The videogame industry, once a niche hobby, has transformed into a colossal entertainment powerhouse, captivating billions across the globe.

In 2025, understanding the intricate statistics of this dynamic sector is crucial for anyone looking to engage with it, whether as a player, developer, investor, or content creator.

This comprehensive guide dives deep into the latest trends, revenue figures, player demographics, and emerging technologies shaping the future of interactive entertainment.

Get ready to explore an industry that consistently defies expectations and continues its exponential growth.

Videogame Industry Statistics: Key Highlights

The perception of gaming has fundamentally shifted. Gone are the days when video games exclusively belonged to a “nerdy” minority.

Today, people from all walks of life embrace gaming, making it a powerful engine of economic growth.

Many individuals even forge full-time careers as professional gamers, streamers, or content creators, earning substantial income from tournaments, podcasts, and social media.

The numbers clearly illustrate the gaming community’s significant status and the industry’s vibrant health.

The videogame market, valued at an estimated 268 billion by 2025, with some forecasts even pushing this figure to $317.91 billion for the same year, demonstrating robust and sustained expansion.

This meteoric rise underscores the industry’s economic significance and its increasing influence on global entertainment.

Key Videogame Industry Statistics (Editor’s Choice) for 2025:

- Global Players: Approximately 3.26 billion individuals worldwide actively engage in video gaming.

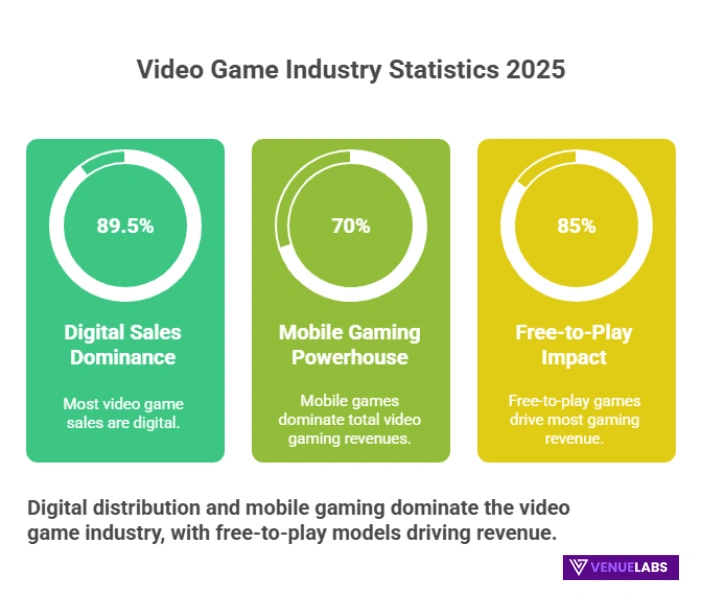

- Digital Sales Dominance: A significant 89.5% of all video game sales occur through digital platforms, highlighting the shift towards online distribution.

- Mobile Gaming Powerhouse: Mobile games account for an estimated 70% of total video gaming revenues.

- Free-to-Play Impact: Around 85% of all gaming revenue comes from free-to-play games, showcasing this business model’s immense success.

- PC Gaming Revenue: The PC gaming sector is projected to generate a substantial $46.7 billion in revenue by 2025.

- Mobile Gaming Revenue: The mobile games industry is forecasted to reach an impressive $138 billion in revenue by 2025.

- Leading Markets: China and the US continue to be the dominant forces in the gaming market, contributing significantly to global industry revenue.

- Emerging Technologies: Virtual Reality (VR) and Augmented Reality (AR) are revolutionizing the gaming experience, offering immersive and interactive gameplay. By 2025, users of AR and VR games are estimated to reach 216 million.

- Cloud Gaming Potential: Cloud gaming services are expected to drive significant market growth, leveraging cloud capabilities for convenient and accessible gaming.

Also read about: Gamers Statistics

General Videogaming Industry Facts: A Deeper Dive

The video gaming industry’s growth trajectory is nothing short of exponential. Here are some fundamental facts that paint a picture of its immense scale and future potential:

- The industry expects a remarkable 10% Compound Annual Growth Rate (CAGR) between 2022 and 2030, indicating sustained expansion.

- In 2022, the global video game industry generated over $200 billion in revenue, surpassing the combined revenue of the music and movie industries.

- Almost 24% of video game developers predict a significant increase in mobile game players by the end of 2025.

- Over 50,000 video games are available on Steam, showcasing the sheer volume of content in the PC gaming market.

- In 2022, 66% of Americans (approximately 215.5 million people) played video games, indicating widespread adoption.

- Globally, 87% of people believe there is a video game for everyone, reflecting the diverse appeal of the medium.

The Benefits of Gaming: More Than Just Entertainment

Beyond entertainment, video games offer numerous tangible benefits, impacting mental stimulation, stress relief, and even social connection. A 2022 survey revealed:

- 93% of video games provide fun and entertainment.

- 91% offer mental stimulation.

- 89% contribute to stress relief.

- 81% inspire people across the world.

- 73% help teach kids healthy ways to win and lose.

- 83% enable new friendships and relationships.

- 46% of players have met good friends or even spouses through gaming.

- 61% meet new people and stay connected with friends.

- 78% believe gaming promotes social interaction.

- 72% confirm gaming stabilizes existing relationships.

These statistics effectively debunk the stereotype of gamers as isolated individuals, highlighting the strong social and cognitive benefits derived from playing.

Also read about: Smartphone Usage Statistics

Revenue Landscape: Where the Money Flows in 2025

The videogame industry’s revenue streams are incredibly diverse, reflecting various business models and consumption patterns. The overall market shows sustained financial strength and impressive growth.

Global Video Gaming Market Revenue (2022-2030, in billions USD):

| Year | Revenue (USD Billion) |

| 2022 | $220.79 |

| 2023 | $249.32 |

| 2024 | $281.53 |

| 2025 | $317.91 |

| 2026 | $358.99 |

| 2027 | $405.37 |

| 2028 | $457.75 |

| 2029 | $516.90 |

| 2030 | $583.96 |

This aggressive growth trajectory positions the videogame industry as a leading player in the entertainment sector for the foreseeable future.

Video Games Revenue Share by Region (Estimated 2025, in billions USD):

| Region | Estimated Revenue (USD Billion) |

| North America | $13.4 |

| Far East | $78.4 |

| Western Europe | $77.4 |

The Asia-Pacific region, particularly China and Japan, continues to dominate the global gaming market, contributing significantly to global industry revenue and innovation.

This region held an estimated 49% of the market share in 2023, with the Americas at 30% and Europe at 17%.

Top-Earning Video Gaming Companies (2022 Data, in millions USD):

| Company | 2022 Earnings (USD Million) |

| Tencent | $8,294 |

| Sony | $4,241 |

| Apple | $3,646 |

| Microsoft | $2,909 |

| NetEase | $2,510 |

| $2,413 | |

| Electronic Arts | $1,904 |

| Nintendo | $1,809 |

| Activision Blizzard | $1,631 |

| Take-Two Interactive | $1,219 |

| Bandai Namco | $906 |

| Sea Group | $893 |

| Nexon | $847 |

| Playtika | $629 |

| Netmarble | $584 |

| 37 Interactive | $564 |

| Square Enix | $552 |

| Embracer Group | $533 |

| Roblox | $518 |

| Ubisoft | $498 |

| CyberAgent | $476 |

| NCSoft | $472 |

| Konami | $451 |

| Warner Bros. Ent. | $396 |

| Century Huatong Group | $390 |

These figures clearly show the immense financial success of established players and the fierce competition driving innovation in the industry.

Video Game Revenue By Subscription (2022-2025, in millions USD):

| Year | Subscription Revenue (USD Million) |

| 2022 | $7,467.7 |

| 2023 | $8,542.9 |

| 2024 | $9,712.3 |

| 2025 | $11,099.1 |

The growth in subscription revenue highlights a consumer preference for ongoing access to game libraries and services, similar to other digital entertainment platforms.

The Global Gaming Community

The number of video game players globally continues to expand, making it one of the most widespread recreational activities on the planet.

Global Video Gaming Players (2022-2027, in billions):

| Year | Number of Players (Billion) |

| 2022 | 3.03 |

| 2023 | 3.26 |

| 2024 | 3.45 |

| 2025 | 3.57 |

| 2026 | 3.69 |

| 2027 | 3.80 |

This consistent growth underscores the universal appeal of gaming and its increasing accessibility across various platforms.

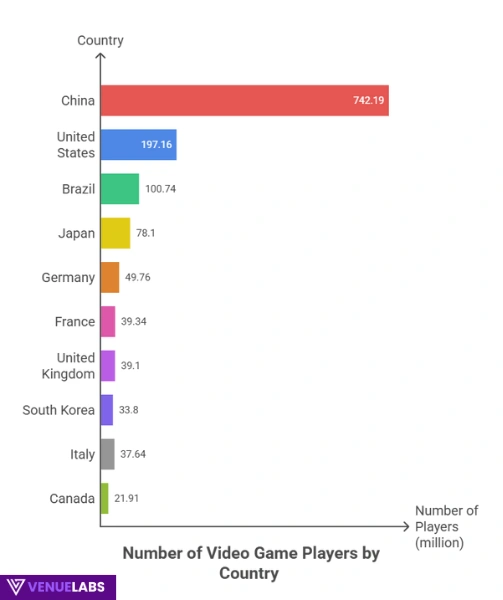

Number of Video Game Players by Country (2022, in millions):

| Country | Number of Players (Million) |

| China | 742.19 |

| United States | 197.16 |

| Brazil | 100.74 |

| Japan | 78.1 |

| Germany | 49.76 |

| France | 39.34 |

| United Kingdom | 39.1 |

| South Korea | 33.8 |

| Italy | 37.64 |

| Canada | 21.91 |

China remains the undisputed leader in player count, followed by the United States, showcasing the sheer scale of engagement in these markets.

Video Gaming Industry Market Share by Countries (2022, in billions USD):

| Country | Market Share (USD Billion) |

| United States | $56.84 |

| China | $50.78 |

| Japan | $42.1 |

| South Korea | $13.37 |

| United Kingdom | $6.41 |

| Germany | $5.14 |

| France | $3.58 |

| Canada | $3.53 |

| Italy | $2.04 |

| Brazil | $1.63 |

While China leads in player numbers, the US takes the top spot in market revenue, indicating higher average spending per player in the American market.

Demographics

The stereotype of the “nerdy teenage boy” gamer is largely outdated. The gaming community is incredibly diverse, spanning all ages, genders, and ethnicities.

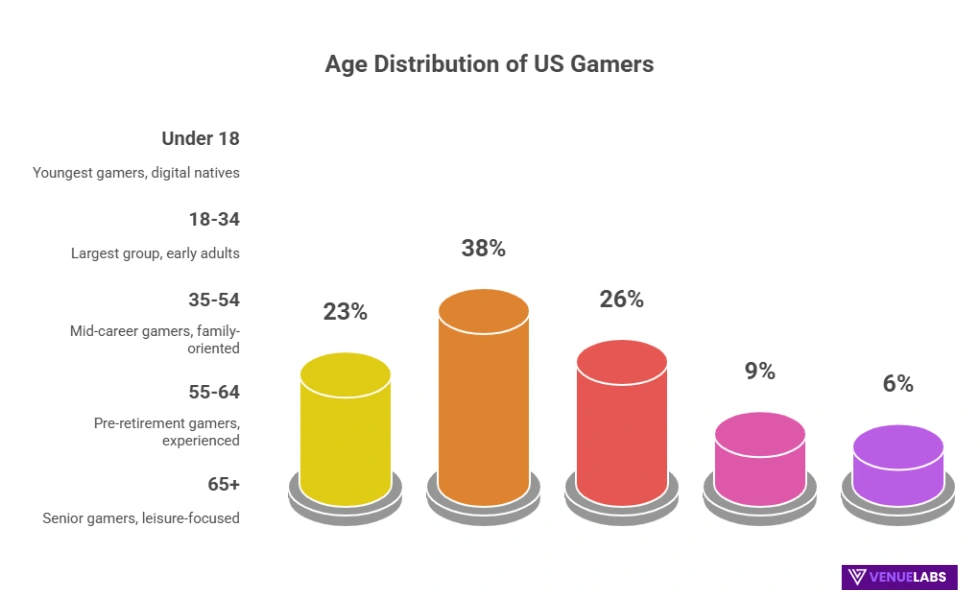

Video Gaming Statistics By Age (2022, US Adults):

| Age Group | Share of Players (Adults) |

| Under 18 | 70% |

| 18 – 34 years | 38% |

| 35 – 54 years | 26% |

| 55 – 64 years | 9% |

| Above 65 years | 6% |

While younger generations (Gen Z and Alpha) still form a significant portion of active mobile and console players (around 79% and 77% respectively), the average age of American gamers is now between 35 and 44 years old.

This reflects the lifelong engagement many individuals have with gaming. Millennials (aged 26-35) spend the most time playing games per week, averaging 7.5 hours.

Gaming Statistics by Gender (2025 Projections based on 2022 data):

| Gender | Share of US Gamers (Estimated 2025) |

| Male | 55% |

| Female | 45% |

The gender gap in gaming continues to narrow significantly. Women now make up a substantial 45% of gamers in the US.

In fact, in five major European markets (UK, Germany, France, Italy, and Spain), over 56 million women play video games, comprising 47% of all gamers in those countries.

Women gamers also show strong spending habits, averaging $359 per year on accessories and downloaded content, compared to $335 for men.

Interestingly, 70% of women gamers primarily play mobile games, as opposed to 66% of men.

Video Games Statistics By Ethnicity (2022, Global):

| Ethnicity | Share of Players |

| Caucasian | 67% |

| Hispanic | 15% |

| African | 12% |

| Asian | 5% |

| Others | 3% |

This breakdown highlights the broad ethnic diversity within the global gaming community, showcasing its widespread appeal across different cultural backgrounds.

Device Usage: How We Play in 2025

Gamers utilize a variety of devices, reflecting personal preferences and the evolution of gaming technology.

Video Game Players’ Statistics by Device Used (Estimated 2025):

| Device/Combination | Share of Players (Estimated 2025) |

| Smartphones | 70% |

| Digital Consoles | 52% |

| PC | 43% |

| Tablets | 26% |

| VR Devices | 7% |

| Mobile and Console Combined | 36% |

| Mobile and PC Combined | 32% |

| PC and Console Combined | 23% |

| Mobile, PC, and Console Combined | 20% |

Mobile phones remain the most popular gaming device, underscoring the dominance of mobile gaming.

However, significant portions of players engage across multiple platforms, indicating a versatile and device-agnostic approach to gaming.

Projected Device User Counts (2025, in millions):

| Device | Number of People (Million) (Estimated 2025) |

| Desktop/Laptops | 92.7 |

| Digital Consoles | 96.9 |

| Mobile Phones | 165.3 |

These numbers highlight the continued importance of dedicated gaming platforms alongside the undeniable influence of mobile gaming.

Global Most Played Video Game Types and Platforms

The diversity of game genres caters to every taste, but certain types consistently attract the largest audiences.

In 2022, casual single-player games were the most favored worldwide, followed closely by first-person shooter games (74.2%) and casual multiplayer games (73.6%).

Popular examples like Candy Crush, PUBG, Fortnite, and Clash of Clans dominate player engagement, especially in high-growth regions like India, China, and Vietnam.

Social Platforms and Gaming Content in 2025:

- Facebook Gaming: Over 800 million people play instant games on Facebook every month. More than 90 million are active in Facebook gaming groups. In Q2 2021, Facebook Gaming hit 1.18 billion hours of content streaming, demonstrating its rapid growth as a live-streaming platform. Brands can effectively target gamers here through tailored marketing strategies.

- YouTube Gaming: YouTube is a cornerstone of gaming entertainment. In 2020, people watched over 100 billion hours of gaming content on the platform, including 10 billion hours of live streams. YouTube hosts over 40 million active gaming channels, with 80,000 having at least 100,000 subscribers. A remarkable 74% of YouTube gamers watch content to improve their playing, and 48% spend more time watching gaming content than playing. Minecraft, Roblox, and Garena Free Fire are among the most-watched games, boasting billions of views.

- Twitch: In 2020, Twitch solidified its position as the largest video gaming content streaming platform, with 140 million monthly active users and a record one trillion minutes of content streamed. This platform remains crucial for live gaming communities and esports viewership.

Tabletop Gaming: A Resurgence in 2025

While digital gaming dominates headlines, the global market for board games is experiencing a notable resurgence. This segment includes a vast array of modern titles beyond classics like chess and Monopoly, such as Pandemic, Cards Against Humanity, and Catan.

- The US leads the board games market, generating $3 billion in revenue in 2020.

- By 2023, the tabletop games market is projected to reach $12 billion, with a projected CAGR of 13% between 2021 and 2026.

- Educational board games saw an 18% rise in online sales worldwide during lockdowns, highlighting their enduring appeal.

- Kickstarter remains a strong platform for tabletop games, raising over $236 million in 2020, a 33% increase year-over-year.

Recent Developments and the Future of Gaming in 2025

The videogame industry is in a constant state of evolution, driven by technological advancements and shifting consumer preferences. Several key developments are shaping its future in 2025 and beyond:

- Increasing Adoption of Cloud Gaming: Services like Xbox Cloud Gaming and GeForce Now are gaining popularity, offering high-quality gaming experiences without the need for expensive hardware. This trend will enhance accessibility and convenience for a broader audience.

- Growth of Esports: Esports continues its rapid expansion, with increasing viewership, investment, and professionalization of gaming tournaments and leagues. This highlights competitive gaming’s rising prominence as both a spectator sport and a lucrative industry.

- Integration of Blockchain Technology: The industry is exploring blockchain for enhanced gameplay, digital asset ownership (NFTs), and in-game economies, signaling a potential shift towards decentralized gaming ecosystems.

- Expansion of Virtual Reality (VR) Gaming: VR gaming is expanding with new hardware and increasingly immersive experiences, driving interest and investment in VR technology and content. Shipments of PC and all-in-one VR headsets are forecast to reach 62 million units by 2025.

- Augmented Reality (AR) in Mobile Gaming: AR continues to innovate mobile gaming, as seen with the success of Pokémon Go. Consumer spending on mobile AR games amounted to $1.3 billion in 2020, and this sector is poised for further growth.

- Emphasis on Inclusivity and Diversity: The industry is increasingly focusing on promoting representation and addressing issues of diversity and inclusivity in game development and community engagement.

- Rise of Indie Game Development: Independent developers continue to thrive, creating innovative and unique gaming experiences that contribute significantly to the diversity and creativity of the gaming landscape.

- Collaboration with Hollywood: Increasing collaboration between the gaming industry and Hollywood, with more game adaptations of popular movies and TV shows, and the integration of cinematic storytelling into games, blurs the lines between entertainment mediums.

- Expansion of Cross-Platform Gaming: Cross-platform play is becoming standard, allowing gamers to play together across different devices and fostering greater connectivity and accessibility.

- Focus on Sustainability: A growing focus on reducing the environmental impact of gaming hardware and operations is prompting companies to explore eco-friendly initiatives and practices.

Insights from Reddit and Quora (2025)

Beyond the hard numbers, online communities like Reddit and Quora offer a pulse on real-time gamer sentiment and common questions in 2025.

- “Is gaming addiction a real concern in 2025, and what are the statistics?” This is a recurring topic. Statistics indicate that 0.3-1% of the population in countries like the US, Canada, Germany, and the UK fit the gaming addiction criteria. Among youth aged 8-18, about 8.5% may suffer from gaming disorder. Reddit discussions often revolve around finding balance, recognizing warning signs, and seeking help, highlighting it as a serious issue for a minority of players.

- “How does cloud gaming actually work, and is it viable for competitive play in 2025?” While many users are excited about cloud gaming’s accessibility, a common concern on Quora is latency, especially for competitive or fast-paced games. While casual gaming works well, competitive players often find dedicated hardware still superior due to input lag. However, improvements in internet infrastructure and streaming technology are continuously addressing these issues.

- “What are the privacy risks associated with online gaming, and how can I protect myself?” Privacy remains a top concern. 61% of Americans feel they need more protection, such as using VPNs for gaming. Reddit threads frequently discuss data collection by game companies, potential for identity theft, and the importance of strong passwords and two-factor authentication.

- “Are gaming NFTs and blockchain games the future, or just a fad?” This is a highly debated topic. While some see blockchain as revolutionary for true digital ownership and play-to-earn models, many gamers on Reddit express skepticism due to concerns about scams, environmental impact, and speculative monetization over gameplay. The consensus is that the technology has potential but needs significant refinement and better implementation to gain widespread acceptance.

- “With so much growth, is the game development industry still a good career path in 2025?” Aspiring developers on Quora often ask about job prospects. The industry’s massive growth creates many opportunities, with 2,457 software development companies in the US supporting 220,000 jobs. However, discussions also highlight the intense competition, long hours (“crunch”), and the importance of specialized skills and portfolios to stand out.

FAQs About Videogame Industry Statistics

1. What is the projected revenue for the global videogame industry in 2025?

The global videogame industry is projected to reach an estimated $268 billion by 2025, with some analyses suggesting it could exceed $317 billion, showcasing its robust and continuous financial growth.

2. How many people play video games worldwide as of 2025?

As of 2025, an estimated 3.57 billion people globally play video games, which translates to a significant portion of the world’s population actively engaging in interactive entertainment.

3. Which platforms dominate the video game market in terms of revenue?

Mobile gaming consistently dominates the market, accounting for approximately 70% of total video gaming revenues. PC gaming and console gaming also contribute significantly, with PC gaming projected to generate $46.7 billion in revenue by 2025.

4. Are there more male or female gamers in 2025?

The gender gap in gaming continues to narrow significantly. In 2025, roughly 45% of gamers in the US identify as female, indicating an increasingly balanced and diverse player base.

5. What are the most important emerging technologies impacting the videogame industry in 2025?

Virtual Reality (VR) and Augmented Reality (AR) are revolutionizing the gaming experience by offering more immersive and interactive gameplay. Additionally, the increasing adoption of cloud gaming services is enhancing accessibility and convenience for a wider audience.

Also Read:

- Artificial Intelligence Statistics

- Gemini Statistics

- Live Streaming Statistics

- Email Marketing Statistics

- Mobile Marketing Statistics

Conclusion

The videogame industry in 2025 is a vibrant, expanding ecosystem characterized by immense revenue, billions of players, and rapid technological innovation.

It has transcended its niche origins to become a powerful cultural and economic force. Mobile gaming continues to lead in revenue and player count, while PC and console gaming maintain strong dedicated user bases.

Emerging technologies like VR, AR, and cloud gaming promise even more immersive and accessible experiences.

As the industry continues to grow and diversify, understanding these statistics and trends is key for anyone looking to engage with this exciting and ever-evolving world.

Source: Statista, Fortune Business Insights