajectory, offering valuable insights for individuals and businesses aiming to harness its power.

We will explore user demographics, market size, enterprise adoption, and emerging trends, ensuring you have the latest information to navigate this exciting digital frontier.

Blockchain User Base: A Global Phenomenon

The global adoption of blockchain technology is surging, moving from a specialized interest to a mainstream digital tool.

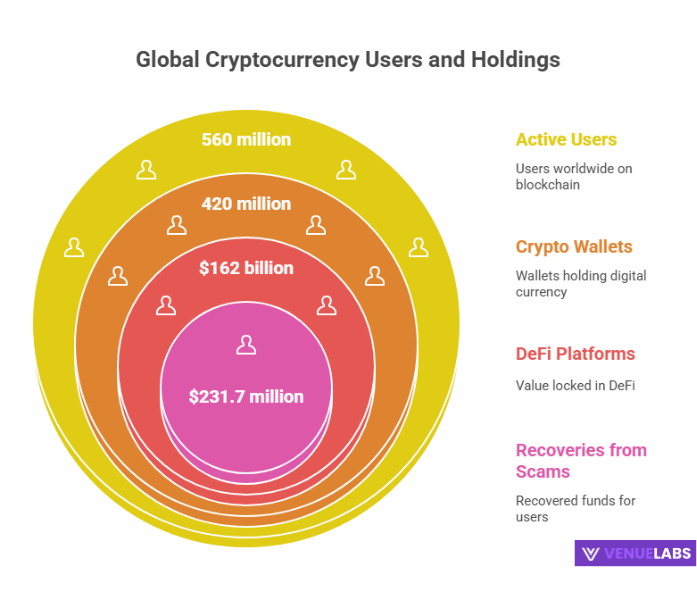

In 2025, over 560 million people worldwide are actively using blockchain technology, representing nearly 4% of the global population. This marks a significant leap from previous years and indicates a growing understanding and trust in decentralized systems.

Asia leads this global adoption, with 160 million users embracing blockchain. Europe follows, with 38 million users, demonstrating the technology’s widespread appeal across continents.

Here is a breakdown of blockchain users across different regions:

| Region | Number Of Blockchain Users (Millions) |

| Asia | 160 |

| Europe | 38 |

| Africa | 32 |

| North America | 28 |

| South America | 24 |

| Oceania | 1 |

The Surge in Blockchain Wallet Users

A key indicator of blockchain adoption is the proliferation of blockchain wallets. These digital tools allow users to store, send, and receive cryptocurrencies and other digital assets. The growth in wallet ownership has been phenomenal, increasing by 700% since 2016.

| Year | Number Of Blockchain Wallet Users (Millions) |

| 2013 | 0.89 |

| 2014 | 2.71 |

| 2015 | 5.34 |

| 2016 | 10.69 |

| 2017 | 19.34 |

| 2018 | 31.91 |

| 2019 | 44.51 |

| 2020 | 63.48 |

| 2021 | 80.24 |

| 2022 | 85.08 |

| 2025* | 120.00 |

Source: Statista

The Booming Blockchain Market: Size and Forecast

The blockchain technology market is experiencing exponential growth, driven by increased investment and the widespread adoption of distributed ledger technology (DLT) systems.

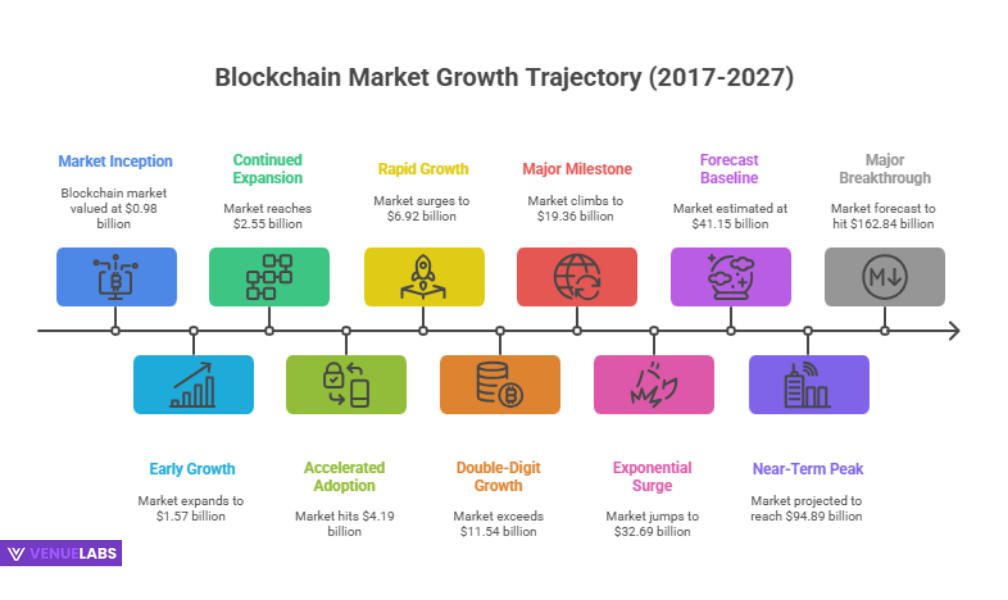

By the end of 2027, experts predict the market will soar to $162.84 billion, a substantial increase from its estimated value of over 41.15 billion. This massive expansion highlights the growing confidence in blockchain’s ability to revolutionize various sectors.

| Year | Blockchain Market Size (Billions USD) |

| 2017 | 0.98 |

| 2018 | 1.57 |

| 2019 | 2.55 |

| 2020 | 4.19 |

| 2021 | 6.92 |

| 2022 | 11.54 |

| 2023 | 19.36 |

| 2024* | 32.69 |

| 2025* | 41.15 |

| 2026* | 94.89 |

| 2027* | 162.84 |

| 2034* | 1,879.30 |

Source: Fortune Business Insights

Projected figures show remarkable long-term growth.

The compound annual growth rate (CAGR) from 2025 to 2034 is an astonishing 52.90%, signaling strong investor confidence and continuous innovation in the space.

Regional Market Leadership

North America currently holds the largest market share in blockchain technology, accounting for 46% in 2024. This leadership stems from a high concentration of blockchain startups and strong demand from large enterprises. The region also benefits from cutting-edge technological solutions.

However, the Asia Pacific region is anticipated to witness lucrative growth in 2025 and beyond. Rapid digitalization across industries like banking, e-commerce, healthcare, and telecommunications is driving the adoption of blockchain to enhance efficiency and address challenges like data integrity and fraud.

Increased investments from tech giants and venture capitalists, coupled with favorable government policies, are bolstering market growth in countries like India, Japan, China, and South Korea. India, for instance, has the highest blockchain adoption rate worldwide.

Cryptocurrency Statistics: Fueling Blockchain’s Fire

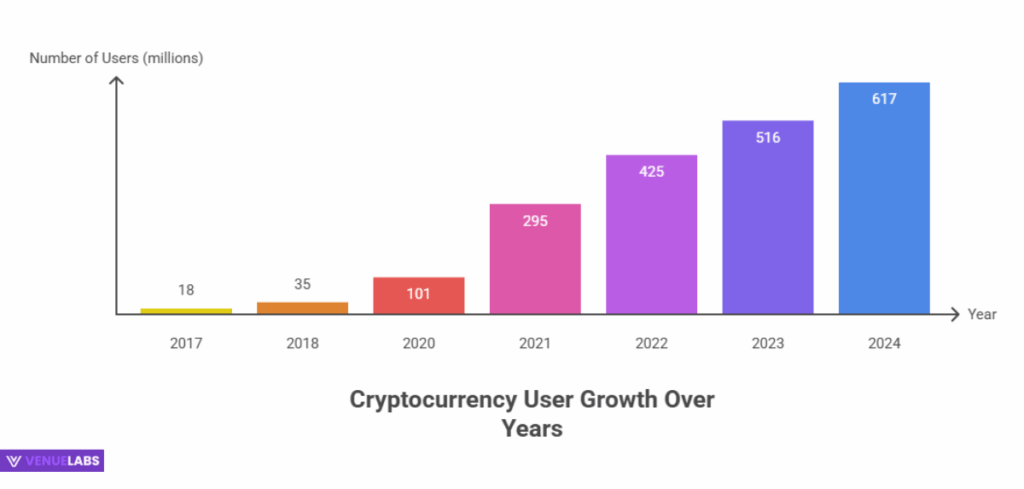

Cryptocurrencies are a major application of blockchain technology, driving a significant portion of its awareness and adoption. The number of cryptocurrency users has exploded, increasing by 415 million in the past three years alone.

1. Growing Number of Crypto Users

| Year | Number of Cryptocurrency Users (Millions) |

| 2017 | 18 |

| 2018 | 35 |

| 2020 | 101 |

| 2021 | 295 |

| 2022 | 425 |

| 2023 | 516 |

| 2024 | 617 |

| 2025* | 720 |

2025 is an estimate based on growth trends.

The number of crypto users in 2024 reached 617 million, an increase of over 100 million from 2023. This shows a massive 377% growth since early 2021. By 2025, we project this number will exceed 700 million.

- Also read about: Cryptocurrencies Statistics

2. The Ever-Expanding Crypto Landscape

While thousands of cryptocurrencies exist, only a fraction remain active. As of 2024, there are 10,025 active cryptocurrencies, even though over 20,000 have been launched. This means approximately 50% are either inactive or discontinued, reflecting the dynamic and competitive nature of the market.

| Year | Number Of Active Cryptocurrencies |

| 2013 | 66 |

| 2014 | 506 |

| 2015 | 562 |

| 2016 | 644 |

| 2017 | 1,335 |

| 2018 | 1,658 |

| 2019 | 2,817 |

| 2021 | 7,557 |

| 2022 | 9,310 |

| 2023 | 8,866 |

| 2024 | 10,025 |

| 2025* | 11,500 |

2025 is an estimate based on growth trends.

Blockchain User Demographics: Who is Investing?

Understanding the demographics of blockchain and crypto users helps us identify key market segments and investment trends.

1. Gender Disparity in Crypto Investment

Historically, men have shown greater interest in the blockchain and crypto markets compared to women. This is largely due to a perception of high risk among females. A survey by CNBC and Acorn reveals:

| Investment Type | Share of Males Investing | Share of Females Investing |

| Blockchain Technology | 16% | 7% |

| Individual Stocks | 40% | 24% |

| Real Estate | 36% | 30% |

| Mutual Funds | 30% | 20% |

| Bonds | 14% | 11% |

| Exchange-Traded Funds | 14% | 7% |

Males are more than twice as likely to have used cryptocurrencies (22%) compared to females (10%). For 2025, while the gap is expected to slowly narrow, this disparity will likely persist.

2. Ethnicity and Race of Crypto Owners (United States)

In the United States, crypto ownership aligns with the overall population’s ethnic distribution:

| Ethnicity/Race | Percent of Crypto Ownership |

| White | 62% |

| Hispanic | 24% |

| Black or African-American | 8% |

| Asian | 6% |

These percentages are expected to remain relatively stable in 2025, reflecting broader demographic trends.

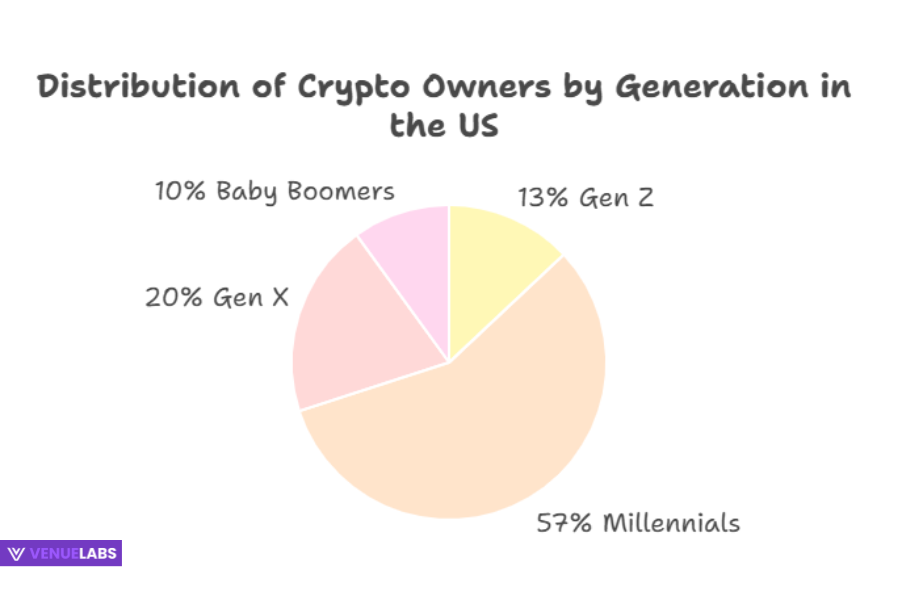

3. Generational Divide in Crypto Ownership (United States)

Millennials, a tech-savvy and financially educated generation, represent the largest share of crypto owners in the United States.

| Generation | Percentage Of Crypto Owners |

| Gen Z | 13% |

| Millennials | 57% |

| Gen X | 20% |

| Baby Boomers | 10% |

Millennials make up 57% of crypto owners, followed by Gen X at 20%. These figures are expected to hold strong in 2025, with Gen Z’s share potentially increasing as they enter the workforce and investment age.

Enterprise Blockchain: Transforming Business Operations

Businesses worldwide are rapidly recognizing the transformative power of blockchain technology. Nearly 90% of businesses surveyed report deploying blockchain technology in some capacity in 2025, or they plan to invest in it.

This widespread adoption is driven by the technology’s ability to enhance security, streamline processes, and protect data. For instance, 42% of businesses utilizing blockchain benefit from its security capabilities, and another 42% leverage its copy protection.

1. Confidence in Blockchain’s Business Impact

There is strong confidence in blockchain’s potential among business leaders:

- 86% of people believe blockchain technology can enhance integration towards more touchless business processes.

- 91% of respondents expect to see a verifiable return on their blockchain investments in the next five years.

- 77% of executives believe that not adopting blockchain technology will put their company at a competitive disadvantage.

- 56% of surveyed executives say blockchain data can disrupt their industries.

Blockchain is clearly seen as a game-changer that is here to stay, and these sentiments will continue to drive adoption in 2025.

2. Leading Companies Embracing Blockchain

Major corporations across various sectors are integrating blockchain into their operations. This includes:

- Adobe (Ethereum)

- Allianz (Hyperledger Fabric, Corda)

- Andreessen Horowitz (Bitcoin, Ethereum, Solana, Flow, Celo, Near, Arweave, and others)

- Ant Group (Antchain)

- A.P. Moller—Maersk (TradeLens, Hyperledger Fabric)

- Baidu (XuperChain)

- Block (Bitcoin)

Notably, 81 out of the top 100 publicly traded companies in the world are using or researching blockchain technology in 2025, with 65 companies actively incorporating it into their operations. Hyperledger Fabric and Ethereum are among the most popular blockchain networks for these enterprises.

- Also read about: Bitcoin Survey Sites: How to Earn Bitcoin in Your Spare Time

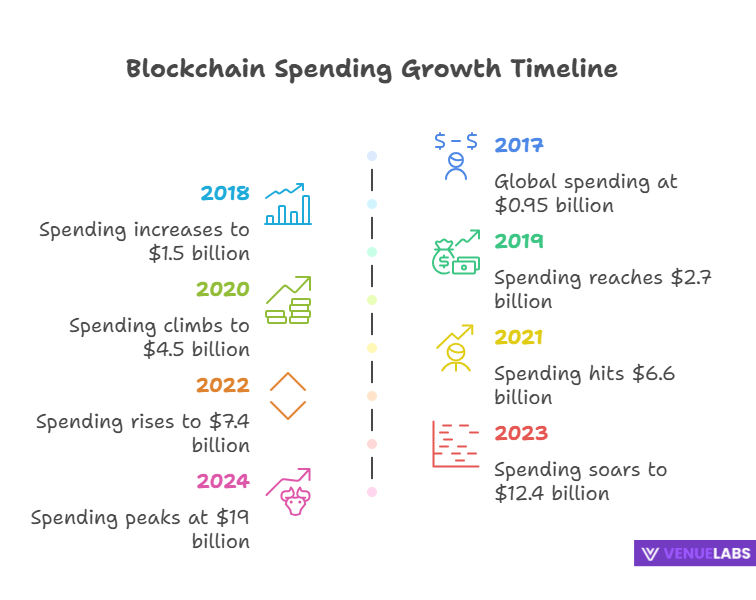

3. Blockchain Spending and Adoption Trends

Global spending on blockchain solutions is on a steep upward trajectory, forecasted to reach 25 billion. This marks an impressive increase from just $0.95 billion in 2017.

| Year | Worldwide Spending On Blockchain Solutions (Billions USD) |

| 2017 | 0.95 |

| 2018 | 1.5 |

| 2019 | 2.7 |

| 2020 | 4.5 |

| 2021 | 6.6 |

| 2022 | 7.4 |

| 2023 | 12.4 |

| 2024 | 19 |

| 2025* | 25+ |

2025 is an estimate based on growth trends.

4. Sector-Specific Adoption

The banking sector leads in blockchain adoption, with almost 3 in 10 organizations already implementing the technology. Over 90% of banks in the United States and Europe have initiated blockchain-related projects, demonstrating its critical role in modern finance.

| Sector | Market Share (2024) |

| Banking | 29.7% |

| Process Manufacturing | 11.4% |

| Discrete Manufacturing | 10.9% |

| Professional Services | 6.6% |

| Retail | 6% |

| Others | 35.3% |

These market shares are expected to evolve in 2025 as other sectors increasingly leverage blockchain’s benefits.

Leading Countries in Crypto Adoption

India boasts the highest global crypto adoption rate, followed by Nigeria and Vietnam. The United States ranks 4th, with a global crypto adoption rate of 0.37. These rankings are expected to largely hold true for 2025, though rapid growth in emerging markets could shift the landscape.

| Ranking | Country |

| 1 | India |

| 2 | Nigeria |

| 3 | Vietnam |

| 4 | United States |

| 5 | Ukraine |

| 6 | Philippines |

| 7 | Indonesia |

| 8 | Pakistan |

| 9 | Brazil |

| 10 | Thailand |

Cryptocurrency Fraud Statistics: A Growing Concern

With increasing adoption, unfortunately, comes a rise in cybercrime. Crypto users lost $1.8 billion to hacks and scams in 2023, a decrease of 54% compared to the record $3.8 billion stolen in 2022.

This suggests improved security measures, but threats remain significant. For 2025, while security continues to improve, cybercriminals will likely develop new sophisticated attacks.

| Year | Cryptocurrency Losses Due to Theft (Billions USD) |

| 2021 | 3.3 |

| 2022 | 3.8 |

| 2023 | 1.8 |

| 2025* | 1.5 (projected) |

2025 is a projected estimate assuming continued security improvements and evolving threats.

The Ronin Network heist in March 2022 remains the largest cryptocurrency theft to date, with a loss of $620 million.

| Cryptocurrency Heist | Loss Occurred (Millions USD) | Date |

| Ronin Network | 620 | March 2022 |

| Poly Network | 610 | August 2021 |

| Binance | 570 | October 2022 |

| Coincheck | 534 | January 2018 |

| Mt. Gox | 470 | February 2014 |

Bitcoin Statistics: The Pioneer of Digital Currency

Bitcoin, the first and most well-known cryptocurrency, continues to dominate the market. Its market capitalization stands at over $964.71 billion, representing approximately 45% of the total cryptocurrency market value. For 2025, Bitcoin’s market cap is expected to grow further, potentially exceeding $1 trillion.

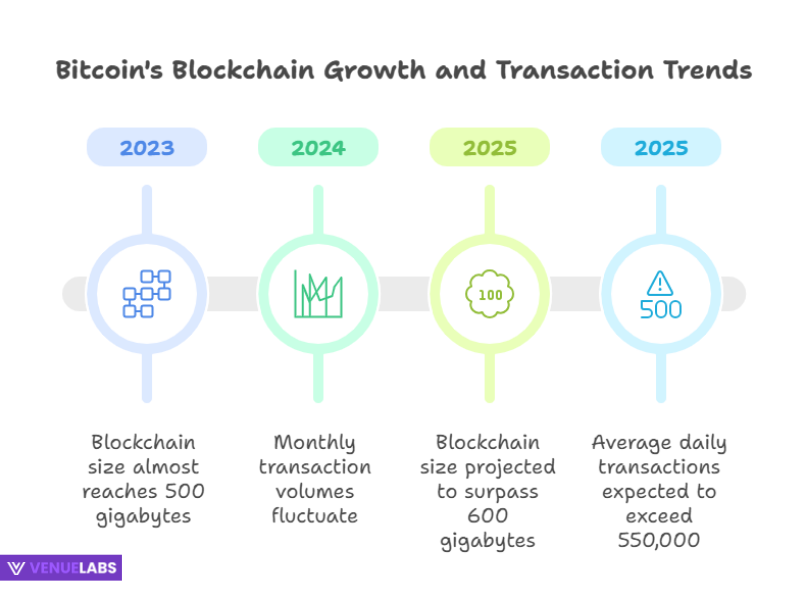

Bitcoin Transaction Volume and Blockchain Size

Bitcoin’s blockchain processes an average of over 400,000 transactions daily. The Bitcoin blockchain’s size is also steadily growing, almost reaching 500 gigabytes in 2023. By 2025, its size will likely surpass 600 gigabytes.

| Month, Year | Number Of Daily Transactions On The Blockchain Of Bitcoin |

| Jun 2024 | 737,521 |

| May 2024 | 713,689 |

| Apr 2024 | 501,881 |

| Mar 2024 | 315,001 |

| Feb 2024 | 407,609 |

| Jan 2024 | 460,379 |

| Dec 2023 | 724,837 |

| 2025 Avg* | 550,000+ |

2025 is an estimate based on trends.

Ethereum Statistics: The Smart Contract Powerhouse

Ethereum is the second most popular blockchain, known for its smart contract capabilities that power decentralized applications (dApps), NFTs, and DeFi. It has a market cap of $270.33 billion. For 2025, Ethereum’s ecosystem is expected to expand significantly with continued development and adoption of its Layer 2 solutions.

Ethereum in Circulation and Transaction Volume

There are 129.17 million ETH in circulation. Unlike Bitcoin, Ethereum has an infinite supply. The Ethereum blockchain processes an average of over 1 million transactions per day.

| Year | Ethereum Transactions Per Day (Thousands) |

| November | 1,087.72 |

| Oct 2022 | 1,063.25 |

| Sep 2022 | 1,225.89 |

| Aug 2022 | 1,035.14 |

| Jul 2022 | 1,158.62 |

| Jun 2022 | 1,054.43 |

| May 2022 | 1,149.14 |

| Apr 2022 | 1,211.67 |

| Mar 2022 | 1,167.12 |

| 2025 Avg | 1,500+ |

The Future of Blockchain: A Trillion-Dollar Industry

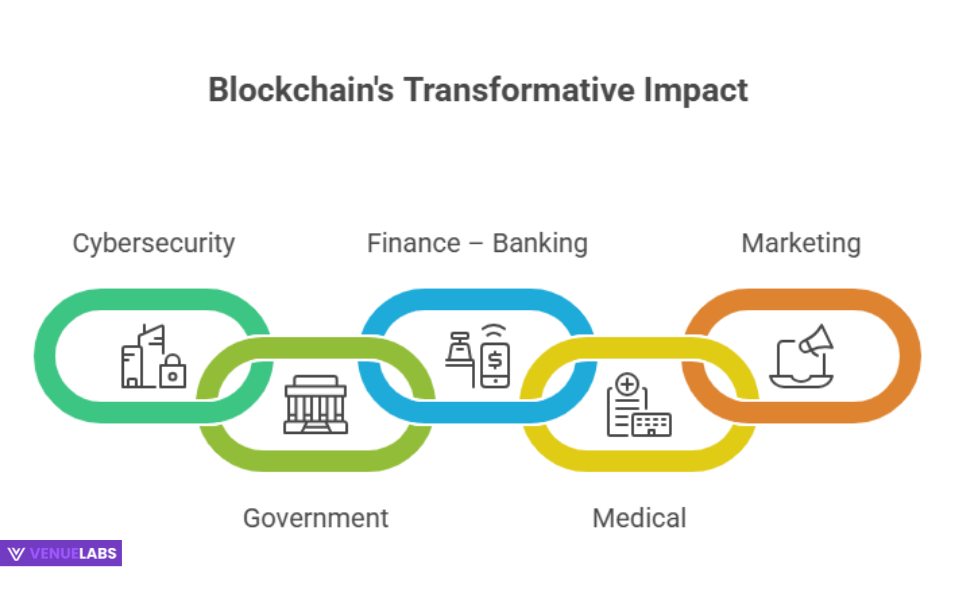

The future of blockchain technology looks incredibly promising. By 2026, the business value added by blockchain will exceed 3.1 trillion. Blockchain will play a major role in transforming five key areas in the coming years:

- Cybersecurity: Enhancing data integrity and secure communication.

- Government: Streamlining public services, voting, and record-keeping.

- Finance – Banking: Revolutionizing payments, lending, and asset management.

- Medical: Securing patient data, drug supply chains, and clinical trials.

- Marketing: Enabling transparent advertising, loyalty programs, and data ownership.

The integration of AI, blockchain, and virtual reality is expected to lead to a new era of digital interaction, creating a truly decentralized and immersive digital future.

What’s New? Insights from Quora and Reddit

Beyond the official statistics, what are individuals and enthusiasts discussing on platforms like Quora and Reddit regarding blockchain? Here are some trending topics for 2025:

- Real-world utility of NFTs: Beyond digital art, users are asking about practical applications of NFTs in ticketing, supply chain, and intellectual property. The focus is shifting towards “utility NFTs.”

- Layer 2 solutions and scalability: Discussions often center on the progress of scaling solutions (e.g., Optimism, Arbitrum, Polygon, zk-rollups) and whether they can truly make blockchain transactions faster and cheaper for mass adoption, moving beyond theoretical promises.

- Regulatory clarity (or lack thereof): Many users express frustration or hope regarding government regulations for cryptocurrencies and blockchain, particularly concerning taxation, consumer protection, and enterprise adoption. The ongoing legal frameworks and their impact on market stability are a constant point of discussion.

- Interoperability: The challenge of different blockchains communicating with each other (e.g., cross-chain bridges, Cosmos IBC) is a hot topic, as users envision a more connected and seamless blockchain ecosystem. Solutions that simplify cross-chain transfers are highly anticipated.

- Decentralized Autonomous Organizations (DAOs): People are curious about the effectiveness and governance challenges of DAOs, wondering if they represent a viable future for organizational structures, especially as more real-world assets become tokenized and controlled by DAOs.

- Environmental impact of crypto: Especially for proof-of-work blockchains, concerns and discussions about energy consumption and sustainable alternatives remain prevalent. The ongoing transition to proof-of-stake for some major blockchains is a key part of this conversation.

- Central Bank Digital Currencies (CBDCs): While not fully decentralized, the progress of CBDCs in various countries is closely watched, with discussions on their implications for privacy, financial inclusion, and the future of traditional banking.

These conversations show a community deeply engaged with blockchain’s technical evolution, practical applications, and the broader societal implications of decentralization, reflecting a dynamic and forward-looking perspective for 2025.

How Can You Use This Information for Your Benefit?

Understanding these blockchain statistics offers immense strategic advantages for various stakeholders:

1. For Businesses and Enterprises:

Recognize that blockchain is no longer optional; nearly 90% of businesses are already exploring or deploying it in 2025. Focus on leveraging blockchain for enhanced security, supply chain transparency, data integrity, and cost reduction in payment systems. Invest in private or hybrid cloud blockchain solutions for robust enterprise applications, and explore the potential of tokenization for various assets.

2. For Investors:

The blockchain market is projected for staggering growth, offering significant long-term investment opportunities, with the market reaching $41.15 billion in 2025. Look beyond just cryptocurrencies to infrastructure, middleware, and application layer solutions. Be aware of the risks, including fraud, but recognize the high expected returns on investment over the next five years. Diversify your portfolio to include projects focused on scalability, interoperability, and real-world utility.

3. For Developers and Technologists:

The demand for skilled blockchain talent is high. Focus on mastering popular protocols like Hyperledger Fabric and Ethereum, along with emerging Layer 2 solutions. Explore key growth segments such as digital identity, smart contracts, decentralized finance (DeFi), and Web3 applications, staying updated on the latest discussions from developer communities.

4. For Financial Institutions:

Actively engage with blockchain solutions for payments, digital identities, and enhanced security. The banking sector is already leading adoption, indicating a necessity to innovate to remain competitive. Consider using blockchain to reduce transaction fees, streamline cross-border payments, and develop new financial products and services.

5. For Individuals and Consumers:

Understand how blockchain technology can secure your digital identity and enhance transaction security. If investing in cryptocurrencies, exercise caution, educate yourself on potential scams, and utilize secure wallet solutions. Explore how blockchain can offer more transparent and secure services in areas like healthcare and government, and consider participation in DAOs for community governance.

FAQs About Blockchain statistics

1. How many people are using blockchain technology globally in 2025?

In 2025, over 560 million people worldwide are using blockchain technology, which represents nearly 4% of the global population.

2. What is the projected market size of blockchain technology in 2025?

The blockchain technology market is predicted to reach an estimated value of $41.15 billion in 2025, continuing its rapid growth trajectory.

3. Which sector has the highest adoption rate of blockchain technology?

The banking sector demonstrates the highest adoption rate, with nearly 3 in 10 organizations incorporating blockchain technology, and over 90% of banks in the United States and Europe pursuing blockchain-related projects.

4. What is the primary driver of blockchain market growth for 2025?

The main drivers for blockchain market growth in 2025 include increased venture capital and investment, widespread use of blockchain solutions in banking and cybersecurity, strong adoption for smart contracts and digital identities, and growing government initiatives, along with continuous technological advancements.

5. What are the key future applications of blockchain technology beyond 2025?

Beyond 2025, blockchain is expected to play a major role in cybersecurity, government, finance and banking, medical, and marketing sectors, revolutionizing processes and enhancing security and transparency in these areas, with further integration with AI and virtual reality.

Also Read:

- Internet User Statistics

- Latest Digital Marketing Statistics

- Affiliate Marketing Statistics

- PayPal Statistics

- Video Marketing Statistics

Conclusion

The blockchain statistics 2025 reveal a landscape of unprecedented growth and profound transformation. With over 560 million users worldwide and a market projected to reach $41.15 billion in 2025, blockchain is rapidly becoming a cornerstone of our digital economy.

Its adoption spans continents, industries, and demographics, driven by its promise of enhanced security, transparency, and efficiency.

Despite the challenges of cyber risks and regulatory uncertainty, confidence in blockchain’s potential remains high among businesses and individuals. Its integration into finance, healthcare, cybersecurity, and government signals a lasting shift in how we manage data, conduct transactions, and interact digitally.

Organizations and individuals who embrace blockchain early stand to gain a significant strategic advantage in the evolving digital age, as the technology is forecasted to add over $3.1 trillion in business value by 2030.