The world of cryptocurrency has grown rapidly — and 2026 is a big year for this evolution.

Today, 559 million people worldwide own cryptocurrency, representing about 9.9% of internet users. This shows that crypto is becoming a real part of how people and businesses use money.

This guide explains crypto adoption in simple terms: who’s using it, where it’s growing fastest, and why more companies and individuals are getting involved.

Whether you’re a beginner or already in the crypto space, this article gives you useful insights without the technical jargon.

What Is Crypto Adoption?

Crypto adoption refers to how people and businesses use cryptocurrencies such as Bitcoin, Ethereum, and stablecoins in everyday life. This includes:

- Payments: Individuals and businesses use crypto to pay salaries, send money abroad, or purchase goods and services.

- Saving & Investing: Many hold crypto to protect their money from inflation or to invest for the future.

- Trading: Buying and selling crypto on exchanges is still very popular.

- DeFi (Decentralized Finance): Users can use tokenized assets such as U.S. Treasury bills on blockchain platforms.

Also read about: Cryptocurrencies Statistics 2026

Global Stats for 2026

- Total market value of crypto: $2.96 trillion

- Expected growth by 2030: $7.98 trillion

- Annual growth rate: 30.1%

- Crypto owners in 2025: 559.4 million (up 33% from 420 million in 2023)

Crypto adoption is rising fast — especially in places where traditional banking systems are expensive or hard to access.

Crypto Ownership Over Time

| Quarter | Ownership Rate | Change |

|---|---|---|

| Q1 2025 | 9.9% | +1% |

| Q4 2024 | 10% | +4.2% |

| Q3 2024 | 9.6% | +1% |

| Q2 2024 | 9.7% | 0% |

| Q1 2024 | 9.7% | 0% |

While the numbers may go up and down slightly, the long-term trend is clear: crypto use is growing steadily.

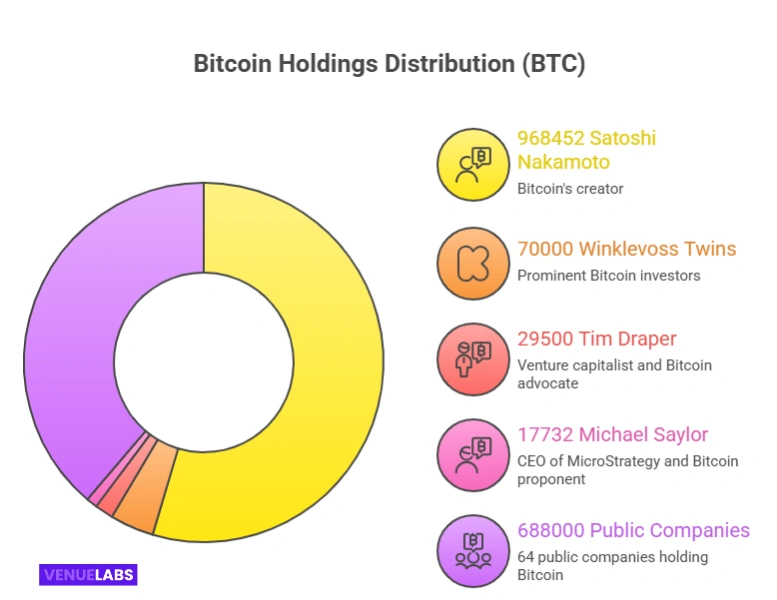

Who Owns the Most Bitcoin?

- Satoshi Nakamoto (Bitcoin’s creator): ~968,452 BTC ($110.02B)

- Winklevoss Twins: ~70,000 BTC

- Tim Draper: ~29,500 BTC

- Michael Saylor: 17,732 BTC

🟢 Over 64 public companies hold a total of 688,000 BTC as of 2025. By 2026, businesses could hold up to 2.3 million BTC.

Also read about: Altcoin Statistics 2026

Crypto Users by Age and Gender

- Most owners are men aged 25–34 (16.2%)

- Women aged 25–34 own the most among females (8.7%)

- Ownership drops as age increases

| Age Group | Men | Women |

|---|---|---|

| 16–24 | 13.5% | 6.0% |

| 25–34 | 16.2% | 8.7% |

| 35–44 | 14.1% | 7.8% |

| 45–54 | 11.2% | 6.0% |

| 55–64 | 7.7% | 4.9% |

| 65+ | 3.2% | 1.8% |

Crypto is most popular with younger men, but women are also joining in — especially in the 25–44 age range.

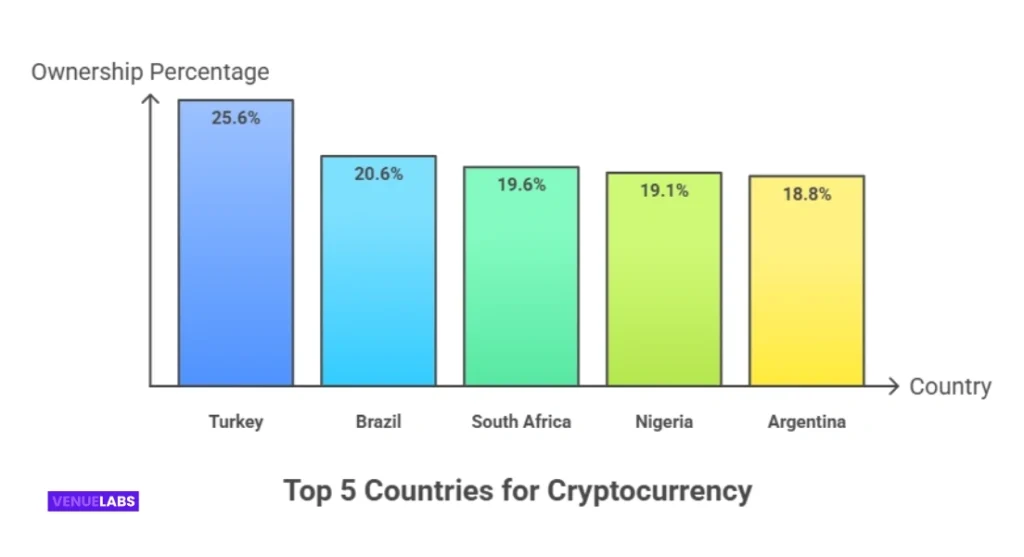

Top Countries for Crypto Ownership

| Country | Ownership Rate |

|---|---|

| Turkey | 25.6% |

| Brazil | 20.6% |

| South Africa | 19.6% |

| Nigeria | 19.1% |

| Argentina | 18.8% |

| U.S.A. | 12.5% |

| China | 3.7% |

| Global Average | 9.9% |

🌍 Emerging countries like Turkey and Brazil lead in adoption, while developed countries like Japan and Germany have lower rates due to stronger traditional financial systems.

U.S. Crypto Trends

- 21% of U.S. adults own crypto

- Highest adoption: Men aged 18–49 (25%)

- Lower ownership among women and seniors

- SEC approved Bitcoin ETFs in 2024, attracting $50B+ in 9 months

- 64 public U.S. companies hold 688,000 BTC

🔌 However, many Americans still don’t understand crypto well. Only 4% say they’ll buy crypto soon, and 55% believe crypto is unsafe.

Also read about: 25 Most Expensive NFTs Ever Sold

Crypto Payments Are Taking Off

- 46% of merchants accept crypto payments

- Main reasons: lower fees, no banks, fast settlement

- 43% of e-commerce stores support crypto

- 87% of crypto payments happen on mobile

- Bitcoin is used in 52% of crypto payment systems

- Stablecoins (like USDT) account for 76% of crypto payments

📱 Crypto payments are beating traditional platforms like PayPal in total global user numbers.

Crypto Wealth Is Growing Fast

| Metric | 2023 | 2024 | Growth |

|---|---|---|---|

| Bitcoin Millionaires | 88,200 | 172,300 | +95% |

| Centi-millionaires | 182 | 325 | +79% |

| Billionaires | 22 | 28 | +27% |

| Total Users (millions) | 425 | 560 | +32% |

| Market Value (USD T) | $1.2T | $2.3T | +89% |

💸 The number of Bitcoin millionaires almost doubled in one year, showing how powerful early investment in crypto can be.

Largest Bitcoin Holders

| Holder / Entity | BTC Owned | Notes |

|---|---|---|

| Satoshi Nakamoto | 968,452 | Creator, wallets mostly inactive |

| MicroStrategy | 597,325 | Largest corporate holder |

| Binance (cold wallet) | 248,600 | Largest exchange wallet |

| U.S. Government | 207,189 | Mostly from seizures |

| China | ~190,000 | From the PlusToken scam |

| Winklevoss Twins | ~70,000 | Early adopters |

| Tim Draper | ~30,000 | Bought from U.S. auction |

| Michael Saylor (personal) | 17,732 | Separate from MicroStrategy |

🌐 The top 1% of addresses control over 87% of all Bitcoin, showing extreme wealth concentration.

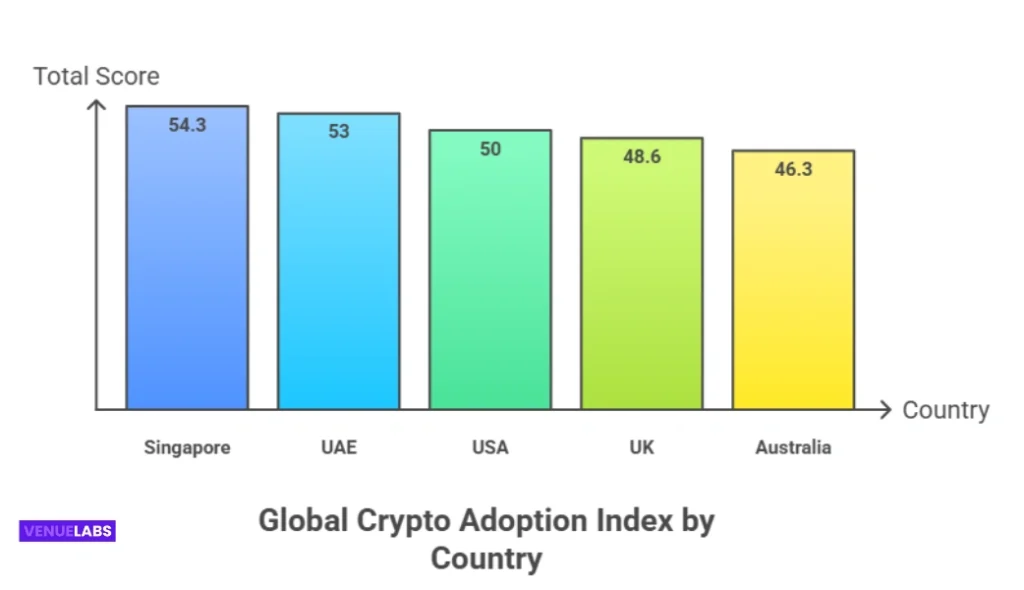

Top Crypto-Friendly Countries (Index Scores)

| Rank | Country | Score (out of 60) |

|---|---|---|

| 1 | Singapore | 54.3 |

| 2 | UAE | 53.0 |

| 3 | USA | 50.0 |

| 4 | UK | 48.6 |

| 5 | Australia | 46.3 |

Singapore leads due to strong infrastructure, innovation, and tax benefits. Europe lags behind in crypto adoption, except for the UK.

Companies That Accept or Use Crypto

- Nexon: Accepts crypto for games like MapleStory; owns 1,717 BTC

- Travala: 80% of bookings paid in crypto; revenue grew 73% in a year

- Other crypto-accepting brands: Gucci, Hublot, Twitch, Air Baltic, Razer, and more

Businesses are seeing the value of crypto in both payments and investment.

Regional Insights

- North America: Strong institutional adoption, Bitcoin ETFs

- Europe: Regulation (MiCA) is making it easier to use crypto

- Asia-Pacific: Singapore leads in innovation and regulation

- Middle East: UAE is growing fast with strong government support

- Africa: Nigeria and Kenya use crypto for remittances and small business

- Latin America: Argentina and El Salvador use Bitcoin to fight inflation

What People Are Asking (Quora & Reddit)

- Is crypto safe to use?

- Where can I spend crypto easily?

- Can crypto help in countries with unstable economies?

- What are NFTs used for?

- Why are some transactions slow and costly?

People want easy-to-use, safe, and practical crypto tools — not just investment platforms.

For Businesses: How to Use Crypto (Playbook)

- Treasury: Hold BTC, ETH, and stablecoins with clear rules

- Payroll: Pay remote workers in stablecoins with tracking

- Customer Payments: Accept crypto, settle in fiat if needed

- Compliance: Follow local rules and keep clear records

- Accounting: Track values and link transactions to invoices

- Risk Management: Keep stablecoins for operating costs and BTC for growth

- ESG: Be transparent about Bitcoin mining energy use

What’s Next for Crypto?

- More stablecoin payments in apps

- Tokenized funds (like crypto versions of mutual funds)

- Stronger regulations that support big investors

- Crypto helping people in developing countries

- Faster and cheaper networks for payments (Layer 2s)

Challenges Ahead

- Regulations differ by country

- Crypto taxes and accounting are complex

- Banks still make crypto-fiat transfers hard

- Risk of hacks or exchange failures

- Price volatility creates uncertainty

- Energy use of mining causes ESG concerns

FAQs About Crypto Adoption Statistics

1. How many people use cryptocurrency in 2025?

In 2025, approximately 559 million people worldwide own cryptocurrency. This represents about 9.9% of the global internet population, showing that digital assets are becoming more mainstream.

2. Which countries have the highest crypto adoption rates?

Turkey leads global crypto adoption with 25.6% of its population owning cryptocurrency. It is followed by Brazil at 20.6%, South Africa at 19.6%, Nigeria at 19.1%, and Argentina at 18.8%. These higher rates are often linked to inflation and expensive traditional banking systems.

3. What role do stablecoins play in crypto adoption?

Stablecoins are a major driver of crypto usage because they maintain a steady value compared to more volatile cryptocurrencies. They account for 76% of all crypto payments, with USDT (Tether) alone making up 33% of total transaction volume. Many businesses prefer stablecoins for faster and lower-cost transactions.

4. Do people consider cryptocurrency safe?

Safety remains a concern for many users. In the United States, 55% of adults believe cryptocurrency is very unsafe, while 32% consider it somewhat unsafe. Despite growing adoption, limited understanding and market volatility continue to affect public trust.

5. How are businesses using cryptocurrency in 2025?

Businesses are increasingly integrating crypto into their operations by accepting digital payments, holding Bitcoin as a treasury asset, and paying international employees using stablecoins. This helps reduce transaction fees, speeds up cross-border payments, and gives companies access to a broader global customer base.

Also Read:

- Remote Work Statistics

- Digital PR Statistics

- Essential Web Hosting Statistics

- Content Marketing Statistics

- Screen Time Statistics

Final Thoughts

Crypto adoption is growing fast, especially in places where traditional finance doesn’t work well.

While there are challenges, the benefits are clear: fast payments, low fees, and new financial tools for everyone.

With more users, better tools, and clearer rules, 2025 is shaping up to be a major turning point for the world of crypto.

Whether you’re an investor, business owner, or just curious — now’s a great time to learn and get involved.

Source: Statista, Security.org