By 2025, Tinder firmly holds its position as the global leader in online dating. It has truly reshaped how millions connect, interact, and find both casual and serious relationships.

Whether you are curious about its massive reach, its booming revenue, or how you can use it to your advantage, this detailed Tinder Statistics guide breaks down everything you need to know about Tinder’s latest statistics.

Tinder at a Glance: Key Statistics for 2026

Tinder’s influence is undeniable. Let’s look at the numbers that define this dating giant in 2025.

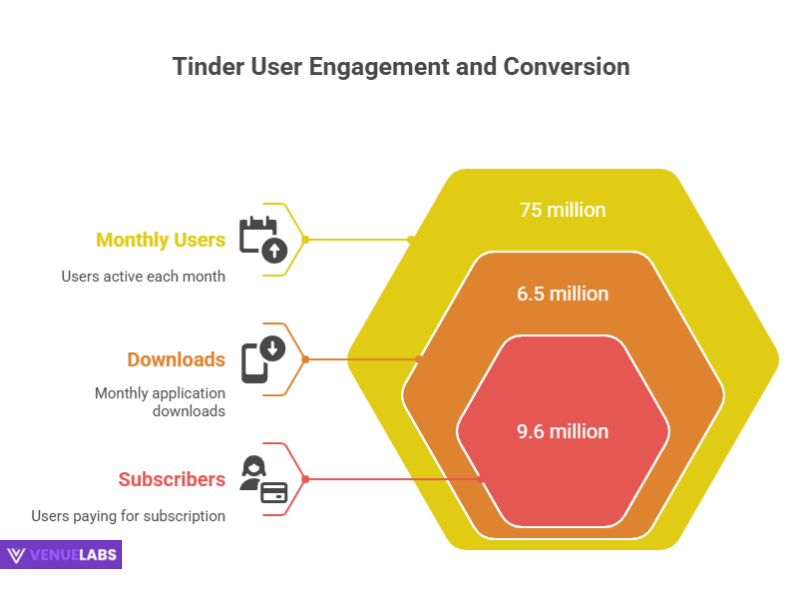

- Monthly Active Users (MAU): Tinder boasts an impressive 75 million monthly active users globally, a figure it has maintained consistently since 2022. This makes it the most widely used dating app on the planet.

- Subscribers: The app currently has 9.6 million paying subscribers. While this shows a slight decrease from its peak in 2022, it still represents a significant revenue stream for the company.

- Downloads: Tinder continues to lead the market in new users, recording over 6.5 million downloads in May 2025 alone, and a staggering 63.58 million downloads in 2024.

- Revenue: In 2024, Tinder generated an astounding $1.96 billion in revenue, marking a consistent upward trend in its financial performance.

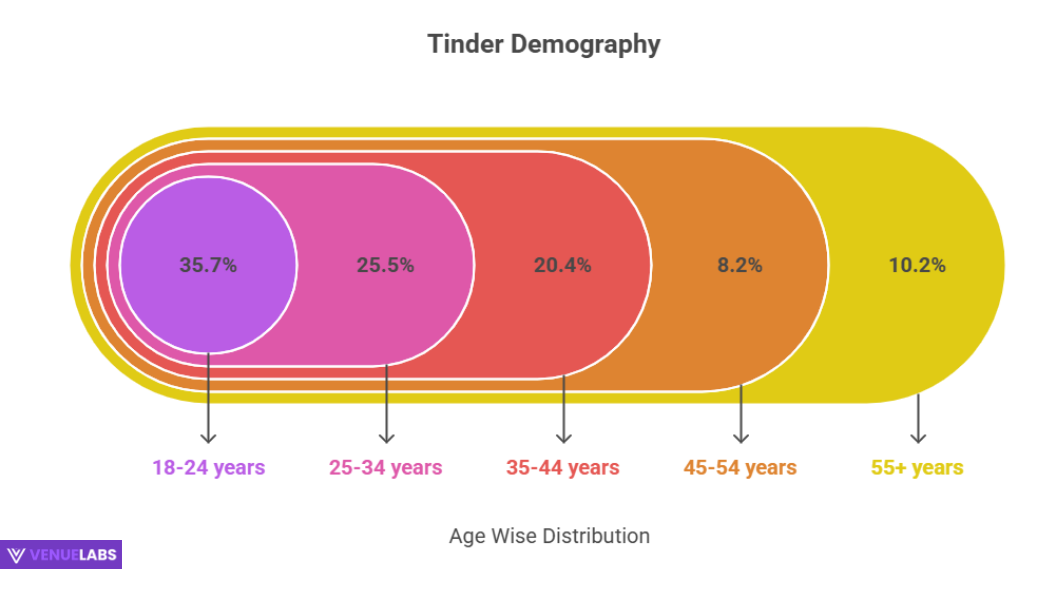

- User Demographics: A significant 61.2% of Tinder users fall within the 18 to 34 age bracket, highlighting its strong appeal to younger generations.

- Daily Swipes: Users perform a combined 1.6 billion swipes every single day, leading to approximately 26 million matches daily.

How Many People Really Use Tinder? A Global Phenomenon

Tinder’s user base is vast and continues to dominate the online dating landscape. Despite the emergence of new competitors, Tinder’s reach remains unparalleled.

1. Tinder’s Monthly Active Users (MAU)

The platform consistently reports 75 million monthly active users worldwide. This number reflects a stable and massive user base, demonstrating Tinder’s enduring appeal. This isn’t just about casual browsers; these are individuals actively engaging with the app, swiping, matching, and messaging.

2. Tinder Subscribers: The Engine of Its Business Model

While 75 million people use the app for free, a significant portion opts for premium features.

- As of 2025, Tinder counts 9.6 million paying subscribers. These users pay for enhanced features that give them an edge in the dating world.

- This number represents a slight dip from its peak of 10.8 million in 2022, and 9.9 million in 2023. This trend suggests increased competition from other apps like Bumble and Hinge, which are steadily gaining traction.

Let’s look at the subscriber growth over the years:

| Year | Number of Tinder Subscribers (in millions) | Key Insight |

| 2015 | 0.7 | Humble beginnings, showing early adoption. |

| 2016 | 1.6 | Initial growth gaining momentum. |

| 2017 | 3.1 | Significant acceleration in user adoption. |

| 2018 | 4.3 | Rapid expansion and successful monetization efforts. |

| 2019 | 8.1 | Continued strong growth, becoming a household name. |

| 2020 | 8.9 | Pandemic-driven boost as people sought online connections. |

| 2021 | 10.6 | Near-peak growth, solidifying market leadership. |

| 2022 | 10.8 (Peak) | The absolute highest point for Tinder’s subscriber count. |

| 2023 | 9.9 | First signs of market maturation and increased competition. |

| 2024 | 9.6 | A continued slight decline as alternatives grow stronger. |

Source: World Population Review

Even with this slight decrease, 9.6 million paying users contribute substantially to Tinder’s multi-billion dollar revenue.

Where in the World is Tinder Most Popular?

Tinder enjoys a global presence, available in over 190 countries. However, certain regions stand out for their concentration of users.

- The United States leads with a remarkable 7.8 million active Tinder users.

- The United Kingdom follows with 5 million users.

- Other top countries include Brazil, Canada, France, Australia, Germany, the Netherlands, Mexico, and Spain.

This distribution highlights Tinder’s strong foundation in Western markets, though its influence stretches across continents.

- Also read about: Instagram Statistics

Who is Using Tinder? Unpacking Demographics

Understanding Tinder’s user demographics is essential for anyone seeking to navigate the app effectively. The data paints a clear picture of who you are likely to encounter.

1. Age Demographics: A Young Person’s World (Mostly)

Tinder overwhelmingly appeals to younger adults.

- A striking 61.2% of all Tinder users are between 18 and 34 years old. This age bracket includes both young adults just starting their dating journeys and those in their early thirties looking for connections.

Let’s break down the age distribution:

| Age Group | Share of Tinder Users | Summary |

| 18-24 years | 35.7% | The youngest demographic, often seeking casual connections or new experiences. |

| 25-34 years | 25.5% | A significant group, balancing career with dating and relationship goals. |

| 35-44 years | 20.4% | A growing segment, showing Tinder’s expanding appeal beyond just youth. |

| 45-54 years | 8.2% | Demonstrates that even older age groups are embracing online dating. |

| 55+ years | 10.2% | A noticeable presence, indicating diverse relationship needs. |

While Tinder is undeniably popular with the younger crowd, the increasing presence of users over 35 (nearly 40% combined) shows its broadening appeal to older individuals who are embracing online dating.

2. Gender Demographics: The Notable Imbalance

One of the most discussed aspects of Tinder is its gender distribution, which shows a significant skew.

- Male Users: 75%

- Female Users: 24%

- Non-binary/Undisclosed: 1%

This means that for every female user, there are roughly three male users. This imbalance profoundly impacts the user experience:

- For Men: Competition is exceptionally high. Men often need to put more effort into their profiles and messaging to stand out and secure matches.

- For Women: They typically receive a very high volume of likes and messages, which can be flattering but also overwhelming.

It’s important to note that this ratio can vary by region. For instance, in parts of Europe, the gender split is much closer to 50/50, while in countries like India, the male user base is even larger.

Sexual Orientation and Time Spent

Tinder caters to diverse sexual orientations, and usage patterns vary:

- Bisexual users make up 15% of the platform and spend around 25 minutes daily on the app.

- Gay/Lesbian users spend significantly more time, averaging 1 hour and 11 minutes daily.

- Heterosexual/Straight users (4.32% of the surveyed group) spend around 65 minutes daily.

This data highlights how different communities engage with the platform.

Income Brackets: A Diverse Economic Landscape

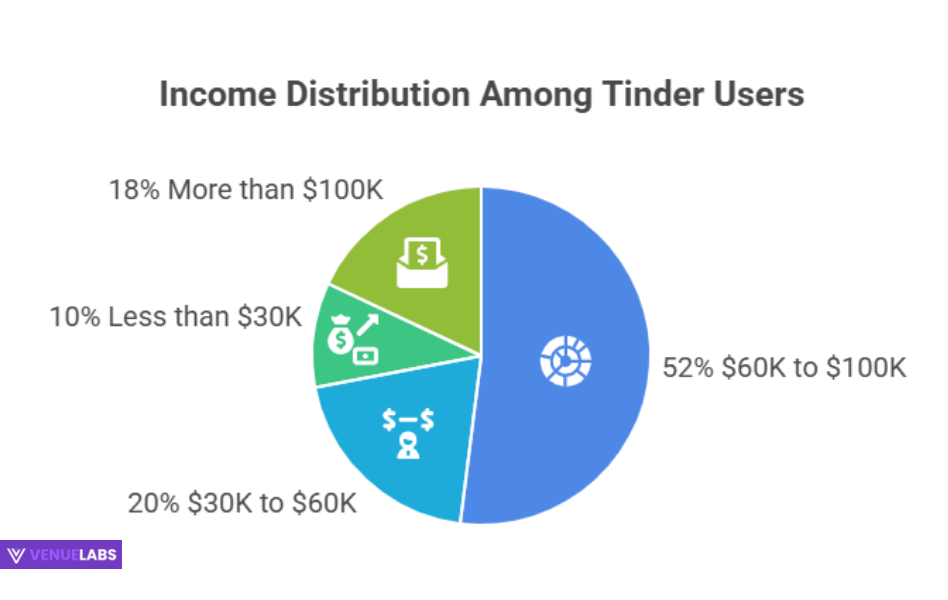

Tinder’s user base also spans various income levels, though there’s a concentration in the middle-income range.

- The largest group, 52% of users, falls into the $60K to $100K income bracket.

- Another 20% earn between $30K and $60K.

- 10% earn less than $30K.

- 18% earn more than $100K.

This shows Tinder is a truly diverse platform, attracting individuals from all walks of life, regardless of their financial standing.

Tinder’s Financial Powerhouse: How It Makes Billions

Tinder’s revenue figures are staggering, demonstrating a highly successful monetization strategy built on its “freemium” model.

1. Tinder’s Revenue Statistics for 2026

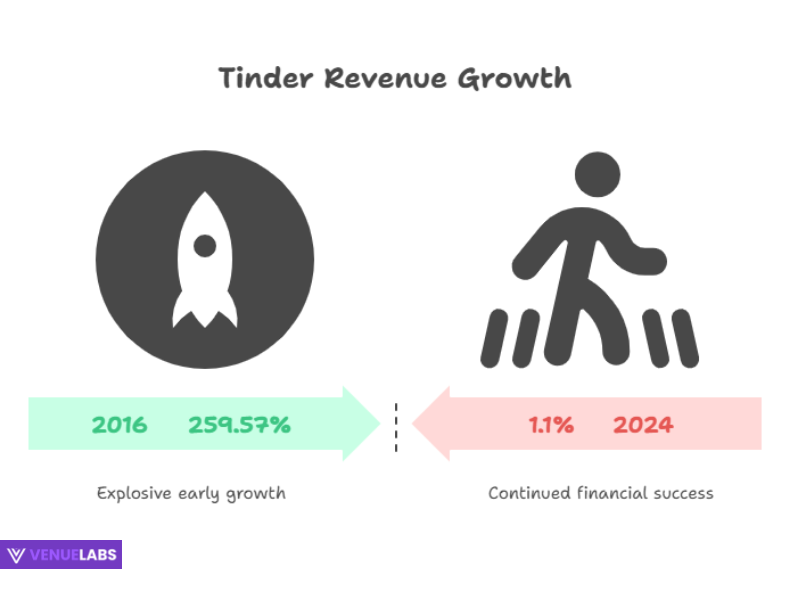

- In 2024, Tinder’s revenue hit $1.96 billion, representing a healthy 1.1% increase from the previous year.

- This follows a 6.9% growth in 2023, when revenue reached $1.91 billion.

The app’s financial trajectory shows consistent growth, especially in its early years, driven by innovation and effective premium offerings.

Tinder’s Revenue by Year: A Steady Climb

| Year | Revenue (in millions USD) | Percentage Increase | Key Insight |

| 2015 | $47 | – | The very beginning of monetization. |

| 2016 | $169 | 259.57% | Explosive early growth, proving market demand. |

| 2017 | $403 | 138.46% | Continued rapid acceleration. |

| 2018 | $805 | 99.75% | Near doubling of revenue, showing peak growth momentum. |

| 2019 | $1,152 | 43.08% | Crossing the billion-dollar mark, solidifying dominance. |

| 2020 | $1,355 | 17.60% | Steady growth even during global disruptions. |

| 2021 | $1,649 | 21.72% | Strong performance as online interactions became crucial. |

| 2022 | $1,794 | 8.80% | Continued expansion, though growth rate began to temper. |

| 2023 | $1,918 | 6.91% | Robust revenue despite increased competition. |

| 2024 | $1,962 | 1.1% | Continued financial success, showing market maturity. |

Source: Statista

Tinder’s financial journey illustrates how a well-executed subscription model can turn a free app into a multi-billion-dollar enterprise.

- Also read about: X Twitter Statistics

2. How Tinder Generates Billions: The “Freemium” Model

Tinder’s success lies in its tiered subscription system and à la carte features:

- Tinder Plus: Offers unlimited swipes, “Rewind” (to undo accidental left swipes), and “Passport” (to change your location and swipe anywhere in the world).

- Tinder Gold: Includes all Plus features, plus the highly coveted “Likes You” feature, allowing users to see who has already swiped right on them for instant matches. It also provides 5 Super Likes per week and 1 free Boost per month.

- Tinder Platinum: The highest tier, offering all Gold features, “Priority Likes” (your profile gets seen faster by people you like), and the ability to “Message Before Matching” by attaching a message to a Super Like.

- À La Carte Purchases: Users can buy individual “Super Likes” (to show strong interest) and “Boosts” (to temporarily make their profile one of the top profiles in their area for 30 minutes).

This multi-layered approach ensures a suitable option for every user, from the casual swiper to the serious dater looking for every possible advantage.

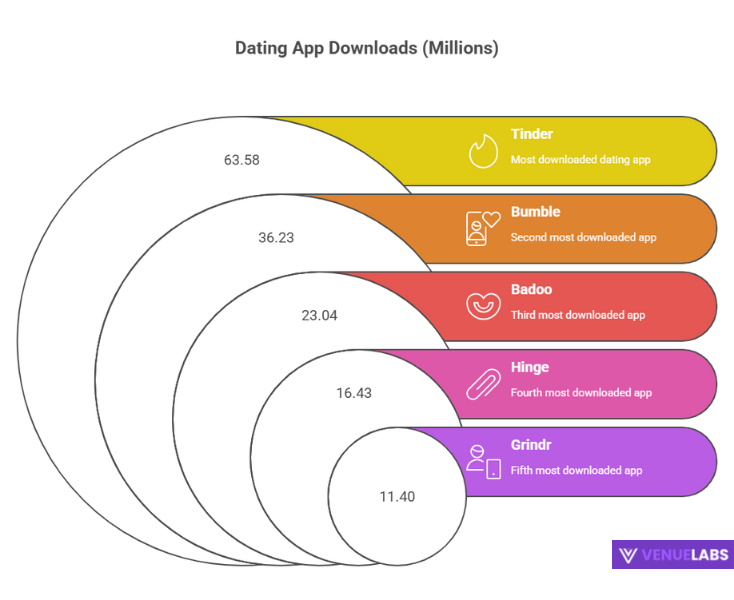

Tinder’s Dominance in Downloads: Attracting New Users

Tinder consistently remains the most downloaded dating app globally, underscoring its powerful brand and broad appeal.

- In May 2025, Tinder recorded over 6.5 million downloads, outperforming all competitors.

- For the full year 2024, Tinder amassed an incredible 63.58 million downloads worldwide.

Let’s compare Tinder’s download performance against its key rivals in 2024:

| Dating App | Number of Downloads (in millions) | Key Insight |

| Tinder | 63.58 | Clear market leader, far surpassing competitors. |

| Bumble | 36.23 | A strong second, known for its female-first approach. |

| Badoo | 23.04 | Consistent performer, with a global presence. |

| FRND | 19.20 | Emerging player in certain markets. |

| Omi | 19.01 | Rapidly growing in Asian markets. |

| Hinge | 16.43 | Gaining traction as a “relationship-focused” app. |

| Boo | 16.35 | Focuses on personality matching. |

| SweetMeet | 13.30 | Popular in specific regions. |

| Soul | 12.09 | Strong in social networking and dating blend. |

| TanTan | 11.60 | Leading dating app in China. |

| PopUp | 11.54 | Newer app, showing promising growth. |

| Grindr | 11.40 | Leading app for gay, bi, trans, and queer people. |

This data clearly illustrates Tinder’s continued success in attracting new users, maintaining its position at the forefront of the online dating industry.

How People Use Tinder: Swiping, Matching, and Behavior Insights

Beyond raw numbers, understanding user behavior on Tinder is key to maximizing your experience. These insights reveal the psychology behind the swipes.

1. The Swipe Dynamic: Men vs. Women

There’s a well-documented difference in how men and women approach swiping:

- Men swipe right on approximately 46% of profiles they see. They often use a “cast a wide net” strategy, swiping right on many profiles and then deciding who to engage with among their matches.

- Women swipe right on only about 14% of profiles. They are generally more selective, carefully evaluating profiles before liking someone.

This difference directly contributes to the gender imbalance in matches, as women have fewer right swipes to distribute among a larger pool of men.

2. What Makes a Successful Tinder Profile?

If you want to get more matches and dates, pay attention to these key elements:

- Photos are Paramount: Having at least 3-4 high-quality photos significantly increases your chances of a match. Profiles with only one photo are often perceived as fake or low-effort.

- Smile! Profiles where the person is smiling in their main photo receive noticeably more right swipes. A friendly, approachable demeanor is attractive.

- Don’t Skip the Bio: While visuals grab attention, a well-written bio is your chance to showcase personality, humor, and what you are looking for. Profiles with a bio consistently receive more matches.

- Connect Your Socials: Linking your Instagram or Spotify account adds authenticity and offers potential matches more insight into your life and interests.

- State Your Intent: 72% of women believe mentioning the kind of relationship they seek is necessary in a dating profile. Being clear can save time and attract compatible matches.

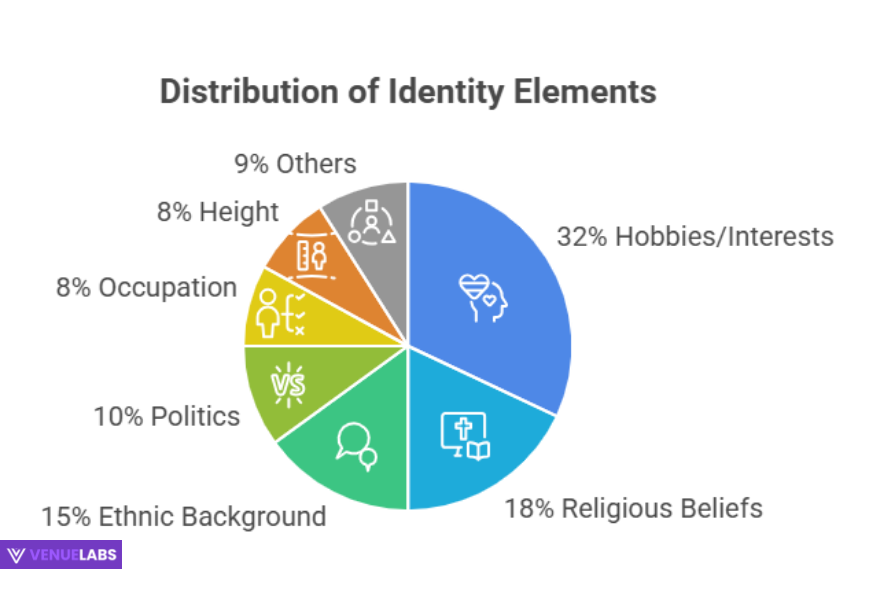

3. What People Look For in a Profile:

Understanding what attracts others can help you refine your profile.

What people look for:

| Profile Element | Percentage |

| Hobbies and Interests | 32% |

| Religious Beliefs | 18% |

| Racial or Ethnic Background | 15% |

| Political Affiliation | 10% |

| Occupation | 8% |

| Height | 8% |

The “Hookup App” Reputation: Is It True?

Tinder has long been branded a “hookup app.” However, statistics tell a more nuanced story:

- Only about 22% of users primarily use Tinder for casual encounters or hookups.

- A much larger group, around 44%, are explicitly looking for long-term relationships.

- The remaining users are there for a mix of reasons, including making new friends, boosting self-confidence, or simply out of curiosity.

This data suggests that while casual dating is part of Tinder’s culture, a significant portion of its user base is seeking more meaningful connections, challenging its traditional reputation.

Tinder vs. The Competition: Staying Ahead in a Crowded Market

Tinder faces fierce competition from other dating apps, most notably Bumble and Hinge.

- Bumble: Known for empowering women by requiring them to make the first move in heterosexual matches. This feature appeals to many women tired of unsolicited messages.

- Hinge: Markets itself as the app “designed to be deleted.” It focuses on more detailed profiles and thoughtful prompts to foster deeper connections, attracting users serious about relationships.

While Tinder still holds the largest market share in terms of users and downloads, the rise of these competitors is a key factor in Tinder’s recent slight dip in subscriber numbers. Users now have excellent alternatives that cater to different dating preferences and goals.

New Insights from User Forums: What People are Asking in 2026

Online communities like Quora and Reddit offer a pulse on what real users are experiencing and asking about Tinder in 2025.

- “Is Tinder still worth it for relationships?”

- Many users, especially men, report feeling like they get fewer matches compared to previous years and question if the app is still effective for finding serious partners due to the gender imbalance. The consensus leans towards “yes, but it requires more effort and a really polished profile.”

- “Why am I getting fewer matches on Tinder compared to Bumble/Hinge?”

- This is a frequent question. Users often find that the algorithm on other apps might favor more detailed profiles or that the user base on those apps is inherently more relationship-focused, leading to different matching experiences.

- “How does the Tinder algorithm actually work in 2025?”

- While Tinder keeps its algorithm proprietary, users speculate heavily. Popular theories involve an “elo score” (how desirable your profile is), recent activity, and even how often you swipe right. Many users report that being active and consistently updating your profile helps.

- “Are Tinder Boosts and Super Likes worth the money in 2025?”

- Opinions are mixed. Many users feel that Boosts still offer a noticeable increase in visibility, especially in dense urban areas. Super Likes are seen as more effective when paired with a thoughtful message (Tinder Platinum feature) rather than just a standalone “super like.”

- “Is the gender ratio getting worse on Tinder?”

- While the 75% male to 24% female ratio is a known statistic, recent anecdotal evidence from male users on forums suggests that the perceived imbalance feels even more pronounced, making it harder to get matches. This could be due to women becoming even more selective.

These discussions highlight that users are increasingly strategic about how they use Tinder and are keenly aware of its evolving dynamics and competition.

FAQs About Tinder Statistics

1. How many people actively use Tinder in 2025?

Tinder has a massive global user base, with approximately 75 million monthly active users worldwide as of 2025. This consistent figure demonstrates its enduring popularity and market dominance in the online dating industry.

2. Is Tinder still making money, and how much revenue does it generate?

Yes, Tinder continues to be an extremely profitable app. In 2024, it generated an impressive $1.96 billion in revenue, primarily through its tiered subscription services like Tinder Plus, Gold, and Platinum, as well as individual in-app purchases like Super Likes and Boosts.

3. What is the gender distribution like on Tinder in 2025?

Tinder has a notable gender imbalance, with approximately 75% of its users being male and 24% being female, with about 1% identifying as non-binary or not disclosing their gender. This disparity significantly influences the user experience for both men and women on the platform.

4. What age group uses Tinder the most in 2025?

The majority of Tinder users fall into the younger adult demographic. A significant 61.2% of all Tinder users are between the ages of 18 and 34, reflecting the app’s strong appeal to millennials and younger generations seeking connections.

5. Is Tinder still considered a "hookup app" in 2025, or do people seek relationships?

While Tinder gained a reputation as a “hookup app,” current statistics show a more diverse user intent. In 2025, only about 22% of users primarily use Tinder for casual encounters, while a larger segment, around 44%, is actively looking for long-term relationships, with the rest having mixed motivations.

Also Read:

- Tumblr Statistics

- Google Searches Statistics

- LinkedIn Statistics

- Quora Statistics

- AI Market Size Statistics

Conclusion: Tinder Remains a Force in Online Dating

Tinder remains the undisputed leader in the online dating world in 2025. With 75 million active users globally and a consistent multi-billion-dollar revenue, it continues to define how millions connect. Its massive user base, especially among the 18-34 age group, solidifies its cultural impact.

While the app faces stiff competition and a noticeable gender imbalance, its ongoing innovation, robust monetization strategies, and unparalleled global reach keep it at the forefront.

For anyone looking to benefit from online dating, understanding Tinder’s statistics, optimizing your profile, and being strategic about your approach is key to success on this ever-evolving platform.