Quick Commerce, often called Q-commerce, has rapidly transformed how we shop, driven by an ever-increasing demand for urgent deliveries.

The COVID-19 pandemic significantly accelerated this trend, making online and home deliveries a mainstream expectation. As we move into 2025, the quick commerce market is not just expanding; it is revolutionizing retail, promising deliveries in minutes rather than days.

This detailed article explores the robust growth of the global quick commerce market, its major players, and how individuals and businesses can benefit from this burgeoning sector.

Quick Commerce Statistics: Speed is the New Standard

Quick commerce fundamentally reshapes traditional e-commerce by focusing on ultra-fast delivery, typically within 10 to 30 minutes.

This immediacy caters to consumers’ immediate needs, from groceries and meals to even small electronics.

The convenience and speed offered by Q-commerce platforms make them increasingly popular, impacting everything from urban logistics to consumer expectations.

Global Market Size & Forecasts: A Half-Trillion Dollar Horizon

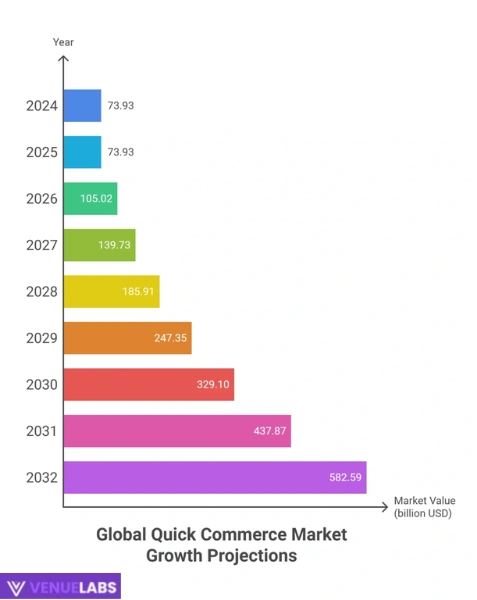

The global quick commerce market stands at a substantial $73.93 billion in 2024. This market is on an explosive growth trajectory, projected to reach an astounding $582.59 billion by 2032.

This represents a compound annual growth rate (CAGR) of 34.3%, highlighting its position as one of the fastest-growing segments in digital retail.

Here is an estimated breakdown of the global quick commerce market’s growth:

| Year | Value (USD, Billions) |

| 2025 | $73.93 |

| 2026 | $105.02* |

| 2027 | $139.73* |

| 2028 | $185.91* |

| 2029 | $247.35* |

| 2030 | $329.10* |

| 2031 | $437.87* |

| 2032 | $582.59* |

Source: Statista

*Projected values based on the data present.

The United States quick commerce market also shows significant growth, expected to be worth $8.78 billion in 2025. It will likely grow at an 8.2% CAGR, reaching $15.24 billion by 2032.

Also read about: Uber Statistics

Demographics Driving Quick Commerce

The Asia-Pacific region dominates the quick commerce market, with India leading the charge. Women, especially those aged 25-34, are key users of online meal delivery services, which serve as a significant precursor and driver for the broader quick commerce market. This demographic insight helps businesses understand their core audience.

| Sr. No. | Age Group | Male Users of Online Meal Delivery | Female Users of Online Meal Delivery |

| 1 | 16-24 | 37.9% | 41.1% |

| 2 | 25-34 | 42.3% | 44.5% |

| 3 | 35-44 | 39.7% | 42.8% |

| 4 | 45-54 | 34.2% | 37.0% |

| 5 | 55-64 | 28.2% | 28.3% |

| 6 | 65+ | 10.0% | 10.4% |

Source: Straits Research

The usage of these services declines sharply for individuals aged 65 and above, indicating a younger demographic’s preference for quick and convenient deliveries.

Quick Commerce by Country: India Leads the Way

India stands out as the fastest-growing quick commerce market globally, projecting a remarkable 17% growth rate in 2025. Its high population density and rapid urbanization provide ideal conditions for Q-commerce to thrive.

This booming sector in India will create an estimated 2.4 million blue-collar jobs by 2027, demonstrating its significant economic impact.

The demand for “dark retail spaces” (warehouses optimized for quick deliveries) in India will also expand from 24 million square feet in 2023 to 37.6 million square feet by 2027.

Japan follows as the second fastest-growing market with a 9.3% growth rate, and Germany and France also show strong growth.

Let’s examine the growth rates of leading quick commerce markets in 2025:

| No. | Country | Growth Rate |

| 1 | India | 17% |

| 2 | Japan | 9.30% |

| 3 | Germany | 8.60% |

| 4 | France | 8.50% |

| 5 | China | 8.30% |

| 6 | United Arab Emirates | 8.00% |

| 7 | United Kingdom | 7.30% |

| 8 | United States | 7.14% |

| 9 | Australia | 6.40% |

| 10 | South Korea | 6.30% |

Also read about: Labubu Statistics

Top Quick Commerce Companies: A Competitive Landscape

The quick commerce sector is highly competitive, with numerous startups vying for market share. Globally, there are 210 quick commerce startups, with 88 of them having received funding.

India’s dominance is evident, with four of the top five most downloaded food delivery apps (Zepto, Zomato, Swiggy, and Blinkit) operating within the country.

Zepto, for instance, became the most downloaded food and drinks app in 2024 with 70.58 million downloads.

Here are the top food delivery apps by number of downloads:

| Sr. No. | Platform | Downloads (Millions) |

| 1 | Zepto: 10-Min Grocery Delivery | 70.58 |

| 2 | Uber Eats: Food & Groceries | 42.68 |

| 3 | Zomato: Food Delivery & Dining | 41.75 |

| 4 | Swiggy Food & Grocery Delivery | 39.18 |

| 5 | Blinkit: Grocery in 10 minutes | 36.17 |

| 6 | DoorDash – Food Delivery | 26.5 |

| 7 | Ele.me | 25.39 |

| 8 | bigbasket: 10 min Grocery app | 22.48 |

| 9 | foodpanda food & groceries | 21.56 |

| 10 | Zé Delivery de Bebidas | 17.74 |

| 11 | Rappi: Food Delivery, Grocery | 16.02 |

| 12 | iFood comida e mercado em casa | 15.46 |

Swiggy, a prominent Indian food delivery and quick commerce platform, has raised the most funding globally, totaling $3.62 billion as of 2025. Other major players like DoorDash, Blinkit, Glovo, and Zepto have also secured substantial investments.

| Sr. No. | Quick Commerce Platform | Total Funding Received Till 2025 (Billions) |

| 1 | Swiggy | $3.62 |

| 2 | DoorDash | $2.5 |

| 3 | Blinkit | $757 million |

| 4 | Glovo | $1.16 |

| 5 | Zepto | $1.95 |

Quick Commerce in India: Market Leaders

Within India, Blinkit holds the largest market share in the quick commerce sector, commanding 45% as of Q4 FY25. The company recorded an impressive Gross Order Value (GOV) of ₹9,421 crore, reflecting a 134% year-on-year increase.

Swiggy Instamart follows with a 27% market share, and Zepto accounts for 21%. Zepto’s revenue, notably, grew by over 1,000% in 2023.

| Sr. No. | Platforms | Market Share |

| 1 | Blinkit | 45% |

| 2 | Swiggy Instamart | 27% |

| 3 | Zepto | 21% |

| 4 | BigBasket Now | 7% |

Quick Commerce in the US: Key Players

In the United States, platforms like Uber Eats, Grubhub, Instacart, and DoorDash lead the quick commerce market. Uber Eats reported a total order value of $74.6 billion in 2024, with a revenue of $13.7 billion. DoorDash generated $10.72 billion in revenue in 2024 and achieved its first yearly profit of $117 million. Instacart, valued at $8.9 billion in 2024, completed 290 million orders and became profitable with a net income of $457 million. GoPuff, another key player, had 1.8 million active users as of 2024.

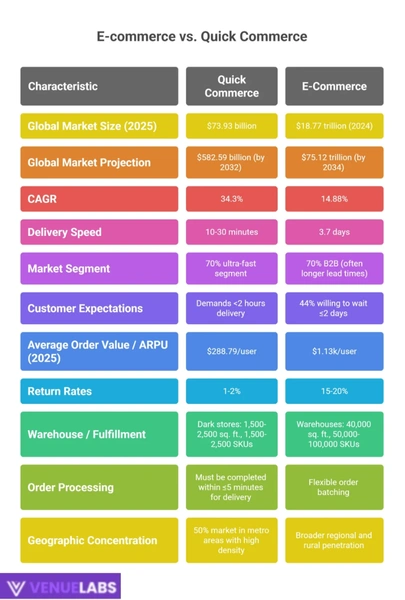

Quick Commerce vs. E-commerce: A Statistical Showdown

While traditional e-commerce remains a much larger market ($4.12 trillion in 2024), quick commerce is rapidly catching up in terms of growth. Q-commerce’s projected CAGR of 34.3% is more than double the 14.6% growth rate of e-commerce, establishing it as one of the fastest-scaling digital retail segments globally.

The core differentiator lies in delivery speed. Quick commerce guarantees deliveries in 10-30 minutes, whereas traditional e-commerce averages 3.7 days.

This speed factor is critical, as 77% of customers now expect deliveries within two hours or less, putting pressure on traditional e-commerce players to adapt faster logistics models.

Here’s a detailed comparison:

| Sr. No. | Category | Quick Commerce | E-Commerce |

| 1 | Global Market Size (2025) | $73.93 billion | $18.77 trillion (2024) |

| 2 | Global Market Projection | $582.59 billion (by 2032) | $75.12 trillion (by 2034) |

| 3 | CAGR | 34.3% | 14.88% |

| 4 | Delivery Speed | 10-30 minutes | 3.7 days |

| 5 | Market Segment | 70% ultra-fast segment | 70% B2B (often longer lead times) |

| 6 | Customer Expectations | Demands <2 hours delivery | 44% willing to wait ≤2 days |

| 7 | Average Order Value / ARPU | $288.79/user (2025) | $1.13k/user (2025) |

| 8 | Return Rates | 1-2% | 15-20% |

| 9 | Warehouse / Fulfillment | Dark stores: 1,500-2,500 sq. ft., 1,500-2,500 SKUs | Warehouses: 40,000 sq. ft., 50,000-100,000 SKUs |

| 10 | Order Processing | Must be completed within ≤5 minutes for delivery | Flexible order batching |

| 11 | Geographic Concentration | 50% market in metro areas with high density | Broader regional and rural penetration |

New Trends and User Questions (from Quora/Reddit):

Online communities like Quora and Reddit frequently buzz with discussions about the practicalities and future of quick commerce. Users often ask:

- How do quick commerce companies manage profitability despite such fast delivery times and high operational costs? This is a hot topic, especially as some global players have struggled. India’s success with profitability models is a point of interest.

- What new categories are quick commerce platforms expanding into beyond groceries and food? People are curious about the evolution of instant deliveries for items like electronics, fashion accessories, or even pharmacy items.

- How does quick commerce impact local businesses and traditional brick-and-mortar stores? There’s a debate about whether it helps or hurts local economies.

- What are the environmental implications of widespread quick commerce, particularly regarding delivery vehicle emissions and packaging waste? Sustainability is a growing concern for many users.

- Will quick commerce become accessible in rural areas, or will it remain primarily an urban phenomenon? The potential for expansion beyond dense metro areas sparks curiosity.

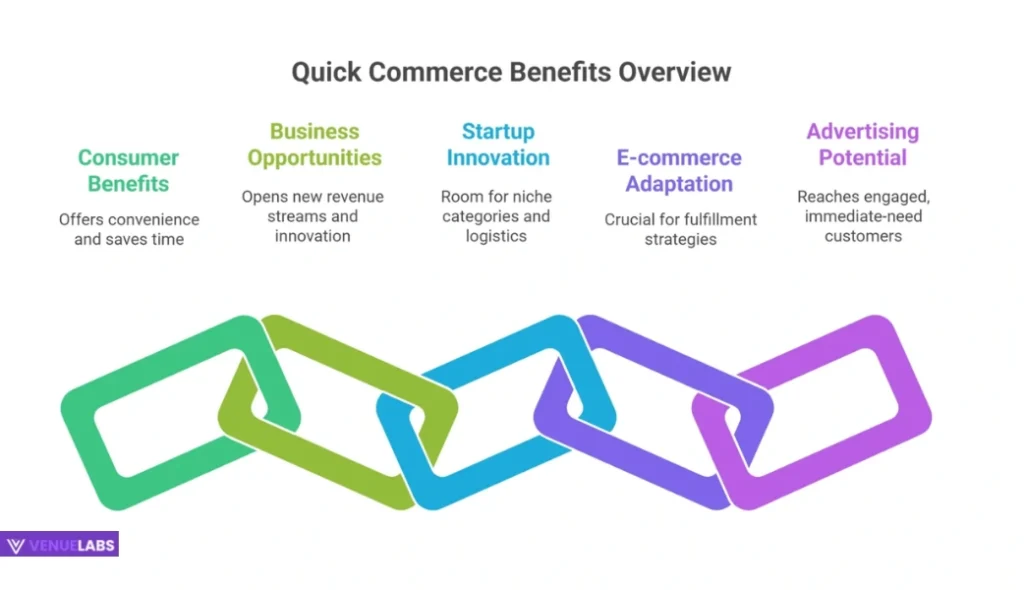

How You Can Benefit from Quick Commerce:

Quick commerce offers significant benefits for both consumers and businesses.

- For Consumers: You gain unprecedented convenience. Need groceries for dinner, a forgotten item, or a last-minute gift? Quick commerce delivers it almost instantly, saving you time and effort. It caters to immediate needs and reduces the need for extensive planning.

- For Businesses: This growing market presents immense opportunities. If you operate in a high-density urban area, integrating quick commerce into your strategy can open new revenue streams and meet evolving customer expectations. For startups, there’s still room to innovate, especially in niche categories or by optimizing logistics further. For larger e-commerce players, understanding Q-commerce trends is crucial for adapting fulfillment strategies and maintaining competitiveness. Advertising on these platforms can reach a highly engaged, immediate-need customer base.

FAQs About Quick Commerce Statistics

1. What is quick commerce, and how fast are its deliveries?

Quick commerce, or Q-commerce, refers to the rapid delivery of goods, typically within 10 to 30 minutes, focusing on immediate consumer needs for items like groceries, meals, and other essentials, making speed its primary differentiator from traditional e-commerce.

2. What is the projected market size of quick commerce by 2032?

The global quick commerce market is projected to reach an impressive $582.59 billion by 2032, experiencing a compound annual growth rate (CAGR) of 34.3%, significantly expanding from its $73.93 billion valuation in 2025.

3. Which country leads the world in quick commerce growth?

India is the global leader in quick commerce growth, with a projected 17% growth rate in 2025, driven by its high population density and rapid urbanization, fostering a thriving environment for ultra-fast delivery services.

4. How does quick commerce compare to traditional e-commerce?

Quick commerce significantly differs from traditional e-commerce primarily in delivery speed (10-30 minutes versus 3.7 days average), a faster growth rate (34.3% CAGR vs. 14.6%), lower average order values, and a focus on high-density urban areas, all while catering to immediate customer expectations for rapid fulfillment.

5. What are "dark stores," and why are they important for quick commerce?

“Dark stores” are retail fulfillment centers that are not open to the public but are specifically designed and optimized for processing online orders for quick delivery, typically smaller than traditional warehouses (1,500-2,500 sq. ft.) and strategically located in urban areas to enable ultra-fast fulfillment.

Also Read:

- Reddit Statistics

- Netflix Subscribers Statistics

- Link Building Statistics

- Most Searched Things on Google Statistics

- Voice Search Statistics

Conclusion:

The global quick commerce market is undergoing explosive growth, projected to reach $582.59 billion by 2032. This nearly 8-fold increase from its current value underscores a profound shift in consumer demand for instant deliveries.

With most orders fulfilled in 10-30 minutes and a vast majority of customers expecting delivery within two hours, quick commerce is rapidly outpacing traditional e-commerce in growth.

India stands as a global leader in this sector, leveraging its unique demographics and robust digital infrastructure.

As AI logistics, dark stores, and sustainable delivery practices continue to evolve, quick commerce is poised to become an indispensable pillar of global retail, fundamentally reshaping how we shop and receive goods.